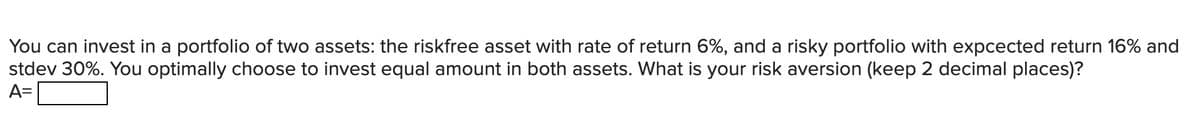

You can invest in a portfolio of two assets: the riskfree asset with rate of return 6%, and a risky portfolio with expcected return 16% and stdev 30%. You optimally choose to invest equal amount in both assets. What is your risk aversion (keep 2 decimal places)? A=

Q: What is Nico's portfolio beta if he invests an equal amount in Asset X with a beta of 0.60, Asset Y…

A: In this question we need to compute the beta of the portfolio if Nico invests equal amount in the…

Q: You manage a risky portfolio with an expected rate of return of 18% and a standard deviation of 28%.…

A: Therefore, the proportion of y is 36.44%.

Q: Equity has a beta of 0.9 and an expected return of 9%. A risk free asset currently earns 2%.(a) What…

A: Since you have posted a question with multiple sub-parts, we will solve the first three subparts for…

Q: Suppose you are an investor with a choice between three securities that are identical in every way…

A: Solution : If we invest in any security than we will firstly calculate the return on that investment…

Q: An investment portfolio consists of two securities, X and Y. The weight of X is 30%. Asset X's…

A: a. expected return of portfolio=wx×rx+wy×ry=0.3×15%+0.7×23%=20.6% answer: expected return = 20.6%

Q: Talal can pick one of two investment portfolios - A and B. Each requires an initial outlay of…

A: Risk-aversion is used to describe the attitude of investor who prefers outcome with lower…

Q: a. What is the expected return on a portfolio that is equally invested in the two assets? (Do not…

A: Portfolio Expected Return: It represents the sum of expected return on individual security/assets…

Q: You manage a risky portfolio with an expected rate of return of 17% and a standard deviation of 36%.…

A: Given, Expected return = 17% Standard deviation = 36% T-bill rate = 6%

Q: You manage a risky portfolio with an expected rate of return of 19% and a standard deviation of 31%.…

A: Given information: Expected rate of return of a risky portfolio is 19%, Standard deviation is 31%,…

Q: Assume you have an optimal risky portfolio with an expected return of 17% and a standard deviation…

A: Expected return (Re) = 17% Risk free rate (Rf) = 5% Risk aversion measure (A) = 2 Standard deviation…

Q: EXPECTER RETURN OF A PORTFOLIO please see attatch file

A: Expected return on portfolio is sum of weighted return on individual stocks

Q: Assume that there is a portfolio with an E(r) =20% and σ = 30%. Also, the risk-free rate of return…

A: Portfolio Expected return E(r) is 20% Standard Deviation is 30% Risk free rate is 7% Degree of risk…

Q: Hi, An investor will choose between Asset Q with an expected return of 6.5% and a standard deviation…

A: Information provided:Asset Q has an expected return of 6.5% and standard deviation of 5.5%Asset U…

Q: you have two investmwnts, each of which has a 0.8% chance if a loss $12 million and a 99.2% chance…

A: The process of identifying, analyzing, and controlling hazards to an organization's capital and…

Q: You have invested $1,000 in a risky asset with an expected rate of return of 0.17 and a standard…

A: Capital asset line (CAL) is a graphical representation of the measure of risk that an investor's…

Q: You invest 80% of your portfolio in a risky portfolio that has an expected rate of return of 15% and…

A: Given: Weight of risky portfolio = 80% Expected return = 15% Standard deviation = 21% T bill rate =…

Q: You invest $100 in a risky asset with an expected rate of return of 15% and a standard deviation of…

A: Hello. Since your question has multiple parts, we will solve the first question for you. If you want…

Q: Suppose there are two investments A and B. Either investment A or B has a 4.5% chance of a loss of…

A: Value at risk (VaR) is a financial statistic that evaluates an investment's risk. VaR is a…

Q: An Equity has a beta of 0.9 and an expected return of 9%. A risk free asset currently earns 2%. i.)…

A:

Q: Suppose you have the following investments: Security Amount Invested Expected Return Beta A $2,000…

A: Portfolio refers to a combination or collection of financial instruments or securities being stocks,…

Q: You manage a risky portfolio with an expected rate of return of 21% and a standard deviation of 33%.…

A: Sharpe ratio is the ratio which measures financial portfolio’s risk adjusted return. It is simply…

Q: You can invest in a portfolio of two assets: the riskfree asset with rate of return 10%, and a risky…

A: Risk free rate(rf) is 10% Expected return(Er) of 14% Standard deviation is 35% To Find: Utility…

Q: You manage a risky portfolio with an expected rate of return of 18% and a standard deviation of 30%.…

A: Risk aversion The behavior of an individual, when such an individual is exposed to the risk and try…

Q: You are considering investing $1,000 in a T-bill that pays 0.06 and a risky portfolio, P,…

A: To solve the question we first need to determine the expected return of the risky portfolio then…

Q: Expected return and standard of a risky portfolio are 11% and 21% respectively. Risk-free rate is…

A: Here, Expected Return of Risky Portfolio is 11% Standard Deviation of Risky Portfolio is 21% Risk…

Q: tock has a beta of 1.2 and an expected return of 16%. The risk-free asset currently earns 5%. a)…

A: In this we have to use capital assets pricing model.

Q: An Equity has a beta of 0.9 and an expected return of 9%. A risk free asset currently earns 2%.…

A: Beta= 0.9 Expected return= 9% Risk free rate of asset= 2%

Q: An analyst has modeled the stock of Crisp Trucking using a two-factor APT model. The risk-free rate…

A: A single factor APT can be extended further to contain more number of independent risk factors that…

Q: Assume you have an optimal risky portfolio with an expected return of 17% and a standard deviation…

A: Given: Expected return = 17% Standard deviation = 27% Risk free rate = 5% Risk aversion = 2

Q: sh to invest, and if he is a constant relative risk aversion, how do you think he wants to allocate…

A: 1 1 Million Portfolio 70% risk 30%…

Q: You compute the optimal risky portfolio to have the expected return of 12% and standard deviation of…

A: Expected return E(r) = 12% Risk free rate (Rf) = 4% Standard Deviation (SD) = 20% Risk Aversion (A)…

Q: You manage a risky portfolio with an expected rate of return of 18% and a standard deviation of 29%.…

A: Expected return of risky portfolio (Re) = 18% Standard deviation of risky portfolio (SDe) = 29%…

Q: portfolio made up of the following three stocks if you want to distribute your investment as…

A: Return on portfolio is weighted average return of portfolio.

Q: You are going to invest $50,000 in a portfolio consisting of assets X, Y, and Z, as follows; What…

A: Expected return of the portfolio can be calculated by averaging the returns of assets in proportion…

Q: ou are considering investing in a combination of a stock and a risk-free asset. The stock has an…

A: The portfolio standard deviation and expected return: When an investment is made in at least two…

Q: You are told that the expected return of the market portfolio is 10%, and its standard deviation is…

A: Market Porfolio Return(Rm)=10% Market Standard Deviation (SDm) =10% Efficient Portfolio Return (Re)=…

Q: Suppose an investor uses two stocks A and B to build a risky portfolio. The following information is…

A: The optimum portfolio is a combination of different risk assets that provide minimum risk and…

Q: Assume a Portfolio of two assets A and B whose standard deviations of their returns are 8.6% and…

A: The question is related to the portfolio Management. In this question we will first calculate…

Q: You have invested $1,000 in a risky asset with an expected rate of return of 0.17 and a standard…

A: Since you have posted a question with multiple sub-parts, we will solve the first three sub-parts…

Q: If the beta of Asset A is 2.2, the risk free rate is 2.5%, and the expected return on Asset A is 8%,…

A: Expected return on market refers to the money that is invested for expecting to make an investment…

Q: You manage a risky portfolio with an expected rate of return of 19% and a standard deviation of 30%.…

A: Sharpe ratio is used to help investors understand the return of an investment compared to its risk.…

Q: f. Assume a Portfolio of two assets A and B whose standard deviations of their returns are 8.6% and…

A: Optimum Portfolio Optimum portfolios represent the possible combination of portfolios that maximize…

Q: You form a complete portfolio by investing 30% of your portfolio in a risky portfolio that has an…

A: Given information: Weight of risky portfolio is 30% Expected rate of return is 9% Standard deviation…

Q: You manage a risky portfolio with expected rate of return of 16% and a standard deviation of 28%.…

A: Since you have asked multiple questions, we will solve the first question for you. If you want any…

Q: Assume that you manage a risky portfolio with an expected rate of return of 20% and a standard…

A: a.Given,Standard Deviation of Portfolio = 46%New Standard Deviation of Portfolio = 35% Calculation…

Q: What is the required return on an investment with a beta of 1.3 if the riskfree rate is 2.0 percent…

A: CAPM evolved as a way to measure this systematic risk. Sharpe found that the return on an individual…

Step by step

Solved in 2 steps

- APT An analyst has modeled the stock of Crisp Trucking using a two-factor APT model. The risk-free rate is 6%, the expected return on the first factor (r1) is 12%, and the expected return on the second factor (r2) is 8%. If bi1 = 0.7 and bi2 = 0.9, what is Crisp’s required return?An investor has an opportunity to invest in two risky assets and a risk-free asset. Theexpected return of the two risky assets are μ1 = 0.12, μ2 = 0.15. Their standarddeviations are σ1 = 0.05 and σ2 = 0.1, and the correlation coefficient between theirreturn is 0.2. The risk-free rate is 0.05. Suppose the investor has $1000 and he wantsto hold a portfolio with expected return of 0.1. If the investor is risk averse, how muchshould he invest in the two risky assets and the risk-free asset?You have invested $1,000 in a risky asset with an expected rate of return of 0.17 and a standard deviation of 0.40 and a T-bill with a rate of return of 0.04. What percentages of your money must be invested in the risky asset and the risk-free asset, respectively, to form a portfolio with an expected return of 0.11? What percentages of your money must be invested in the risk-free asset and the risky asset, respectively, to form a portfolio with a standard deviation of 0.20? Calculate the slope of CAL. If the degree of risk aversion A=4, what proportion of the money should be invested in risky asset. Sub Parts to be solved

- You have invested $1,000 in a risky asset with an expected rate of return of 0.17 and a standard deviation of 0.40 and a T-bill with a rate of return of 0.04. What percentages of your money must be invested in the risky asset and the risk-free asset, respectively, to form a portfolio with an expected return of 0.11? What percentages of your money must be invested in the risk-free asset and the risky asset, respectively, to form a portfolio with a standard deviation of 0.20? Calculate the slope of CAL. If the degree of risk aversion A=4, what proportion of the money should be invested in risky asset.You are constructing a portfolio of two assets, Asset A and Asset B. The expected returns of the assets are 12 percent and 15 percent, respectively. The standard deviations of the assets are 29 percent and 48 percent, respectively. The correlation between the two assets is .25 and the risk-free rate is 5 percent. What is the optimal Sharpe ratio in a portfolio of the two assets? What is the smallest expected loss for this portfolio over the coming year with a probability of 2.5 percent?You are evaluating various investment opportunities currently available and you have calculated expected returns and standard deviations for five different well-diversified portfolios of risky assets:Portfolio Expected Return Standard DeviationQ 7.8% 10.5%R 10.0 14.0S 4.6 5.0T 11.7 18.5U 6.2 7.5a. For each portfolio, calculate the risk premium per unit of risk that you expect to receive ([E(R) − RFR]/σ). Assume that the risk-free rate is 3.0 percent.b. Using your computations in Part a, explain which of these five portfolios is most likely tobe the market portfolio. Use your calculations to draw the capital market line (CML).c. If you are only willing to make an investment with σ = 7.0%, is it possible for you toearn a return of 7.0 percent?d. What is the minimum level of risk that would be necessary for an investment to earn7.0 percent? What is the composition of the portfolio along the CML that will generatethat expected return?e. Suppose you are now willing to make an investment…

- Suppose that you have the following two opportunities from which to construct a complete portfolio: risk-free asset earning 2%, and a risky asset with expected return of 12% and standard deviation of 20%. If you construct a complete portfolio that has expected return of 5%, what is its standard deviation?Suppose that you have the following two opportunities from which to construct a complete portfolio: risk-free asset earning 2%, and a risky asset with expected return of 12% and standard deviation of 20%. If you construct a complete portfolio that has standard deviation of 12%, what is its expected return?You are evaluating various investment opportunities currently available and you have calculated expected returns and standard deviations for five different well-diversified portfolios of risky assets. PORTFOLIO EXPECTED RETURN STANDARD DEVIATION Q 7.8% 10.5% R 10.0% 14.0% S 4.6% 5.0% T 11.7% 18.5% U 6.2% 7.5% a) For each portfolio, calculate the risk premium per unit of risk that you expect to receive [(E(R) –RFR)/ơ]. Assume that the risk free rate is 3.0%. b) Using…

- You manage a risky portfolio with an expected return of 12% and a standard deviation of 24%. Assumethat you can invest and borrow at a risk-free rate of 3%, using T-bills. a) Draw the Capital Allocation Line (CAL) for this combination of risky portfolio and risk-free asset.What is the Sharpe ratio of the risky portfolio?b) Your client chooses to invest 50% of their funds into your risky portfolio and 50% risk-free. Whatis the expected return and standard deviation of the rate of return on their portfolio?Suppose that each of two investments has a 4% chance of a loss of $10 million, a 2% chance of a loss of $1 million, and a 94% chance of a profit of $1 million. They are independent of each other. What is the VaR for a portfolio consisting of the two investments when the confidence level is 95%? Also calculate the expected shortfall. (show steps)Suppose you are considering investing your entire portfolio in three assets A, B and C. You expect that after you invest, four possible mutually exclusive scenarios will occur, with associated returns (in %) for each of the three assets as listed below. The probability of each scenario is given below. A B C Probabilities return 0.05 0.50% -3.60% 3.60% 0.35 0.60% 2.75% 0.15% 0.45 3.66% 1.45% 0.45% 0.15 -4.80% -0.60% 6.30% Find the expected returns and standard deviations of Asset A, B & C. (HINT: the expected return is given by the probability-weighted sum of returns in each scenario. The expected standard deviation is given by the square root of the probability-weighted sum of squared deviations from the expected return.) Is there any reason to invest in Asset A given its low expected return and high standard deviation?