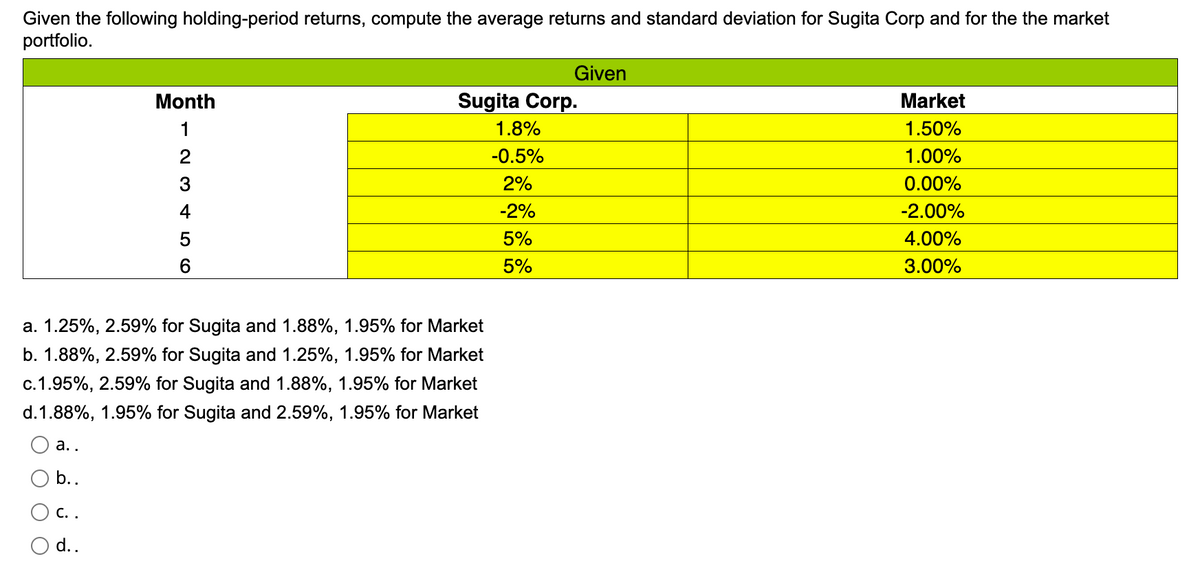

Given the following holding-period returns, compute the average returns and standard deviation for Sugita Corp and for the the market portfolio. Month 1 2 3 4 5 6 Given Sugita Corp. 1.8% -0.5% 2% -2% 5% 5% a. 1.25%, 2.59% for Sugita and 1.88%, 1.95% for Market b. 1.88%, 2.59% for Sugita and 1.25%, 1.95% for Market c.1.95%, 2.59% for Sugita and 1.88%, 1.95% for Market d.1.88%, 1.95% for Sugita and 2.59%, 1.95% for Market O a.. O b.. Oc.. d.. Market 1.50% 1.00% 0.00% -2.00% 4.00% 3.00%

Given the following holding-period returns, compute the average returns and standard deviation for Sugita Corp and for the the market portfolio. Month 1 2 3 4 5 6 Given Sugita Corp. 1.8% -0.5% 2% -2% 5% 5% a. 1.25%, 2.59% for Sugita and 1.88%, 1.95% for Market b. 1.88%, 2.59% for Sugita and 1.25%, 1.95% for Market c.1.95%, 2.59% for Sugita and 1.88%, 1.95% for Market d.1.88%, 1.95% for Sugita and 2.59%, 1.95% for Market O a.. O b.. Oc.. d.. Market 1.50% 1.00% 0.00% -2.00% 4.00% 3.00%

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter10: Stockholder's Equity

Section: Chapter Questions

Problem 78E: Ratio Analysis Consider the following information. Required: Calculate the stockholder payout...

Related questions

Question

100%

Transcribed Image Text:Given the following holding-period returns, compute the average returns and standard deviation for Sugita Corp and for the the market

portfolio.

a..

b..

C..

Month

a. 1.25%, 2.59% for Sugita and 1.88%, 1.95% for Market

b. 1.88%, 2.59% for Sugita and 1.25%, 1.95% for Market

c.1.95%, 2.59% for Sugita and 1.88%, 1.95% for Market

d. 1.88%, 1.95% for Sugita and 2.59%, 1.95% for Market

d..

123 45

6

Given

Sugita Corp.

1.8%

-0.5%

2%

-2%

5%

5%

Market

1.50%

1.00%

0.00%

-2.00%

4.00%

3.00%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 5 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Essentials of Business Analytics (MindTap Course …

Statistics

ISBN:

9781305627734

Author:

Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Publisher:

Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage