You have been hired by Patterson Planning Corp., an events planning company that recently had a fire in which some of the accounting records were damaged. In reviewing the fixed asset records, you find three depreciation schedules that are not labeled. They are listed in the following table. One of the assets has a depreciation rate of $4.30 per hour. Year Schedule A Schedule B Schedule C 1 $10,000 $10,125 $9,460 6,000 13,500 6,450 3 3,600 13,500 7,310 4 2,160 13,500 6,450 740 3,375 4,300 6. 6,880 7 4,730 Total $22,500 $54,000 $45,580 Depreciation 1. Determine which depreciation method is shown in each schedule on the Patterson Planning Corp. panel. Then match each schedule to the asset description that best characterizes the type of assets often depreciated using that method. Asset Description Depreciation Schedule Used Asset producing steady revenues Asset with variable in-service time Asset generating greater revenues in the early years A V Feedback 2. For each of the depreciation schedules shown on the Patterson Planning Corp., fill in the following information. If an amount box does not require an entry, leave it blank. A B Useful life 7 x Residual value Asset cost Total operating hours

You have been hired by Patterson Planning Corp., an events planning company that recently had a fire in which some of the accounting records were damaged. In reviewing the fixed asset records, you find three depreciation schedules that are not labeled. They are listed in the following table. One of the assets has a depreciation rate of $4.30 per hour. Year Schedule A Schedule B Schedule C 1 $10,000 $10,125 $9,460 6,000 13,500 6,450 3 3,600 13,500 7,310 4 2,160 13,500 6,450 740 3,375 4,300 6. 6,880 7 4,730 Total $22,500 $54,000 $45,580 Depreciation 1. Determine which depreciation method is shown in each schedule on the Patterson Planning Corp. panel. Then match each schedule to the asset description that best characterizes the type of assets often depreciated using that method. Asset Description Depreciation Schedule Used Asset producing steady revenues Asset with variable in-service time Asset generating greater revenues in the early years A V Feedback 2. For each of the depreciation schedules shown on the Patterson Planning Corp., fill in the following information. If an amount box does not require an entry, leave it blank. A B Useful life 7 x Residual value Asset cost Total operating hours

Century 21 Accounting General Journal

11th Edition

ISBN:9781337680059

Author:Gilbertson

Publisher:Gilbertson

Chapter19: Accounting For Plant Assets, Depreciation, And Intangible Assets

Section19.5: Declining-balance Method Of Depreciation

Problem 1OYO

Related questions

Question

100%

Hello,

I am needing help with answering question 2 and final question #1.

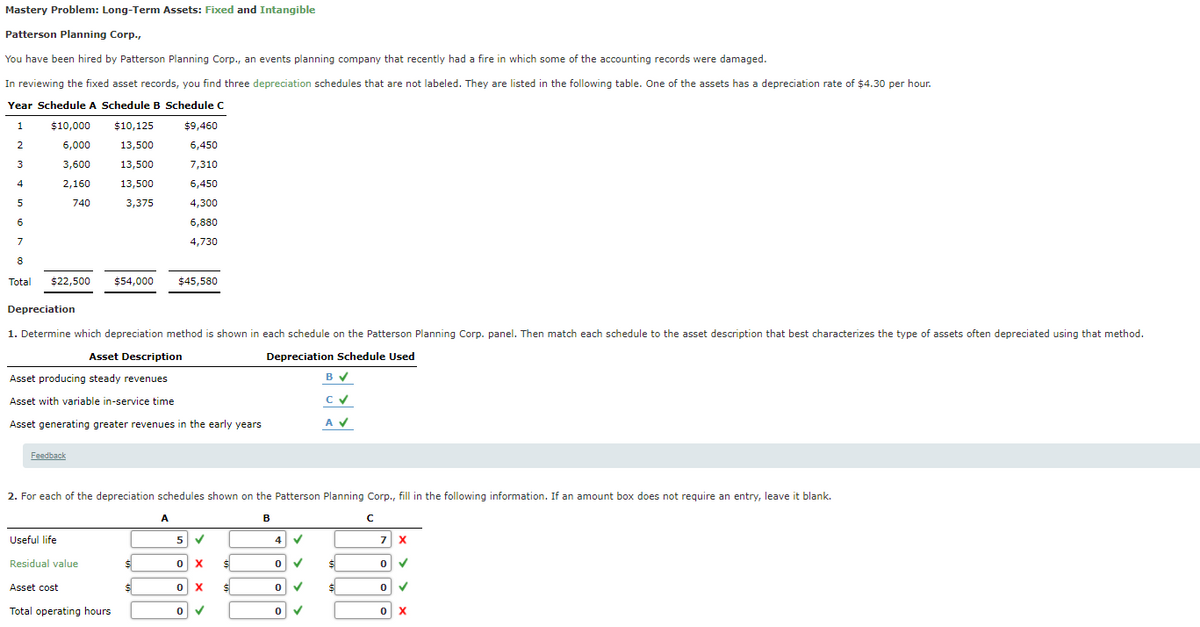

Transcribed Image Text:Mastery Problem: Long-Term Assets: Fixed and Intangible

Patterson Planning Corp.,

You have been hired by Patterson Planning Corp., an events planning company that recently had a fire in which some of the accounting records were damaged.

In reviewing the fixed asset records, you find three depreciation schedules that are not labeled. They are listed in the following table. One of the assets has a depreciation rate of $4.30 per hour.

Year Schedule A Schedule B Schedule C

1

$10,000

$10,125

$9,460

2

6,000

13,500

6,450

3

3,600

13,500

7,310

4

2,160

13,500

6,450

5

740

3,375

4,300

6

6,880

7

4,730

8

Total

$22,500

$54,000

$45,580

Depreciation

1. Determine which depreciation method is shown in each schedule on the Patterson Planning Corp. panel. Then match each schedule to the asset description that best characterizes the type of assets often depreciated using that method.

Asset Description

Depreciation Schedule Used

Asset producing steady revenues

Asset with variable in-service time

Asset generating greater revenues in the early years

A V

Feedback

2. For each of the depreciation schedules shown on the Patterson Planning Corp., fill in the following information. If an amount box does not require an entry, leave it blank.

A

B

Useful life

4

Residual value

Asset cost

Total operating hours

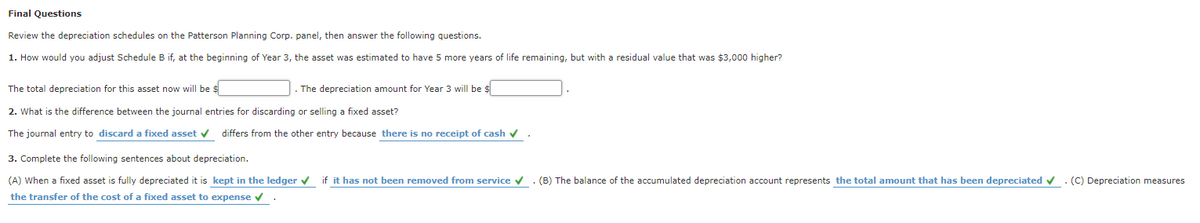

Transcribed Image Text:Final Questions

Review the depreciation schedules on the Patterson Planning Corp. panel, then answer the following questions.

1. How would you adjust Schedule B if, at the beginning of Year 3, the asset was estimated to have 5 more years of life remaining, but with a residual value that was $3,000 higher?

The total depreciation for this asset now will be s

The depreciation amount for Year 3 will be $

2. What is the difference between the journal entries for discarding or selling a fixed asset?

The journal entry to discard a fixed asset v differs from the other entry because there is no receipt of cash v.

3. Complete the following sentences about depreciation.

(A) When a fixed asset is fully depreciated it is kept in the ledger v if it has not been removed from service v. (B) The balance of the accumulated depreciation account represents the total amount that has been depreciated v. (C) Depreciation measures

the transfer of the cost of a fixed asset to expense v

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 10 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning