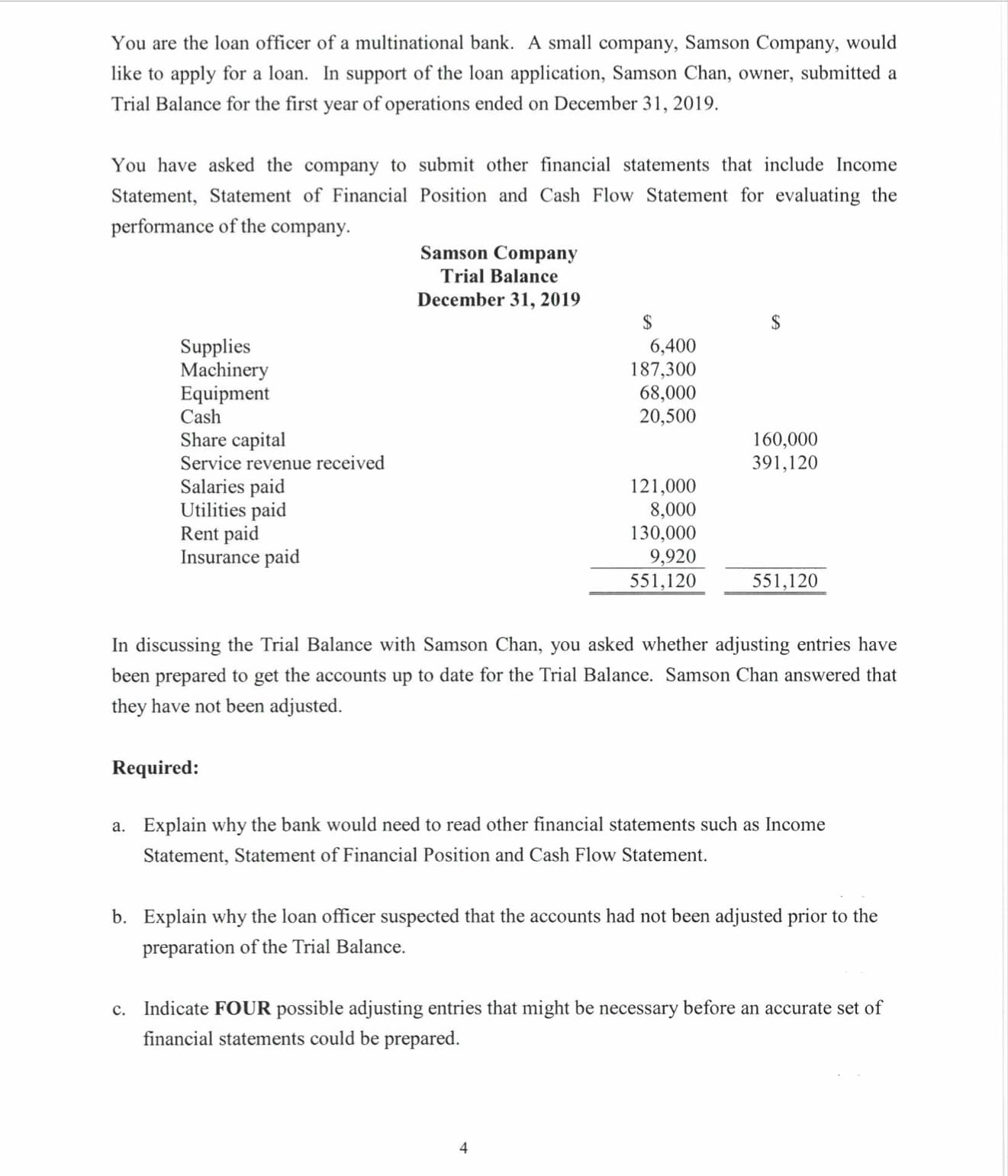

You are the loan officer of a multinational bank. A small company, Samson Company, would like to apply for a loan. In support of the loan application, Samson Chan, owner, submitted a Trial Balance for the first year of operations ended on December 31, 2019. You have asked the company to submit other financial statements that include Income Statement, Statement of Financial Position and Cash Flow Statement for evaluating the performance of the company. Samson Company Trial Balance December 31, 2019 2$ Supplies Machinery Equipment 6,400 187,300 68,000 20,500 Cash Share capital Service revenue received 160,000 391,120 Salaries paid Utilities paid Rent paid Insurance paid 121,000 8,000 130,000 9,920 551,120 551,120 In discussing the Trial Balance with Samson Chan, you asked whether adjusting entries have been prepared to get the accounts up to date for the Trial Balance. Samson Chan answered that they have not been adjusted. Required: a. Explain why the bank would need to read other financial statements such as Income Statement, Statement of Financial Position and Cash Flow Statement. b. Explain why the loan officer suspected that the accounts had not been adjusted prior to the preparation of the Trial Balance. c. Indicate FOUR possible adjusting entries that might be necessary before an accurate set of financial statements could be prepared.

You are the loan officer of a multinational bank. A small company, Samson Company, would like to apply for a loan. In support of the loan application, Samson Chan, owner, submitted a Trial Balance for the first year of operations ended on December 31, 2019. You have asked the company to submit other financial statements that include Income Statement, Statement of Financial Position and Cash Flow Statement for evaluating the performance of the company. Samson Company Trial Balance December 31, 2019 2$ Supplies Machinery Equipment 6,400 187,300 68,000 20,500 Cash Share capital Service revenue received 160,000 391,120 Salaries paid Utilities paid Rent paid Insurance paid 121,000 8,000 130,000 9,920 551,120 551,120 In discussing the Trial Balance with Samson Chan, you asked whether adjusting entries have been prepared to get the accounts up to date for the Trial Balance. Samson Chan answered that they have not been adjusted. Required: a. Explain why the bank would need to read other financial statements such as Income Statement, Statement of Financial Position and Cash Flow Statement. b. Explain why the loan officer suspected that the accounts had not been adjusted prior to the preparation of the Trial Balance. c. Indicate FOUR possible adjusting entries that might be necessary before an accurate set of financial statements could be prepared.

Financial Accounting

14th Edition

ISBN:9781305088436

Author:Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:Carl Warren, Jim Reeve, Jonathan Duchac

Chapter4: Completing The Accounting Cycle

Section: Chapter Questions

Problem 3CP

Related questions

Question

Transcribed Image Text:You are the loan officer of a multinational bank. A small company, Samson Company, would

like to apply for a loan. In support of the loan application, Samson Chan, owner, submitted a

Trial Balance for the first year of operations ended on December 31, 2019.

You have asked the company to submit other financial statements that include Income

Statement, Statement of Financial Position and Cash Flow Statement for evaluating the

performance of the company.

Samson Company

Trial Balance

December 31, 2019

2$

Supplies

Machinery

Equipment

6,400

187,300

68,000

20,500

Cash

Share capital

Service revenue received

160,000

391,120

Salaries paid

Utilities paid

Rent paid

Insurance paid

121,000

8,000

130,000

9,920

551,120

551,120

In discussing the Trial Balance with Samson Chan, you asked whether adjusting entries have

been prepared to get the accounts up to date for the Trial Balance. Samson Chan answered that

they have not been adjusted.

Required:

a. Explain why the bank would need to read other financial statements such as Income

Statement, Statement of Financial Position and Cash Flow Statement.

b. Explain why the loan officer suspected that the accounts had not been adjusted prior to the

preparation of the Trial Balance.

c. Indicate FOUR possible adjusting entries that might be necessary before an accurate set of

financial statements could be prepared.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT