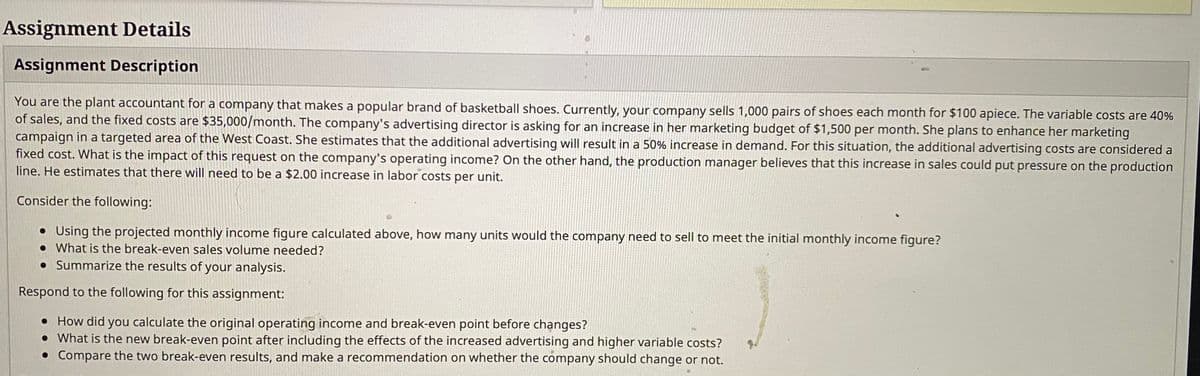

You are the plant accountant for a company that makes a popular brand of basketball shoes. Currently, your company sells 1,000 pairs of shoes each month for $100 apiece. The variable costs are 40% of sales, and the fixed costs are $35,000/month. The company's advertising director is asking for an increase in her marketing budget of $1,500 per month. She plans to enhance her marketing campaign in a targeted area of the West Coast. She estimates that the additional advertising will result in a 50% increase in demand. For this situation, the additional advertising costs are considered a fixed cost. What is the impact of this request on the company's operating income? On the other hand, the production manager believes that this increase in sales could put pressure on the production line. He estimates that there will need to be a $2.00 increase in labor costs per unit. Consider the following: Using the projected monthly income figure calculated above, how many units would the company need to sell to meet the initial monthly income figure? What is the break-even sales volume needed? Summarize the results of your analysis. Respond to the following for this assignment: How did you calculate the original operating income and break-even point before changes? What is the new break-even point after including the effects of the increased advertising and higher variable costs? Compare the two break-even results, and make a recommendation on whether the company should change or not.

You are the plant accountant for a company that makes a popular brand of basketball shoes. Currently, your company sells 1,000 pairs of shoes each month for $100 apiece. The variable costs are 40% of sales, and the fixed costs are $35,000/month. The company's advertising director is asking for an increase in her marketing budget of $1,500 per month. She plans to enhance her marketing campaign in a targeted area of the West Coast. She estimates that the additional advertising will result in a 50% increase in demand. For this situation, the additional advertising costs are considered a fixed cost. What is the impact of this request on the company's operating income? On the other hand, the production manager believes that this increase in sales could put pressure on the production line. He estimates that there will need to be a $2.00 increase in labor costs per unit.

Consider the following:

- Using the projected monthly income figure calculated above, how many units would the company need to sell to meet the initial monthly income figure?

- What is the break-even sales volume needed?

- Summarize the results of your analysis.

Respond to the following for this assignment:

- How did you calculate the original operating income and break-even point before changes?

- What is the new break-even point after including the effects of the increased advertising and higher variable costs?

- Compare the two break-even results, and make a recommendation on whether the company should change or not.

Trending now

This is a popular solution!

Step by step

Solved in 2 steps