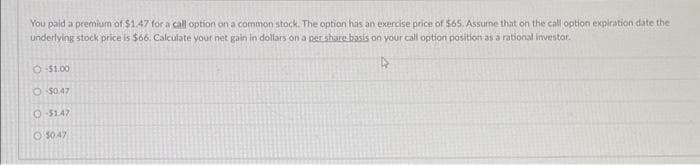

You paid a premium of $1.47 for a call option on a common stock. The option has an exercise price of $65. Assume that on the call option expiration date the underlying stock price is $66. Calculate your net gain in dollars on a pershare basis on your call option position as a rational investor. 4 O-$1.00 O $0.47 O-$1.47 O 5047

Q: 1)What would be the unlevered beta of Simon So CFO's suggestion? 2) What would be new beta…

A: Please note that as per the guidelines I am required to answer only the first 3 questions. Beta…

Q: estion: Defined payout policy. What are the two main ways companies distribute earnings to…

A: The shareholders are the owners of the company and they invest in the market to earn money and hence…

Q: What would be concluded about the South African Mobile Phone sector between 2008 and 2011? A. The…

A: Stock markets show ups and downs and stocks market are quite volatile in nature but overall market…

Q: The stock KZ has an equity beta of 1.8. The market risk premium is 5% and the current risk-free rate…

A: Ke (required return) = Risk free rate + (Beta x Market risk premium)

Q: Roybus, Inc., a manufacturer of flash memory, just reported that its main production facility in…

A:

Q: You receive £5,000 in three years' time and the cost of capital for the project is 7%. What is that…

A: Solution: Present value stands for the value calculated in today's terms. The formula for present…

Q: Assume you want to start your own small business. You like to open a bakery or nail salon. We assume…

A:

Q: a-1. Calculate the IRR on the two projects. a-2. Calculate the NPV on the two projects. a-3. Do the…

A: IRR (Internal rate of return) is the discount rate at which the PV of cash inflows will equal the PV…

Q: State of Economy Probability T-Bills Phillips Pay-up Rubber-Made…

A: according to bartleby guidelines , if question involves multiple subparts , then 1st sub 3 parts…

Q: Net present value is better than Payback period (PP)... A. because it is a simple method OB. because…

A: Solution:- Net Present Value (NPV) means the net present value of cash inflows after deducting…

Q: What are the advantages and disadvantages of a fixed principal, fixed interest loan? 4. What is the…

A: Please not that as per the guidelines, I am required to answer only the first three questions.…

Q: SteelCo is an all-equity firm with a share price of R15 and 300 000 shares outstanding. The company…

A: formula to be used V=D/(1-Tc)-E/(1+r) where: V=Value of the firm D=Value of the firm's debt Tc…

Q: Use the spreadsheet below to answer the question that follows: A B 1 Car Sales Report Month 2 3 Jan.…

A: Month Vehicles sold 2016 Vehicles sold 2017 Vehicles Sold 2018 Jan-March 214 202 208 May-Aug 355…

Q: The following units of an inventory item were available for sale during the year: Beginning…

A: Solution:- Weighted average method of inventory is the method of inventory valuation in which…

Q: You want to buy a computer for $2,000. The interest rate is on the loan is 12%, and you have 18…

A: First we will calculate EMI, so that we know how much we are paying in each payment. Formula for…

Q: 5. Compare the following 2 alternatives with a method of your choice. The market rate is 6% and…

A: As per the given information: Alternative A: Construction cost - $2,000,000 Benefits/yr - $450,000…

Q: calculate the firms: d) P/E ratio given the market price above e) ROE, f) Debt-equity ratio…

A: Solution:- Price Earnings ratio (P/E ratio) is the ratio of current market price per share to the…

Q: What are the portfolio weights for a portfolio that has 115 shares of Stock A that sell for $80 per…

A:

Q: The following table gives Foust Company's earnings per share for the last 10 years. The common…

A: Given: Year EPS Year EPS 2012 $3.90 2017 $5.73 2013 $4.21 2018 $6.19 2014 $4.55…

Q: . Your firm is considering a new office complex. Your firm already owns land suitable for the new…

A: Land value increase with time and there is no depreciation in the land but there is appreciation in…

Q: Consider a five-year, default-free bond with annual coupons of 8% and a face value of $1,000 and…

A: Bond Bonds are an integral aspect of the financial system, serving as a vital source of cash for…

Q: Discuss the disadvantages of owning a bond

A: Bartleby's Guideline: “Since student have asked multiple question, we will solve the first question…

Q: has an interest rate of 2.88% (APR) and is amortized over 30 years, using fixed monthly payments.…

A: Loans are paid by equal periodic monthly payments and these monthly payment carry the payment for…

Q: If next years dividend, D = $1.25, g (which is constant) = 5.5%, and the current price, P = $28,…

A: Stock's expected return is calculated using following equation Expected return on stock = D1P0+g…

Q: The Continental Bank advertises capital savings at 6.1% compounded annually while TD Canada Trust…

A: Solution:- When an amount is invested somewhere, it earns interest on it. Effective Annual Rate…

Q: Your stockbroker has called to tell you about two stocks: Uber Technologies, Inc. (UBER) and Lyft,…

A: We will first find the expected return using the prices; required return using CAPM and the required…

Q: Hedge Funds have become an increasingly popular investment options over the past 15 years, with…

A: Hedge funds refer to a partnership traded in the pooling of funds and employing various strategies…

Q: Jack Corp. has a profit margin of 4.0 percent, total asset turnover of 2.1, and ROE of 16.42…

A: Return on equity = Profit margin * Total asset turnover ratio * Equity multiplier 16.42% = 4%*2.1*…

Q: Malko Enterprises’ bonds currently sell for $1,050. They have a 6-year maturity, an annual coupon of…

A:

Q: Calculate approximately to three decimal places the composite price index for all three stocks…

A: There are two indexes used in the stock market one is price index and other is quantity index both…

Q: An investor invested 2 200 euros in an inde the same time the consumer price index has climbed from…

A: Inflation and interest rate are quite related to each other. The return on investment depends on the…

Q: Office Depot has an invoice for $3,814 dated May 8, with terms of 3/10, 2/15, n/30. The invoice also…

A: Credit terms are offered to encourage early and timely payments. The terms indicate the below: 3/10:…

Q: . Suppose you invested £100 in ASOS a year ago. It paid a dividend of £2 today and then you sold it…

A: Holding period return is rate of return realized by holding the stock during the and all cash flow…

Q: For each of the following annuities, find the best matching description (given that each answer…

A: An annuity refers to a stream of equal cash flows that occur at regular intervals. There are…

Q: Max's Brakes is introducing a new revolutionary brake-pad for vehicles that will never wear out.…

A: Cash fixed expense per year is $1500 Depreciation expense is $600 The selling price is $100 The…

Q: How will a firm's cash cycle be affected if one of the firm's suppliers that was only accepting cash…

A: concept. 1. account payable days or days payable outstanding. It takes into account the amount of…

Q: Assume you purchase (at par) one 12-year bond with a 6.10 percent coupon and a $1,000 face value.…

A: The realized yield refers to the actual return earned from an investment during the holding period.…

Q: About the exercise of the selection of the vehicle: model A costs 32,000 and Model B 28,000 interest…

A: We have to compare the cost of the two models and find the correct statement. Each model has an…

Q: d) Would you buy or sell this share? Why? e) Explain the difference between common and preference…

A: Risk premium - It is a measure of excess return that an investor requires for risk taken in an…

Q: A company issued 20-year bonds with par value $1,000 two years ago at a coupon rate of 5 percent.…

A: Given: Particulars Amount Years 20 Face value $1,000 Coupon rate 5% Yield to maturity 4%

Q: Full Boat Manufacturing has projected sales of $123.5 million next year. Costs are expected to be…

A: The free cash flow method is used to find the intrinsic value of share or the present value of the…

Q: CREDIT CARD COMPOUNDING INTEREST. Your friend wants to purchase a new TESLA car for $65,000. All…

A: Facing scarcity of funds, your friend will have to use the credit card to fund the balance monthly…

Q: Millennial Manufacturing has net credit sales for 2018 in the amount of $1,443,630, beginning…

A: A. Average Accounts receivable = (Opening accounts receivable balance + Closing accounts receivable…

Q: Wonder Plc is considering two investment projects in another city and the estimated cash flows are…

A: We have to assess the viability of two projects using NPV and payback period methods.

Q: John and Rosamond want to retire in 10 years and can save $170 every three months. They plan to…

A: The Future Value of an Ordinary Annuity refers to the concept which gives out the compounded or…

Q: A consumer buys a used car for $19800 with monthly payments of $390, an annual interest rate of…

A: Solution:- When an amount is borrowed, it can either be repaid as a lump sum payment or in…

Q: Suppose that each week, you deposit $28 into a savings account whose annual rate is 1.6% with weekly…

A: Solution:- When an equal amount is deposited each period at end of period, it is called ordinary…

Q: Consider the following information about the various states of economy and the returns of various…

A: State of the economy Probability T-Bills Philips Pay-up Rubber-Made Market Index Recession 0.2 7%…

Q: Which one is not an assumption of a perfect capital market? No taxes No dividend distribution No…

A: In "perfect capital markets," no buyer or seller (or issuer) of securities is substantial enough for…

Q: What is the future value of an investment of $1,000 paid every year for five (5) years when the…

A: Future value of amount includes the amount being deposited and amount of the compounding interest…

5

Step by step

Solved in 2 steps

- Snyder purchased a call option on a stock (non-dividend). The time to maturity is 0.4 years. The stock price is $49, the strike price is $56, the risk-free rate is 0.03 as a decimal, and the volatility is 0.1 as a decimal. What is the gamma of the option, rounded to three decimal places?For each of the 100-share options shown in the following table below; use the underlying stock price at expiration and other information to determine the amount of profit or loss an investor would have had. Option Type of option Cost of option Strike price per share Underlying stock price per share at expiration A Call $214 $48 $53 B Call $372 $45 $48 C Put $537 $63 $54 D Put $297 $32 $36 E Call $495 $27 $24 The profit (loss) experienced on option A is $ ? (Round to the nearest dollar. Enter a negative number for loss.)One of the categories of options available to investors and speculators is LEPOs. Assuming 7.00 per cent margin, what would be the percentage return and dollar profit to an investor who purchased one LEPO (for 1000 shares) for a premium of $26 220 and later closed out the position when the LEPO premium was $28 430?

- Suppose that both a call option and a put option have been written on a stock with an exerciseprice of $40. The current stock price is $42, and the call and put premiums are $3 and $0.75,respectively. Calculate the profit to positions of both the short call and the long put with an expiration day stock price of $43.A non-dividend-paying stock has a current price of 800 ngwee. In any unit of time (t, t + 1) the price of the stock either increases by 25% or decreases by 20%. K1 held in cash between times t and t + 1 receives interest to become K1.04 at time t + 1. The stock price after t time units is denoted by St.Required:I. Calculate the risk-neutral probability measure for the model.II. Calculate the price (at t = 0) of a derivative contract written on the stock with expiry date t = 2 which pays 1,000 ngwee if and only if S2 is not 800 ngwee (and otherwise pays 0).Stock Price to ProfitYou buy an “at the money” April call option on M&M Corp. common stock, which has a strikeprice of $25 and a premium of $4. At what minimum price of M&M Corp. stock will you make a profit? At what minimum price should you exercise the option and buy the stock?

- A stock is currently selling for $22.00 per share. Ignoring interest, determine the intrinsic value of a call option should there exist equally probable stock prices of $25.00 and $23.00.Calculate the profit or loss per share of stock to an investor who buys a call option on a stock whose price is K90 but a call option exercise price if K100 if the stock price at expiration is K105. Calculate the profit or loss for a purchaser of a put option with the same exercise price and expiration?A non – dividend – paying stock with a current price of $52, the strike price is $50, the risk free interest rate is 12% pa, the volatility is 30% pa, and the time to maturity is 3 months? a) Calculate the price of a call option on this stock b) What is the price of a put option price on this stock? c) Is the put-call parity of these options hold?

- A stock is currently priced at 43.75 when options are about to expire. What is the net profit of a CALL option with a strike price of 45 for the BUYER of the option if the premium paid was 1.75? (per share) Group of answer choices 1.75 0.00 -2.25 -1.75 45.00A collar is established by buying a share of stock for $54, buying a 6-month put option with exercise price $47, and writing a 6-month call option with exercise price $61. On the basis of the volatility of the stock, you calculate that for a strike price of $47 and expiration of 6 months, N(d1) = 0.7298, whereas for the exercise price of $61, N(d1) = 0.6374. Required: What will be the gain or loss on the collar if the stock price increases by $1? What happens to the delta of the portfolio if the stock price becomes very large? What happens to the delta of the portfolio if the stock price becomes very small?An investor who wishes to purchase the stock belonging to Entity A to hold for two years will receive a dividend of $ 0.7 per share for the first year, $ 1.3 for the second year from this investment, and at the end of the second He estimates that it can be sold for $ 12.0 USD. What is the real value of the stock if the minimum rate of return expected by the investor is 20%? a) 15b) 2.81c) 9.81d) 21.81e) 5.81 ============= If the discount rate is 9%, what is the present value of 5375 USD received at the end of each year for 12 years?a) 25000,375b) 10000,5c) 12450,5d) 15500,375e) 38490,375 ============== The price / earnings ratio of the beta company stock has been calculated as 7.4. If the expected earnings per share of this stock for the next year is 2.5 USD, what is the real value of the stock? If the stock of this company is currently trading at 25 USD, can the relevant stock be purchased? a) 18.5 and should not be boughtb) 36 and must be purchasedc) 45 and must be purchased d) 18.5…