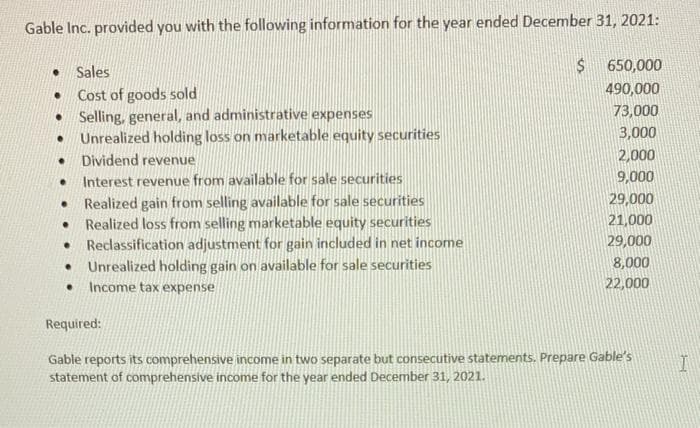

Gable Inc. provided you with the following information for the year ended December 31, 2021: Sales 650,000 490,000 Cost of goods sold • Selling, general, and administrative expenses Unrealized holding loss on marketable equity securities 73,000 3,000 Dividend revenue 2,000 Interest revenue from available for sale securities 9,000 Realized gain from selling available for sale securities Realized loss from selling marketable equity securities Reclassification adjustment for gain included in net income Unrealized holding gain on available for sale securities 29,000 21,000 29,000 8,000 Income tax expense 22,000 Required: Gable reports its comprehensive income in two separate but consecutive statements. Prepare Gable's statement of comprehensive income for the year ended December 31, 2021.

Gable Inc. provided you with the following information for the year ended December 31, 2021: Sales 650,000 490,000 Cost of goods sold • Selling, general, and administrative expenses Unrealized holding loss on marketable equity securities 73,000 3,000 Dividend revenue 2,000 Interest revenue from available for sale securities 9,000 Realized gain from selling available for sale securities Realized loss from selling marketable equity securities Reclassification adjustment for gain included in net income Unrealized holding gain on available for sale securities 29,000 21,000 29,000 8,000 Income tax expense 22,000 Required: Gable reports its comprehensive income in two separate but consecutive statements. Prepare Gable's statement of comprehensive income for the year ended December 31, 2021.

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter21: The Statement Of Cash Flows

Section: Chapter Questions

Problem 13P: Comprehensive The following are Farrell Corporations balance sheets as of December 31, 2019, and...

Related questions

Question

please answer all parts

Transcribed Image Text:Problem 2 answers:

Transcribed Image Text:Gable Inc. provided you with the following information for the year ended December 31, 2021:

$650,000

• Sales

Cost of goods sold

• Selling, general, and administrative expenses

Unrealized holding loss on marketable equity securities

490,000

73,000

3,000

2,000

9,000

Dividend revenue

• Interest revenue from available for sale securities

Realized gain from selling available for sale securities

Realized loss from selling marketable equity securities

• Reclassification adjustment for gain included in net income

• Unrealized holding gain on available for sale securities

• Income tax expense

29,000

21,000

29,000

8,000

22,000

Required:

Gable reports its comprehensive income in two separate but consecutive statements. Prepare Gable's

statement of comprehensive income for the year ended December 31, 2021.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning