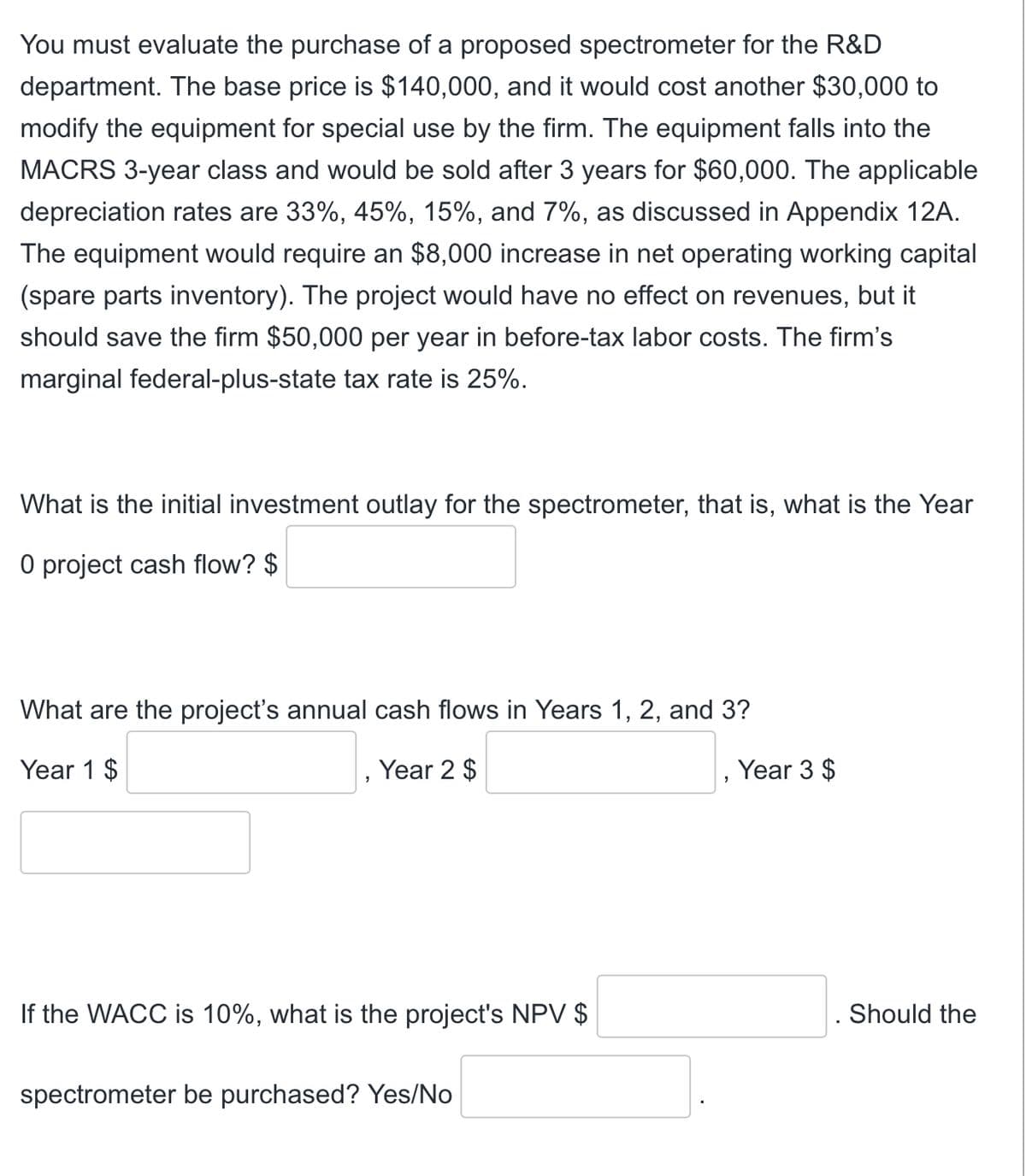

You must evaluate the purchase of a proposed spectrometer for the R&D department. The base price is $140,000, and it would cost another $30,000 to modify the equipment for special use by the firm. The equipment falls into the MACRS 3-year class and would be sold after 3 years for $60,000. The applicable depreciation rates are 33%, 45%, 15%, and 7%, as discussed in Appendix 12A. The equipment would require an $8,000 increase in net operating working capital (spare parts inventory). The project would have no effect on revenues, but it should save the firm $50,000 per year in before-tax labor costs. The firm's marginal federal-plus-state tax rate is 25%. What is the initial investment outlay for the spectrometer, that is, what is the Year O project cash flow? $ What are the project's annual cash flows in Years 1, 2, and 3? Year 1 $ Year 2 $ Year 3 $ If the WACC is 10%, what is the project's NPV $ Should the spectrometer be purchased? Yes/No

You must evaluate the purchase of a proposed spectrometer for the R&D department. The base price is $140,000, and it would cost another $30,000 to modify the equipment for special use by the firm. The equipment falls into the MACRS 3-year class and would be sold after 3 years for $60,000. The applicable depreciation rates are 33%, 45%, 15%, and 7%, as discussed in Appendix 12A. The equipment would require an $8,000 increase in net operating working capital (spare parts inventory). The project would have no effect on revenues, but it should save the firm $50,000 per year in before-tax labor costs. The firm's marginal federal-plus-state tax rate is 25%. What is the initial investment outlay for the spectrometer, that is, what is the Year O project cash flow? $ What are the project's annual cash flows in Years 1, 2, and 3? Year 1 $ Year 2 $ Year 3 $ If the WACC is 10%, what is the project's NPV $ Should the spectrometer be purchased? Yes/No

Intermediate Financial Management (MindTap Course List)

13th Edition

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Eugene F. Brigham, Phillip R. Daves

Chapter13: Capital Budgeting: Estimating Cash Flows And Analyzing Risk

Section: Chapter Questions

Problem 7P

Related questions

Question

Thank you

Transcribed Image Text:You must evaluate the purchase of a proposed spectrometer for the R&D

department. The base price is $140,000, and it would cost another $30,000 to

modify the equipment for special use by the firm. The equipment falls into the

MACRS 3-year class and would be sold after 3 years for $60,000. The applicable

depreciation rates are 33%, 45%, 15%, and 7%, as discussed in Appendix 12A.

The equipment would require an $8,000 increase in net operating working capital

(spare parts inventory). The project would have no effect on revenues, but it

should save the firm $50,000 per year in before-tax labor costs. The firm's

marginal federal-plus-state tax rate is 25%.

What is the initial investment outlay for the spectrometer, that is, what is the Year

O project cash flow? $

What are the project's annual cash flows in Years 1, 2, and 3?

Year 1 $

Year 2 $

Year 3 $

If the WACC is 10%, what is the project's NPV $

. Should the

spectrometer be purchased? Yes/No

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

Recommended textbooks for you

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning