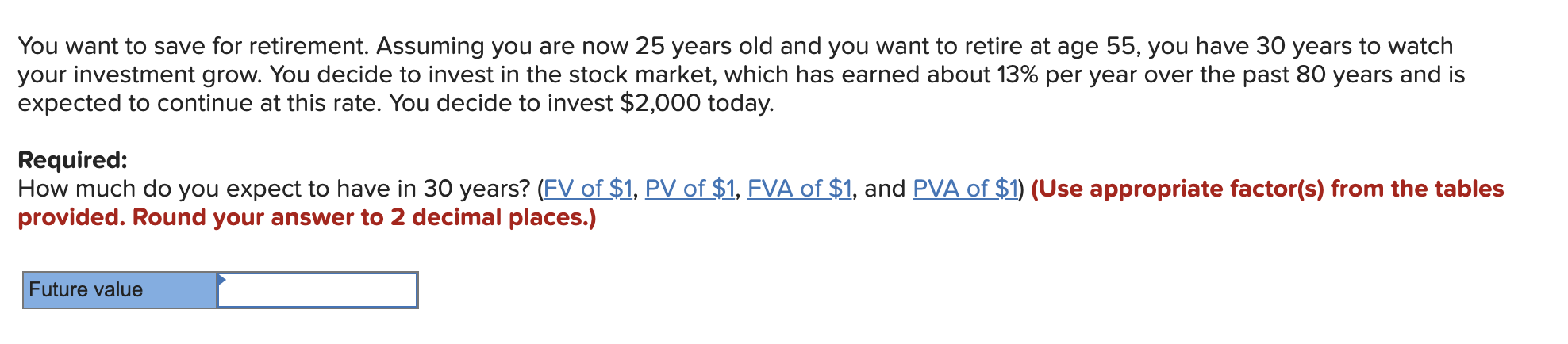

You want to save for retirement. Assuming you are now 25 years old and you want to retire at age 55, you have 30 years to watch your investment grow. You decide to invest in the stock market, which has earned about 13% per year over the past 80 years and is expected to continue at this rate. You decide to invest $2,000 today. Required: How much do you expect to have in 30 years? (FV of $1, PV of $1, FVA of $1, and PVA of $1) (Use appropriate factor(s) from the tables provided. Round your answer to 2 decimal places.) Future value

You want to save for retirement. Assuming you are now 25 years old and you want to retire at age 55, you have 30 years to watch your investment grow. You decide to invest in the stock market, which has earned about 13% per year over the past 80 years and is expected to continue at this rate. You decide to invest $2,000 today. Required: How much do you expect to have in 30 years? (FV of $1, PV of $1, FVA of $1, and PVA of $1) (Use appropriate factor(s) from the tables provided. Round your answer to 2 decimal places.) Future value

Pfin (with Mindtap, 1 Term Printed Access Card) (mindtap Course List)

7th Edition

ISBN:9780357033609

Author:Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Chapter2: Using Financial Statements And Budgets

Section: Chapter Questions

Problem 6FPE

Related questions

Question

Transcribed Image Text:You want to save for retirement. Assuming you are now 25 years old and you want to retire at age 55, you have 30 years to watch

your investment grow. You decide to invest in the stock market, which has earned about 13% per year over the past 80 years and is

expected to continue at this rate. You decide to invest $2,000 today.

Required:

How much do you expect to have in 30 years? (FV of $1, PV of $1, FVA of $1, and PVA of $1) (Use appropriate factor(s) from the tables

provided. Round your answer to 2 decimal places.)

Future value

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

Recommended textbooks for you

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

PFIN (with PFIN Online, 1 term (6 months) Printed…

Finance

ISBN:

9781337117005

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

PFIN (with PFIN Online, 1 term (6 months) Printed…

Finance

ISBN:

9781337117005

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning