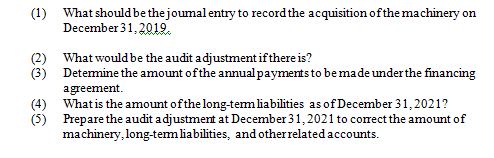

(1) What should be the joumal entry to record the acquisition of the machinery on December 31, 2019. (2) What would be the audit adjustment if there is? (3) Detemine the amount of the annual payments to be made underthe financing agreement.

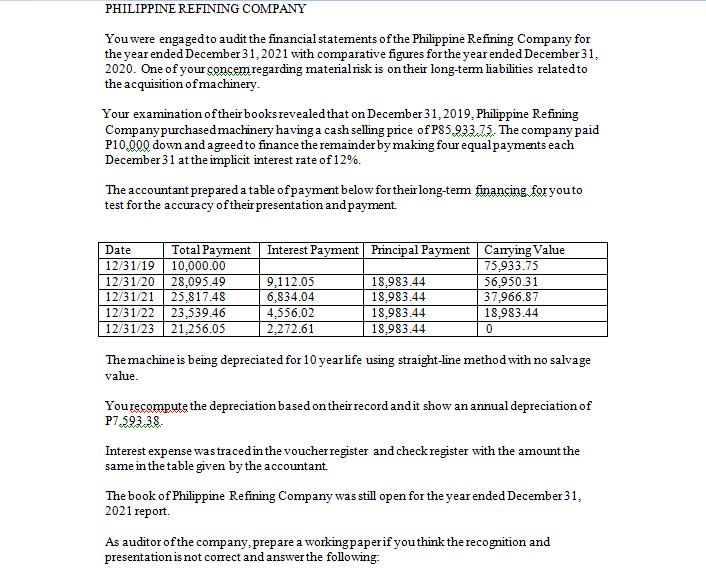

You were engaged to audit the financial statements of the Philippine Refining Company for the year ended December 31, 2021 with comparative figures for the year ended December 31, 2020. One of your concern regarding material risk is on their long-term liabilities related to the acquisition of machinery. Your examination of their books revealed that on December 31, 2019, Philippine Refining Company purchased machinery having a cash selling price of P85,933.75. The company paid P10,000 down and agreed to finance the remainder by making four equal payments each December 31 at the implicit interest rate of 12%. The accountant prepared a table of payment below for their long-term financing for you to test for the accuracy of their presentation and payment. Date Total Payment Interest Payment Principal Payment Carrying Valu 12/31/1910,000.00 75.933.75 12/31/20 28.095.49 9.112.05 18,983.44 $6.950.31 12/31/21 25.817.48 6.834,04 18,983.44 137.966.87 12/31/22/23.519.46 4,556,02 18.983.44 18.983.44 12/312321.256.05 2.272.61 18.983.44 The machine is being

Step by step

Solved in 2 steps