4. LSP Inc. reported the following financial facts at the year-end Dec 2018. Total Interest-Bearing Debt= $37,000; Sales= $15,000; Total Operating Cost= $4,000. If tax rate is 40% and interest rate is 6%, Find interest expense for the corresponding company. $2220 $7000 $2700 $346 None of the above 5. LSP Inc. recently reported $150,000 of sales, $75,500 of operating costs other than depreciation, and $10,200 of depreciation. The company had $16,500 of outstanding bonds that carry a 7.25% interest rate, and its federal-plus-state income tax rate was 35%. How much was the firm's net income? The firm uses the same depreciation expense for tax and stockholder reporting purposes. $35,167.33 $37,018.24 $38,966.57 O $41,017.44

4. LSP Inc. reported the following financial facts at the year-end Dec 2018. Total Interest-Bearing Debt= $37,000; Sales= $15,000; Total Operating Cost= $4,000. If tax rate is 40% and interest rate is 6%, Find interest expense for the corresponding company. $2220 $7000 $2700 $346 None of the above 5. LSP Inc. recently reported $150,000 of sales, $75,500 of operating costs other than depreciation, and $10,200 of depreciation. The company had $16,500 of outstanding bonds that carry a 7.25% interest rate, and its federal-plus-state income tax rate was 35%. How much was the firm's net income? The firm uses the same depreciation expense for tax and stockholder reporting purposes. $35,167.33 $37,018.24 $38,966.57 O $41,017.44

Fundamentals Of Financial Management, Concise Edition (mindtap Course List)

10th Edition

ISBN:9781337902571

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Eugene F. Brigham, Joel F. Houston

Chapter3: Financial Statements, Cash Flow, And Taxes

Section: Chapter Questions

Problem 19SP

Related questions

Question

What is the solution for this questions

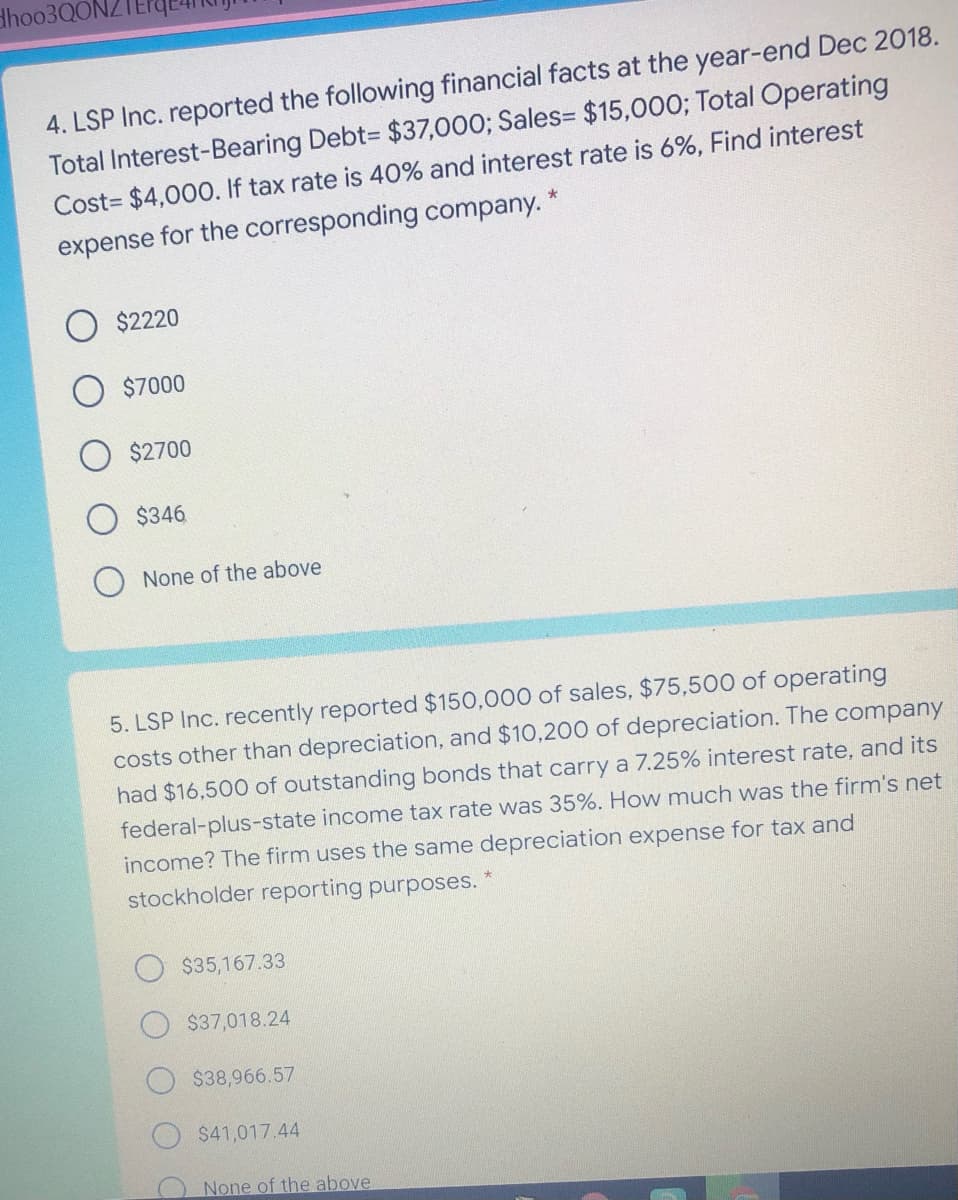

Transcribed Image Text:dhoo3Q0NZ

4. LSP Inc. reported the following financial facts at the year-end Dec 2018.

Total Interest-Bearing Debt= $37,000; Sales= $15,000; Total Operating

Cost= $4,000. If tax rate is 40% and interest rate is 6%, Find interest

expense for the corresponding company. *

$2220

$7000

$2700

$346

None of the above

5. LSP Inc. recently reported $150,000 of sales, $75,500 of operating

costs other than depreciation, and $10,200 of depreciation. The company

had $16,500 of outstanding bonds that carry a 7.25% interest rate, and its

federal-plus-state income tax rate was 35%. How much was the firm's net

income? The firm uses the same depreciation expense for tax and

stockholder reporting purposes.

$35,167.33

$37,018.24

$38,966.57

$41,017.44

None of the above

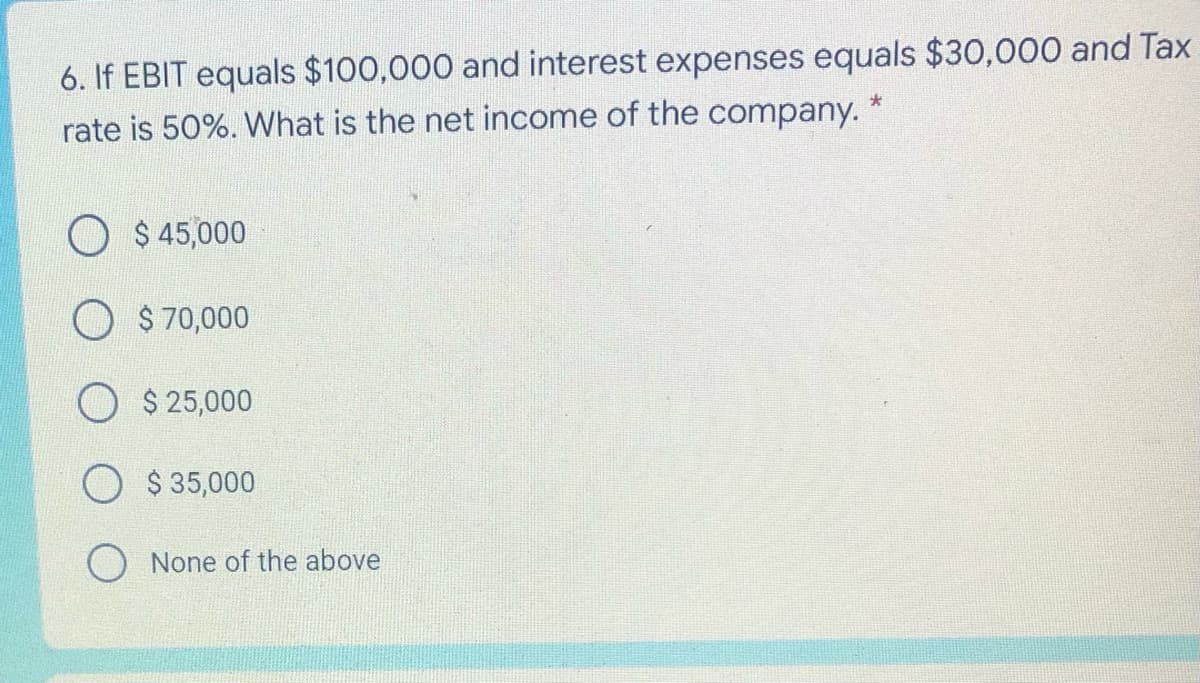

Transcribed Image Text:6. If EBIT equals $100,000 and interest expenses equals $30,000 and Tax

rate is 50%. What is the net income of the company. *

O $ 45,000

O $70,000

O $ 25,000

$ 35,000

O None of the above

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning