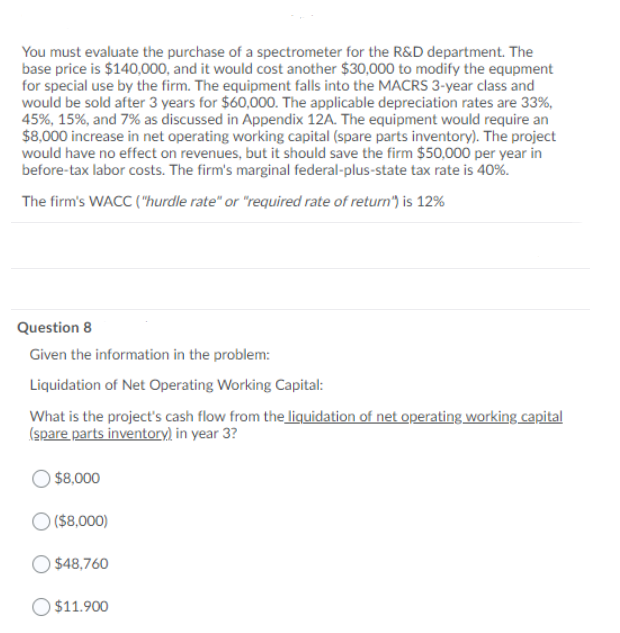

You must evaluate the purchase of a spectrometer for the R&D department. The base price is $140,000, and it would cost another $30,000 to modify the equpment for special use by the firm. The equipment falls into the MACRS 3-year class and would be sold after 3 years for $60,000. The applicable depreciation rates are 33%, 45%, 15%, and 7% as discussed in Appendix 12A. The equipment would require an $8,000 increase in net operating working capital (spare parts inventory). The project would have no effect on revenues, but it should save the firm $50,000 per year in before-tax labor costs. The firm's marginal federal-plus-state tax rate is 40%. The firm's WACC ("hurdle rate" or "required rate of return") is 12% Question 8 Given the information in the problem: Liquidation of Net Operating Working Capital: What is the project's cash flow from the liquidation of net operating working capital (spare parts inventory) in year 3? O $8,000 ) ($8,000) $48,760 O $11.900

You must evaluate the purchase of a spectrometer for the R&D department. The base price is $140,000, and it would cost another $30,000 to modify the equpment for special use by the firm. The equipment falls into the MACRS 3-year class and would be sold after 3 years for $60,000. The applicable depreciation rates are 33%, 45%, 15%, and 7% as discussed in Appendix 12A. The equipment would require an $8,000 increase in net operating working capital (spare parts inventory). The project would have no effect on revenues, but it should save the firm $50,000 per year in before-tax labor costs. The firm's marginal federal-plus-state tax rate is 40%. The firm's WACC ("hurdle rate" or "required rate of return") is 12% Question 8 Given the information in the problem: Liquidation of Net Operating Working Capital: What is the project's cash flow from the liquidation of net operating working capital (spare parts inventory) in year 3? O $8,000 ) ($8,000) $48,760 O $11.900

Intermediate Financial Management (MindTap Course List)

13th Edition

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Eugene F. Brigham, Phillip R. Daves

Chapter13: Capital Budgeting: Estimating Cash Flows And Analyzing Risk

Section: Chapter Questions

Problem 7P

Related questions

Question

Transcribed Image Text:You must evaluate the purchase of a spectrometer for the R&D department. The

base price is $140,000, and it would cost another $30,000 to modify the equpment

for special use by the firm. The equipment falls into the MACRS 3-year class and

would be sold after 3 years for $60,000. The applicable depreciation rates are 33%,

45%, 15%, and 7% as discussed in Appendix 12A. The equipment would require an

$8,000 increase in net operating working capital (spare parts inventory). The project

would have no effect on revenues, but it should save the firm $50,000 per year in

before-tax labor costs. The firm's marginal federal-plus-state tax rate is 40%.

The firm's WACC ("hurdle rate" or "required rate of return") is 12%

Question 8

Given the information in the problem:

Liquidation of Net Operating Working Capital:

What is the project's cash flow from the liquidation of net operating working capital

(spare parts inventory) in year 3?

O $8,000

) ($8,000)

$48,760

O $11.900

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Recommended textbooks for you

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning