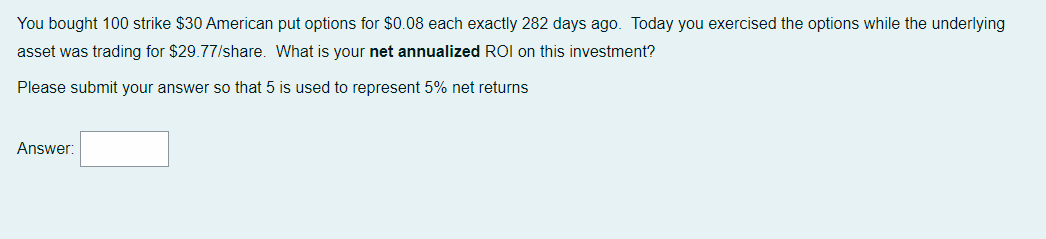

You bought 100 strike $30 American put options for $0.08 each exactly 282 days ago. Today you exercised the options while the underlying asset was trading for $29.77/share. What is your net annualized ROI on this investment? Please submit your answer so that 5 is used to represent 5% net returns

Q: What is the delta hedge (number of options) for call options with a strike of $71.85 required to…

A: Delta is the ratio of the change in the price of an option to the change in the price of the…

Q: Assume that the risk-free rate is 7.5% and the market risk premium is 3%. What is the required…

A: Risk free rate = 7.5% Market risk premium = 3% Beta of overall market = 1 As per CAPM, the…

Q: Given the following holding-period returns, compute the average returns and standard deviation for…

A: Holding period returns are available for a stock and market. The average return and standard…

Q: Every year, on 1st January, starting in 2020 and ending in 2049 (so 30 payments), you deposit $1,000…

A: Here the customer has 30 times from (2020 to 2049) each year $1000, to receive $ 50000 at the end…

Q: The margin on an adjustable-rate mortgage is 2.5% and the rate cap is 5% over the life of the loan.…

A: An adjustable-rate mortgage is a loan in which the interest rate on the loan keeps on fluctuating.…

Q: Pecos Corporation is considering several investment proposals, as shown below: Investment Proposal…

A: Profitability index of an investment proposal is calculated using following equation Profitability…

Q: Robert Gillman, an equity research analyst at Gillman Advisors, believes in efficient markets. He…

A: The annualized percentage rate of growth in a fund's payment over time is known as its dividend…

Q: Ethical issues in finance are important because they bear on our financial well-being. Ethical…

A: A financial market is a marketplace that provides opportunities for businesses to supplement their…

Q: Walmart has just paid an annual dividend of $3.39. Dividends are expected to grow by 6% for the next…

A: The board of directors of the firm typically decides the dividend amount, which might change…

Q: You owe $1,032.56 on a credit card with an 11.25% APR. The minimum due is $150.00. What is the…

A: Interest amount refers to the minimum cost to be charged over the investment made by the investors…

Q: The following data is provided for a PPP project. Benefits Disbenefits To the People $115,000 per…

A: This problem will use the conventional benefit-cost ratio method to solve it. If the value of the…

Q: QUESTION 2 Consider a company that is forecasted to generate free cash flows of $24 million next…

A: To determine whether a stock is overvalued or undervalued, businesses are valued and the valuation…

Q: Use $1.40 per gallon for gasoline and 12,000 miles per year and comp the amount of money in a bank…

A: In this question ,we will be drawing a graph of the amount of bank savings and the amount of…

Q: Which of the following is NOT true about competitive dynamics? High market commonality and high…

A: Competitive dynamics refer to the interactions among firms in a competitive market. It is a critical…

Q: salvage provide the following expected forecasts: Sales $5,000,000 Variable expenses $3,000,000…

A: The NPV of a project refers to the profitability of the project after considering the PV of cash…

Q: Suppose that today’s date is April 15. A bond with a 8% coupon paid semiannually every January 15…

A: The invoice price of the bond needs to be determined, in between the coupon dates. The invoice price…

Q: Suppose that California Co., a U.S.-based MNC that invests in projects all over the world, is…

A: It is a case of optimization of risk and return. Projects portfolios present on efficient frontier…

Q: Miguel Perez of Pamona, California, obtained a two-year installment loan for $1,600 to buy a…

A: To calculate the amount Miguel needs to pay off the loan, we need to find the remaining principal…

Q: it say that the answers are incorrect above^

A: Coefficient of Variation: It expresses a measure of statistics of the scattering of data points in…

Q: Popie Drink Corp issued 12 year bonds 2 years ago at a coupon rate of 8.4 percent. The bonds make…

A: Compound = semiannually = 2 Time = nper = (12 - 2) * 2 = 20 semiannually Coupon rate = 8.4/ 2 = 4.2%…

Q: Shannon deposited $15,500 into a fund at the beginning of every quarter for 20 years. He then…

A:

Q: Sarah the Company Secretary of Beta Plc, The company is a non-listed public company. She seeks your…

A: Companies issue shares to the general public to raise funds to support business expansionary…

Q: Walmart has just paid an annual dividend of $3.39. Dividends are expected to grow by 6% for the next…

A: The intrinsic value of the stock is the present value of future cash flows from the stock namely…

Q: Problems - Find the Net Present Value and Benefit Cost Ratio for the following: 3. Productivity…

A: Net present value (NPV) refers to the difference between the present value of cash inflows and…

Q: Consider a loan of $7300 at 4.4% compounded semiannually, with 18 semiannual payments. Find the…

A: Amortization Schedule: Amortization schedule refers to a schedule of loan amortization that shows…

Q: A decrease in the sales of a current project because of the launching of a new project is O A.…

A: Cannibalism is the term used to describe a situation in which the introduction of a new project…

Q: IBM has paid a dividend for many years and currently has a dividend yield around 5%. You would like…

A: Since you have asked multiple question , we will solve the first question for you. If you want any…

Q: Savings of $5600 per year can be achieved through either a $14 000 machine (A) with a seven-year…

A: The concept of money's time value indicates that any sum today is worth more than what it will be in…

Q: Reese is comparing retirement plans with prospective employers. ABC, Inc., offering a salary of…

A: Future Value: It represents the future expected value of the present/current sum of the amount. It…

Q: In addition to the bonds and preferred stock described in requirements 1 and 2, Micro Advantage has…

A: We will have to first calculate the current market value of all three forms of capital structure,…

Q: A $15,000 investment will be allowed to grow at 5.5% compounded semiannually until it can support…

A:

Q: Compute the principal (in $) for the loan. Use ordinary interest when time is stated in days.…

A: When the lender lends a loan to the borrower, he charges a rate of interest on the borrowed amount.…

Q: he formula for the duration of a perpetual bond that makes an equal payment each year in perpetuity…

A: The bond duration refers to the risk of change in the price of the bond in terms of the change in…

Q: Suppose you have mean-variance utility function with a coefficient of risk Aversion-0, which stocks…

A: The risk aversion measures the risk preference. In this case, the investor is risk neutral as his…

Q: Suppose our corporation can borrow in EUR at 0.08% for 1 year. The current exchange rate is…

A: Interest rate parity is a theory that suggests that the difference between two countries' interest…

Q: The S&P 500 Index represents a portfolio comprised of 500 large publicly traded companies. A year…

A: Data given: Value of index a year ago=$4677 Current value of index=$3824 Dividend paid= 4% of…

Q: The real risk-free rate is 3%, and inflation is expected to be 4% for the next 2 years. A 2-year…

A: Maturity risk premium is the extra return earned on the long term bond as a compensation for the…

Q: Two mutually exclusive projects are under consideration: Year 0 1 3,000 2 3,500 3 4,000 4 4,500 5…

A: Pay Back period is that under which investor will return his invested amount without any income.…

Q: (Common stock valuation) Dubai Metro's stock price was at $90 per share when it announced that it…

A: Given, Current stock price = $90 Dividend (D1) = $8 Growth rate = 0.09

Q: The Flatiron Group, a private equity firm headquartered in Boulder, Colorado, borrows £5,000,000 for…

A:

Q: XYZ Corp. is currently an all-equity firm that has 250,000 shares of stock outstanding with a market…

A: Financial leverage is the practice of using borrowed funds (debt) to support the acquisition of…

Q: You own 200 shares of stock in Halestorm Incorporated, that currently sells for $82.75 per share.…

A: Value of the stock on the ex dividend date needs to be determined. On the ex dividend date, the…

Q: Suppose you are a euro-based investor who just sold Microsoft shares that you had bought six months…

A: It is a problem that requires the concept to rate of return to calculate profit from the investment.…

Q: Suppose you are considering two possible investment opportunities: a 12-year Treasury bond and a…

A: Different risk components of a bond have different risk premia. The information has been provided on…

Q: A stock is expected to pay a dividend next year of $1.8. The dividend amount is expected to grow at…

A: Data given: D1=$1.8 Growth rate=6.0% Required rate of return=8.5% Required: Dividend yield on the…

Q: Porter Plumbing's stock had a required return of 10.25% last year, when the risk-free rate was 5.50%…

A: Old Required rate of return = 10.25% Risk free rate = rf = 5.50% old Market risk premium = old mrp =…

Q: Sofr interest rate is 8% for 9-month and 7.5% for 6-month (both per annum and continuous). The…

A: Sofr interest rate is 8% for 9-month and 7.5% for 6-month (both per annum and continuous) Formula to…

Q: our firm needs to borrow $1.0 million for one year. The firm has no other short term borrowings and…

A: Four different short term borrowing alternatives are available. The best one from the perspective of…

Q: 1. Calculate the standard deviation of both service providers and interpret which share carries the…

A: To calculate the standard deviation of the two service providers, we need to calculate the variance…

Q: Consider a stock with current price S0 = 29 per share. A european call option on this stock that…

A: A call option gives the right but not the obligation to buy at the strike price. In this question,…

Step by step

Solved in 2 steps

- A stock is trading at $80 per share. The stock is expected to have a yearend dividend of $4 per share (D1 = $4), and it is expected to grow at some constant rate, g, throughout time. The stock’s required rate of return is 14% (assume the market is in equilibrium with the required return equal to the expected return). What is your forecast of gL?Y2 You bought 100 strike $30 American put options for $0.08 each exactly 270 days ago. Today you exercised the options while the underlying asset was trading for $29.82/share. What is your net annualized ROI on this investment? Please submit your answer so that 5 is used to represent 5% net returnsStanton Company stock is trading for 50 in a two‑time period environment, so that each relevant time period is 6 months. The stock might increase by exactly 20% in just one period or perhaps in both periods. Of course, the stock might not increase in either period. If the stock price does not increase in a given period, it will decline by 16.67 percent in that particular period. One-year options with an exercise price equal to 60 are trading on this stock. The annual riskless rate of return equals 0. a. What is the value of a put in this environment? b. What is the probability (risk-neutral probability) implied in this framework that the Stanton Company stock price will exceed 40 when options expire?

- A stock priced at $65 has three-month calls and puts with an exercise price of $55 available. The calls have a premium of $3.91, and the puts cost $1.6. The risk-free rate is 1.6%. If the put options are mispriced, what is the profit per option assuming no transaction costs? Bring out 4 decimal placesSuppose you had just gone long (purchased) on lot of Syarikat XYZ stock at a price of RM 15.00 each, for a total investment of RM 15,000. You believe this stock has long term potential but wish to protect yourself from any short-term downside movement in price. Suppose 3-month, at-the-money put options on Syarikat XYZ stocks are being quoted at RM 0.15 or 15 sen each or RM 150 per lot (RM 0.15 x 1,000).a. What would be the appropriate options strategy to hedge the long stockposition? b. Show (in a table) the payoff to the combined position for a given range ofstocks prices at options maturity in 3-months. c. Draw the payoff profile of combined positions.Based on five years of monthly data, you derive the following information forthe companies listed: Company SDi rm Padma 11.10% 0.82 Meghna 12.60% 0.63 Jamuna 6.60% 0.45 Karnafully 9.70% 0.70 SD on Market 7.60% 1.00 Assuming a risk-free rate of 9% and expected return for the market portfolio is 16 % compute the expected (required) return for all the stocks.

- On January 1, 1997, a stock portfolio is worth $100 thousand. On September 30, 1997, $8.9 thousand is withdrawn from the portfolio, and immediately after this withdrawal the portfolio has a value of $105 thousand. Twelve months later, the value of the portfolio is $108 thousand, and the investor adds $3 thousand worth of stock to his portfolio. On December 31, 1998, the portfolio is worth $100 thousand. Over the two-year period, the annual time-weighted rate of return is X and annual dollar-weighted rate of return is Y. Find |X-Y|A stock is selling today for $110. The stock has an annual volatility of 64 percent and the annual risk-free rate is 7 percent. Calculate how much the current stock price would need to change for the purchaser of the put option to break even in one year. Calculate the level of volatility that would make a $95 call option sell for $30. (Use Goal Seek or Solver). Calculate the level of volatility that would make a $95 put option sell for $8. (Use Goal Seek or Solver). Please show work in excel.Year-to-date, Yum Brands had earned a 4.80 percent return. During the same time period, Raytheon earned 5.13 percent and Coca-Cola earned −0.64 percent.If you have a portfolio made up of 40 percent Yum Brands, 30 percent Raytheon, and 30 percent Coca-Cola, what is your portfolio return? (Round your answer to 2 decimal places.) Portfolio return: ____.__%

- Both a call and a put currently are traded on stock XYZ; both have strike prices of $50 and expirations of 6 months. What will be the profit to an investor who buys the call for $4 in the following scenarios for stock prices in 6 months? What will be the profit in each scenario to an investor who buys the put for $6? $40 $45 $50 $55 $60The spot price of a stock is 70. The stock pays continuous dividends at a rate of 2% annually. The continuously compounded risk-free interest rate is 6%. You notice a 5-month forward price in the market that would allow you to perform a reverse cash-and-carry arbitrage and make a profit of 2.35 on one forward contract in 5 months. What is the forward price you found in the market?Teh stocks is currently selling for $15.25 par share and its noncallable $1000 par value, 20 year, 7.25% conds with semiannual payment are selling for $875.00. The beta is 1.25, the yield on a six month T-bill is 3.50% on yield of 20 year TBond is 5.50%. The required return on the stock market is 11.5% by the market and has a average annual return of 14.50% during the past 5 years. The firms tax is 40%. using CAPM what is the firms cost of common stock? (13.65%, 11.73%, 11.15%, 13% or 12.32%)