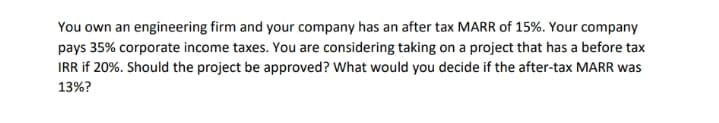

You own an engineering firm and your company has an after tax MARR of 15%. Your company pays 35% corporate income taxes. You are considering taking on a project that has a before tax IRR if 20%. Should the project be approved? What would you decide if the after-tax MARR was 13%?

Q: State whether the Portfolio Nature is Defensive/Aggressive. Weight on XOM Weight on PFE Portfolio R...

A: A defensive portfolio is made up of equities that have a low beta. The equities in this portfolio ar...

Q: Reddie, Mcdonald & Griffiths Inc. has a risk-free rate of 5% and a market risk premium of 8%. The co...

A: Given, Two investments X and Y The risk free rate is 5% and market risk premium is 8%.

Q: The "Fly By Night" Used Car Lot uses the following to illustrate their 11.8% finance plan on a car p...

A: Present Value: The present value is the value of cash flow stream or the fixed lump sum amount at t...

Q: 6. Market value ratios Ratios are mostly calculated using data drawn from the financial statements o...

A: “Since you have posted a question with multiple sub-parts, we will solve first three subparts for yo...

Q: A stock has a beta of 1.1, the expected return on the market is 10.4 percent, and the risk-free rate...

A: Expected return = Risk free rate+Beta*(Market return-Risk free rate) Where Risk free rate = 4.75% Be...

Q: Calculate the price of a 180-day Treasury bill purchased at a 5% discount rate if the T-bill has a f...

A: Time period is 180 days Discount rate is 5% Face value or FV is E5,000 To Find: Price of T- bill

Q: How much will be received in 6 years if Php35,000 is deposited in an account earning 5.5% interest p...

A: Answer - Formula for Future Value - FV=PV(1+i)n, Where, PV = Present Value i= Interest Rate n = N...

Q: e has its choice between long-term debt and eq

A: In business we need finance but there are different method of finance each method have cost and adva...

Q: If Shannon Pegnim had started her IRA at age 35 rather than age 14, how big of an annual contributio...

A: IRA refers to the individual retirement account of an individual which is used by the individual to ...

Q: 2. A financial manager must choose between three alternative investments. Each asset is expected to ...

A: Wealth maximization is the concept of maximizing the value of the shares held by the shareholder, to...

Q: lax S O both debtholders and equityholders. debtholders. equityholders. only the firm's customers.

A: In the capital structure of company there use of debt and equity and proper use of debt and equity w...

Q: Correlations change over time. Assets more strongly positively correlated wh market crashes, and les...

A: A portfolio is a collection of financial assets such as stocks, bonds, commodities, cash and cash eq...

Q: Maria invested part of her P800,000.00 in an investment earning 12% per annum while the remaining at...

A: Solution:- When an amount is invested somewhere, it earns some interest on it and that’s why every r...

Q: APR by table lookup (

A: APR stands for Annual percentage rate means the amount of interest charge over the principal amount ...

Q: You just leased a Honda Civic that sells for $25,350. The terms of your lease require you to make 60...

A: Price of the car (P) = 25350 n = 60 months Let r = Monthly interest rate Monthly payment (M) = $310 ...

Q: John obtained a loan of $25,000 at 4.6% compounded monthly. How long (rounded up to the next payment...

A: Loan amount = $25,000 Interest rate = 4.6% Monthly payment = $2,810

Q: usra has a term loan that she still owes $15,483.58. The annual interest rate on this lo his month s...

A: Loans are paid by the monthly payment that carry the payment of principal amount and payment of inte...

Q: ind the simple interest of P210,000 for 3 years at 5 %.

A: We know that simple interest can be calculated using the formula given below. Simple Interest = (Pri...

Q: If you sign a discount note for $7,500 at a bank discount rate of 9% for 9 months, what is the effec...

A: Effective Annual Rate: The effective annual rate of interest is the actual or the real rate of inter...

Q: If you have a project combined with above-average market risk, which one of the following decisions ...

A: WACC is the average rate cost of capital calculated by multiplying the cost of funds by its weight. ...

Q: A project has initial costs of $1,000 and subsequent cash inflows of $700, 200, 200 and 200. The com...

A: Since you have posted a question with multiple sub parts, we will be solving first 3 sub parts for y...

Q: Assume you put $400 per month into a retirement account for 14 years, and the account has an APR of ...

A: “Since you have posted a question with multiple sub-parts, we will solve first three subparts for yo...

Q: Suppose that shares of FC Inc. are trading at $100. Consider an American put option with strike pric...

A:

Q: Find the simple interest of P210,000 for 3 years at 5 %.

A: Simple interest is a quick and easy way to calculate a loan's interest charge. The daily interest ra...

Q: - 10000 4000 4000 4000 4000

A: Pay back period is the number of years required to recover initial investment in the form of cash fl...

Q: Find the interest rate for a $9000 deposit accumulating to $11,517.62, compounded quarterly for 9 ye...

A: Interest rate (r) = n[(A/P)1/nt - 1] Where, Number of compounding in a year (n) = 4 Years (t) = 9 Ac...

Q: how much can Marcus spend on a car (that is, what is the total cost of the car that Marcus can purch...

A: Loan amortization refers to a schedule which is prepared to shows the periodic loan payments, amount...

Q: The broad stock market's P/E ratio (the inverse of its earnings yield) tends to rise as treasury yie...

A: With increase in yield on the treasury will increase the earning expectation of the market and requi...

Q: 11. An elective project is currently under review. The first alternative requires an initial investm...

A: A cost-benefit analysis is a systematic process that businesses use to determine which decisions to ...

Q: 37) In Walker's taxonomy identification with a company's annual financial results affecting all empl...

A: AS per Walker'sTaxanomy, the company's financial results of the company affects the Team incentives....

Q: What is Chipotle’s TIE

A: TIE of a company means Times Interest ratio or interest cover ratio of a company. It evaluates a com...

Q: ndholders. areholders. areholders and the federal government.

A: Interest tax sheild is the reduced cost of capital due to the advantages of tax deductions.

Q: found three investment choices for a one-year deposit: 9.4% APR compounded monthly, 9.4% APR compoun...

A: Effective interest is the interest after considering the impact of compounding on the interest and i...

Q: Assume that the population of a town (one million people) is exposed to a toxle pollutant. The envir...

A: The benefit of avoiding the chances of death or fatality helps in knowing the economic value is know...

Q: Brandon purchased a car using a 5-year car lease at 5.80% compounded quarterly that required her to ...

A: To Find: Cost of the car

Q: Consider a loan of $7700 at 6.8% compounded semiannually, with 18 semiannual payments. Find the foll...

A: Loan amortization refers to a schedule which is prepared to shows the periodic loan payments, amount...

Q: MacElroy Trucks recently purchased a new rig costing S130,000. They financed this purchase at 12 per...

A: An annuity is a sequence of payments to be paid at equal intervals. An annuity is a type of long-ter...

Q: Office of Business Administration tells you that Villa Apartment has a project to expand the current...

A: NPV is the difference between present value of cash inflows and initial investment. NPV =PV of all c...

Q: Match the correct answer for the following questions v The present worth of $400 in year 1 and amoun...

A: 1) First year amount (A1) = $400 Increase of $30 every year till year 5 r = 12%

Q: Choose from the two machines which is more economical: Machine B 14000 P2,000 2,400 Machine A First ...

A: You have asked to specifically calculate part c. Concept . Present worth cost method. In this me...

Q: Taking the corporate taxes into account, if there is no possibility of financial distress, a firm ca...

A: Use of debt has a benefit and a cost associated with it. The benefit is that use of debt reduces tax...

Q: Find the payment made by the ordinary annuity with the given present value. $216,967; quarterly paym...

A:

Q: 1- The Present value (Now). 2- The Future value (at year-5)|

A: Time value of money (TVM) is used to measure the value of money at different point of time in the fu...

Q: Suppose portfolio mean return is 25% and standard deviation 30%. Find the 2 standard deviation range...

A: We will find out the value of 5% VaR and will check whether it is below -30% or above.

Q: A sum of P1,000 is invested now and left for eight years, at which time the principal is withdrawn. ...

A: Invested amount or principal amount is P1,000 Effective Annual interest rate is 5% Principal is with...

Q: Which alternative offers you the highest effective rate of return?

A: Investment appraisal is the method of evaluating and selecting investments from various investment o...

Q: Financial leverage will shareholders' expected return and. shareholders' risk. O increase; do nothin...

A: Financial leverage is the use of debt to acquire the new assets. This is done due to expected increa...

Q: If P25, 000 is deposited now into a savings account that earns 6% per year, what uniform annual amou...

A: Present Value of Ordinary Annuity refers to a concept that determines the value of cash flows at pre...

Q: Suppose that 6-month, 12-month, 18-month, 24-month, and 30-month aero rates are 4 42 4.4% 4.6, nd 4....

A: Answer - Bond price is the present discounted value of future cash flows i.e. coupon amount and Mat...

Q: 3. If banks heeded Shakespeare's admonition “Neither a borrower nor a lender be", what would happen ...

A: If banks had noted Shakespeare's rebuke, the circular flow of the economy will become much smaller. ...

Please answer fast

Step by step

Solved in 3 steps

- Universal Exports Inc. is a small company and is considering a project that will require $650,000 in assets. The project will be financed with 100% equity. The company faces a tax rate of 25%. What will be the ROE (return on equity) for this project if it produces an EBIT (earnings before interest and taxes) of $155,000? 10.73% 17.88% 18.77% 12.52% Determine what the project’s ROE will be if its EBIT is –$50,000. When calculating the tax effects, assume that Universal Exports Inc. as a whole will have a large, positive income this year. -4.64% -6.67% -5.22% -5.8% Universal Exports Inc. is also considering financing the project with 50% equity and 50% debt. The interest rate on the company’s debt will be 12%. What will be the project’s ROE if it produces an EBIT of $155,000? 28.11% 18.74% 26.77% 21.42% What will be the project’s ROE if it produces an EBIT of –$50,000 and it…Genesis Corporation want to purchase a piece of machinery for $150,000 that will cost $20,000 to have it delivered and installed. Based on past information, they believe they can sell the machinery for $25,000 in 5 years. The company’s marginal tax rate is 34%. If the applicable CCA rate is 20% and the required return on this project is 15%, what is the present value of the CCA tax shield?The Monumental Co. is considering purchasing a piece of equipment costing $624,001. The equipment belongs in a 30% CCA class. What is the anticipated tax shield in year three on this equipment if the company is in the 32% marginal tax bracket?

- A company has purchased a new piece of machinery for $100,000. The estimate it will result in annual cost savings of $15,000 per year, this will increase every year by $500. The machinery will last for 8 years, at which time it will be sold for $7,000. What is the company's BEFORE tax rate of return? The company estimates a federal tax rate of 21%. What is their AFTER tax rate of return?You are expanding your operations and buying a new machine. The new machine will cost $440,000 and will cost $22,000 to ship and install. The new machine will make more products so you will need to purchase $40,000 of inventory to meet the demand. You plan to operate the machine for two years and then sell the machine for $200,000. The corporate tax rate is 35%. If the depreciation rates are 12% in Year 1 and 18% in Year 2, what is the depreciation tax shield for Year 1 of the project? Group of answer choices A. $21,696.00 B. $17,680.00 C. $18,984.00 D. $19,404 E. $18,080.00Wizard Co. is considering a project that will require $500,000 in assets. The project will be financed with 100% equity. The company faces a tax rate of 30%. What will be the ROE (return on equity) for this project if it produces an EBIT (earnings before interest and taxes) of $145,000? 20.3% 17.3% 14.2% 16.2% Determine what the project’s ROE will be if its EBIT is –$60,000. When calculating the tax effects, assume that Wizard Co. as a whole will have a large, positive income this year. -9.2% -8.4% -8.8% -7.6% Wizard Co. is also considering financing the project with 50% equity and 50% debt. The interest rate on the company’s debt will be 13%. What will be the project’s ROE if it produces an EBIT of $145,000? 25.2% 36.2% 29.9% 31.5% What will be the project’s ROE if it produces an EBIT of –$60,000 and it finances 50% of the project with equity and 50% with debt? When calculating the…

- Your firm is considering financing a project that costs $1,000,000 by raising $500,000 in equity and $500,000 in debt with a 7% interest rate for 8 years. The NPV of the unlevered project would be -$50,000. Assume that the tax rate for your firm stays at 24%. What is the value of the tax subsidy to debt in this case? Is this value large enough to take the levered project?Your firm is considering a project that would cost $325,000 and be depreciated straight-line over four years to $0 book value. Your firm estimates $15,000 in yearly after-tax operating costs. The required return is 12.0 percent, and the firm pays a 21.0 percent tax rate. What is the equivalent annual cost of this project?Shelton Tax Services is considering investing in new software for their corporate tax business. The investment will require an outlay of $350,000 initially, and is expected to generate the following after-tax cash flows: Year 1, $60,000; Year 2, $80,000; Year 3, $105,000; Year 4, $120,000; Year 5, $145,000. Shelton uses a discount rate of 10%. What is the net present value of the proposed investment? Should this investment be accepted or rejected? Must show your computation steps. Use the appropriate tables in Appendix A to obtain the relevant present value factor and round up your final answer to the nearest dollar.

- Taufel, Inc. is considering implementing a cost-cutting project. The pre-tax cost reduction is expected to be $18,000 for each of the three years of the project's life. The project has an initial cost of $40,000 and belongs in a 20% CCA class. The company has a tax rate of 32% and the discount rate for the project is 9%. The project can be sold to another company at the end of year 3 for $2,000. What is the NPV of the project? $750 $700 $675 $650 $625National Co. has the opportunity to increase its annual sales by P125,000 by selling to a new, riskier group of customers. The uncollectible expense is expected to be 10%, and collection costs will be 10%. The company’s manufacturing and selling expenses are 70% of sales, and its effective tax rate is 40%. If National Co. were to accept this opportunity, the company’s after tax profits would increase byA corporation is considering purchasing a machine that costs $120,000 andwill save $X per year after taxes. The cost of operating the machine, including maintenance and depreciation, is $20,000 per year after taxes. The machine will be needed for four years after which it will have a zero salvage value. If the firm wants a 14% rate of return after taxes, what is the minimum after-tax annual savings that must be generated to realize a 14% rate of return after taxes?(a) $50,000(b)$61,184(c) $91,974(d) $101,974