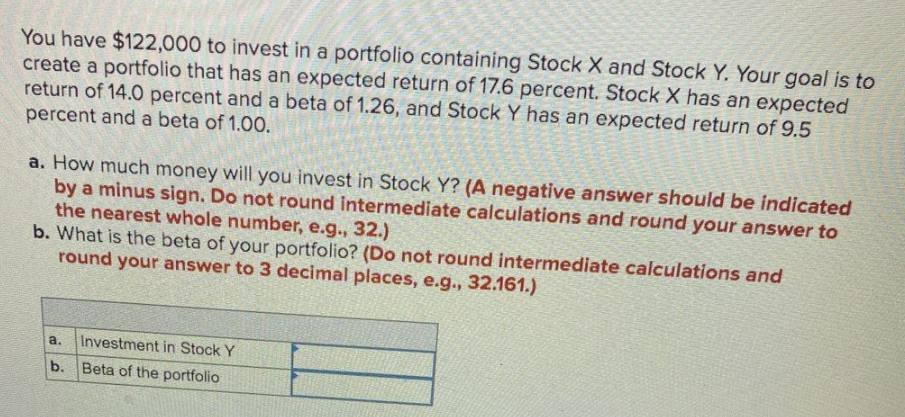

You have $122,000 to invest in a portfolio containing Stock X and Stock Y. Your goal is to create a portfolio that has an expected return of 17.6 percent. Stock X has an expected return of 14.0 percent and a beta of 1.26, and Stock Y has an expected return of 9.5 percent and a beta of 1.00. a. How much money will you invest in Stock Y? (A negative answer should be indicated by a minus sign. Do not round Intermediate calculations and round your answer to the nearest whole number, e.g., 32.) b. What is the beta of your portfolio? (Do not round intermediate calculations and round your answer to 3 decimal places, e.g., 32.161.) a. Investment in Stock Y b. Beta of the portfolio

You have $122,000 to invest in a portfolio containing Stock X and Stock Y. Your goal is to create a portfolio that has an expected return of 17.6 percent. Stock X has an expected return of 14.0 percent and a beta of 1.26, and Stock Y has an expected return of 9.5 percent and a beta of 1.00. a. How much money will you invest in Stock Y? (A negative answer should be indicated by a minus sign. Do not round Intermediate calculations and round your answer to the nearest whole number, e.g., 32.) b. What is the beta of your portfolio? (Do not round intermediate calculations and round your answer to 3 decimal places, e.g., 32.161.) a. Investment in Stock Y b. Beta of the portfolio

Chapter8: Analysis Of Risk And Return

Section: Chapter Questions

Problem 25P

Related questions

Question

Transcribed Image Text:You have $122,000 to invest in a portfolio containing Stock X and Stock Y. Your goal is to

create a portfolio that has an expected return of 17.6 percent. Stock X has an expected

return of 14.0 percent and a beta of 1.26, and Stock Y has an expected return of 9.5

percent and a beta of 1.00.

a. How much money will you invest in Stock Y? (A negative answer should be indicated

by a minus sign. Do not round Intermediate calculations and round your answer to

the nearest whole number, e.g., 32.)

b. What is the beta of your portfolio? (Do not round intermediate calculations and

round your answer to 3 decimal places, e.g., 32.161.)

a.

Investment in Stock Y

b. Beta of the portfolio

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning