You have been doing a good business at your auto service & repair shop, Business is brisk! You have decided that, rather than just blowing your profits on a big party, to invest in a way to grow your business and - you hope -- bring in even more profits later. You have been working 50 hours per week at the shop but haven't taken any pay yet. You have money left to divide between your wage, and money to invest in growing your business. The more wages you pay yourself the less you will have to invest in your shop. > Weekly, you have been selling 30 brake replacements ($300 each), and 100 oil changes ($80 each). > Labor costs, have been about $4,400 per week: Technicians: $1,200 each Porter: $620 Service Writer: $800 Cashier: $580 > Supplies & parts cost you $3,400 per week > Rent & utilities for your shop is $5,000 per week > Insurance is $1,200 per week Show your work & circle your answer: 6. Calculate your total weekly revenue. 7. Calculate your weekly profit. 8. Determine your own weekly salary (This must come out of your answer to #7)? 9. Calculate your own hourly wage (based on your answer in #8). 10. Identify how much money is left for investment in capital goods? 11. Describe how division-of-labor exists in your shop.

You have been doing a good business at your auto service & repair shop, Business is brisk! You have decided that, rather than just blowing your profits on a big party, to invest in a way to grow your business and - you hope -- bring in even more profits later. You have been working 50 hours per week at the shop but haven't taken any pay yet. You have money left to divide between your wage, and money to invest in growing your business. The more wages you pay yourself the less you will have to invest in your shop. > Weekly, you have been selling 30 brake replacements ($300 each), and 100 oil changes ($80 each). > Labor costs, have been about $4,400 per week: Technicians: $1,200 each Porter: $620 Service Writer: $800 Cashier: $580 > Supplies & parts cost you $3,400 per week > Rent & utilities for your shop is $5,000 per week > Insurance is $1,200 per week Show your work & circle your answer: 6. Calculate your total weekly revenue. 7. Calculate your weekly profit. 8. Determine your own weekly salary (This must come out of your answer to #7)? 9. Calculate your own hourly wage (based on your answer in #8). 10. Identify how much money is left for investment in capital goods? 11. Describe how division-of-labor exists in your shop.

Chapter10: The Basics Of Capital Budgeting: Evaluating Cash Flows

Section: Chapter Questions

Problem 1aM

Related questions

Question

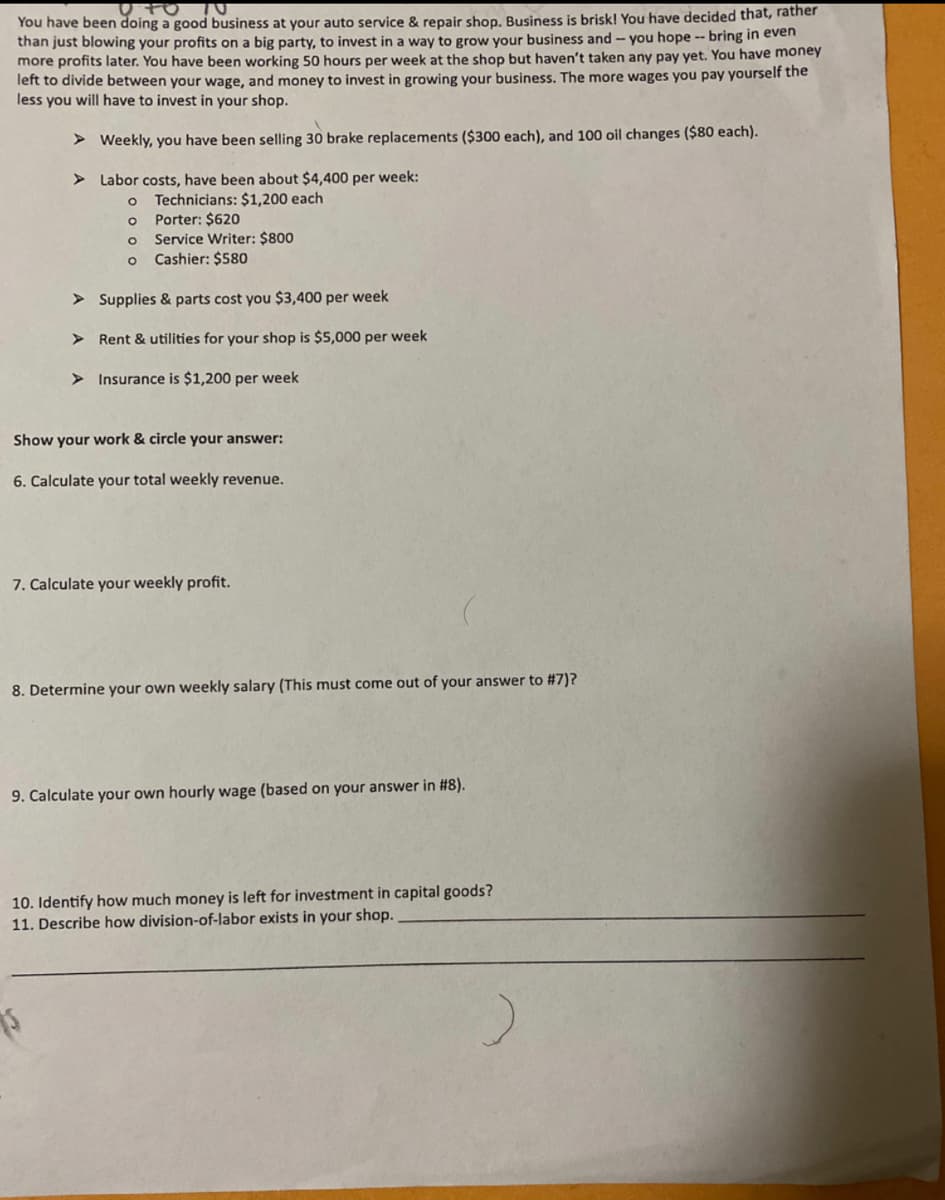

Transcribed Image Text:You have been doing a good business at your auto service & repair shop. Business is brisk! You have decided that, rather

than just blowing your profits on a big party, to invest in a way to grow your business and - you hope -- bring in even

more profits later. You have been working 50 hours per week at the shop but haven't taken any pay yet. You have money

left to divide between your wage, and money to invest in growing your business. The more wages you pay yourself the

less you will have to invest in your shop.

> Weekly, you have been selling 30 brake replacements ($300 each), and 100 oil changes ($80 each).

> Labor costs, have been about $4,400 per week:

Technicians: $1,200 each

Porter: $620

Service Writer: $800

Cashier: $580

> Supplies & parts cost you $3,400 per week

> Rent & utilities for your shop is $5,000 per week

> Insurance is $1,200 per week

Show your work & circle your answer:

6. Calculate your total weekly revenue.

7. Calculate your weekly profit.

8. Determine your own weekly salary (This must come out of your answer to #7)?

9. Calculate your own hourly wage (based on your answer in #8).

10. Identify how much money is left for investment in capital goods?

11. Describe how division-of-labor exists in your shop.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Recommended textbooks for you

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning