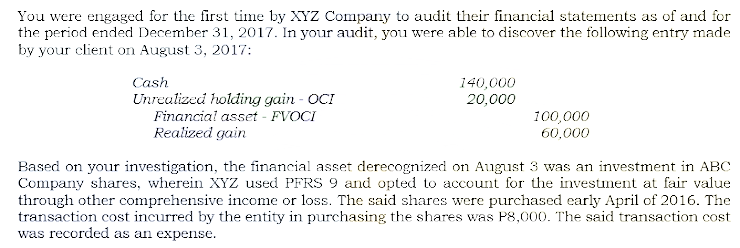

You were engaged for the first time by XYZ Company to audit their financial statements as of and for the period ended December 31, 2017. In your audit, you were able to discover the following entry made by your client on August 3, 2017: Cash 140,000 20,000 Unreulized holding gain - OCI Financial asset - FVOCI Realized gain 100,000 60,000 Based on your investigation, the financial asset derecognized on August 3 was an investment in ABC Company shares, wherein XYZ used PFRS 9 and opted to account for the investment at fair value through other comprehensive income or loss. The said shares were purchased early April of 2016. The transaction cost incurred by the entity in purchasing the shares was P8,000. The said transaction cost was recorded as an cynense

You were engaged for the first time by XYZ Company to audit their financial statements as of and for the period ended December 31, 2017. In your audit, you were able to discover the following entry made by your client on August 3, 2017: Cash 140,000 20,000 Unreulized holding gain - OCI Financial asset - FVOCI Realized gain 100,000 60,000 Based on your investigation, the financial asset derecognized on August 3 was an investment in ABC Company shares, wherein XYZ used PFRS 9 and opted to account for the investment at fair value through other comprehensive income or loss. The said shares were purchased early April of 2016. The transaction cost incurred by the entity in purchasing the shares was P8,000. The said transaction cost was recorded as an cynense

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter12: Intangibles

Section: Chapter Questions

Problem 3P

Related questions

Question

Because of the errors, the

Zero

8,000

52,000

60,000

None of the choices

Transcribed Image Text:You were engaged for the first time by XYZ Company to audit their financial statements as of and for

the period ended December 31, 2017. In your audit, you were able to discover the following entry made

by your client on August 3, 2017:

Cash

140,000

20,000

Unrealized holding gain - OCI

Financial asset - FVOCI

Realized gain

100,000

60,000

Based on your investigation, the financial asset derecognized on August 3 was an investment in ABC

Company shares, wherein XYZ used PFRS 9 and opted to account for the investiment at fair value

through other comprehensive income or loss. The said shares were purchased early April of 2016. The

transaction cost incurred by the entity in purchasing the shares was P8,000. The said transaction cost

was recorded as an expense.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning