You will be working with the Income Statement and Balance Sheet of Dell Technologies, Inc. Determine the cash conversion cycle for Dell technology for the years 2020-2021

You will be working with the Income Statement and Balance Sheet of Dell Technologies, Inc. Determine the cash conversion cycle for Dell technology for the years 2020-2021

Chapter9: Responsibility Accounting And Decentralization

Section: Chapter Questions

Problem 3PB: The income statement comparison for Rush Delivery Company shows the income statement for the current...

Related questions

Question

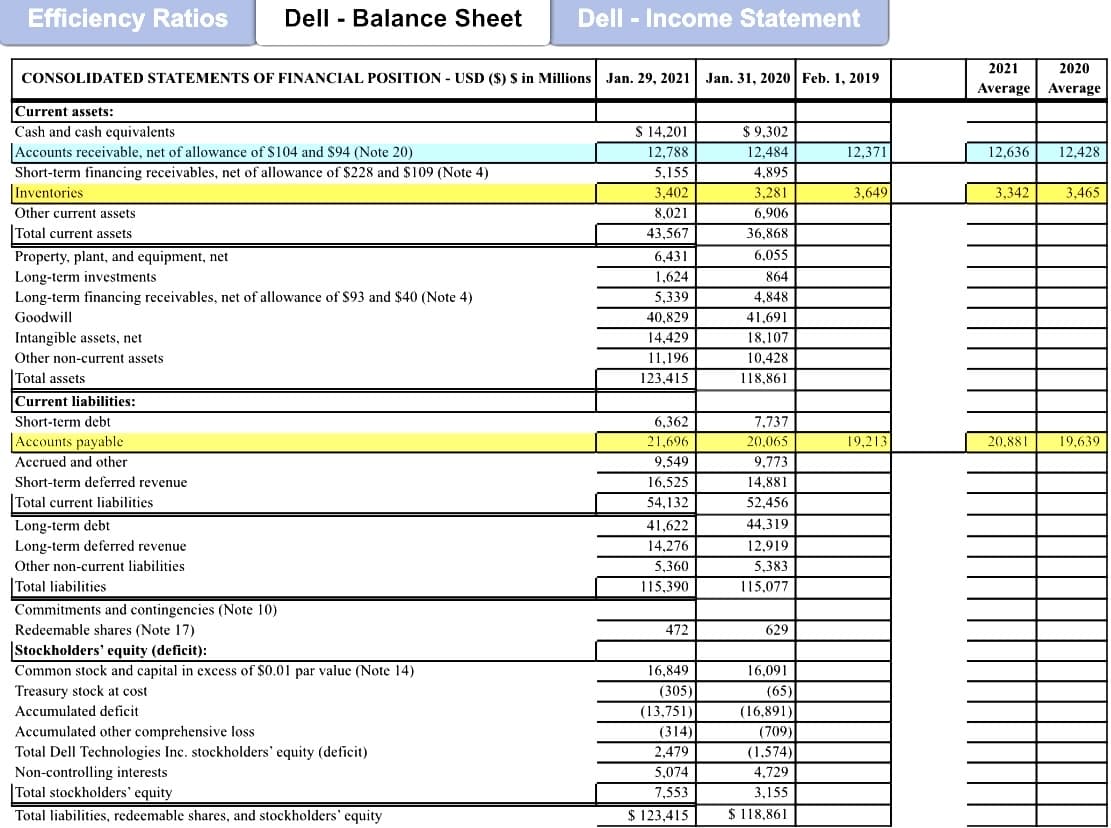

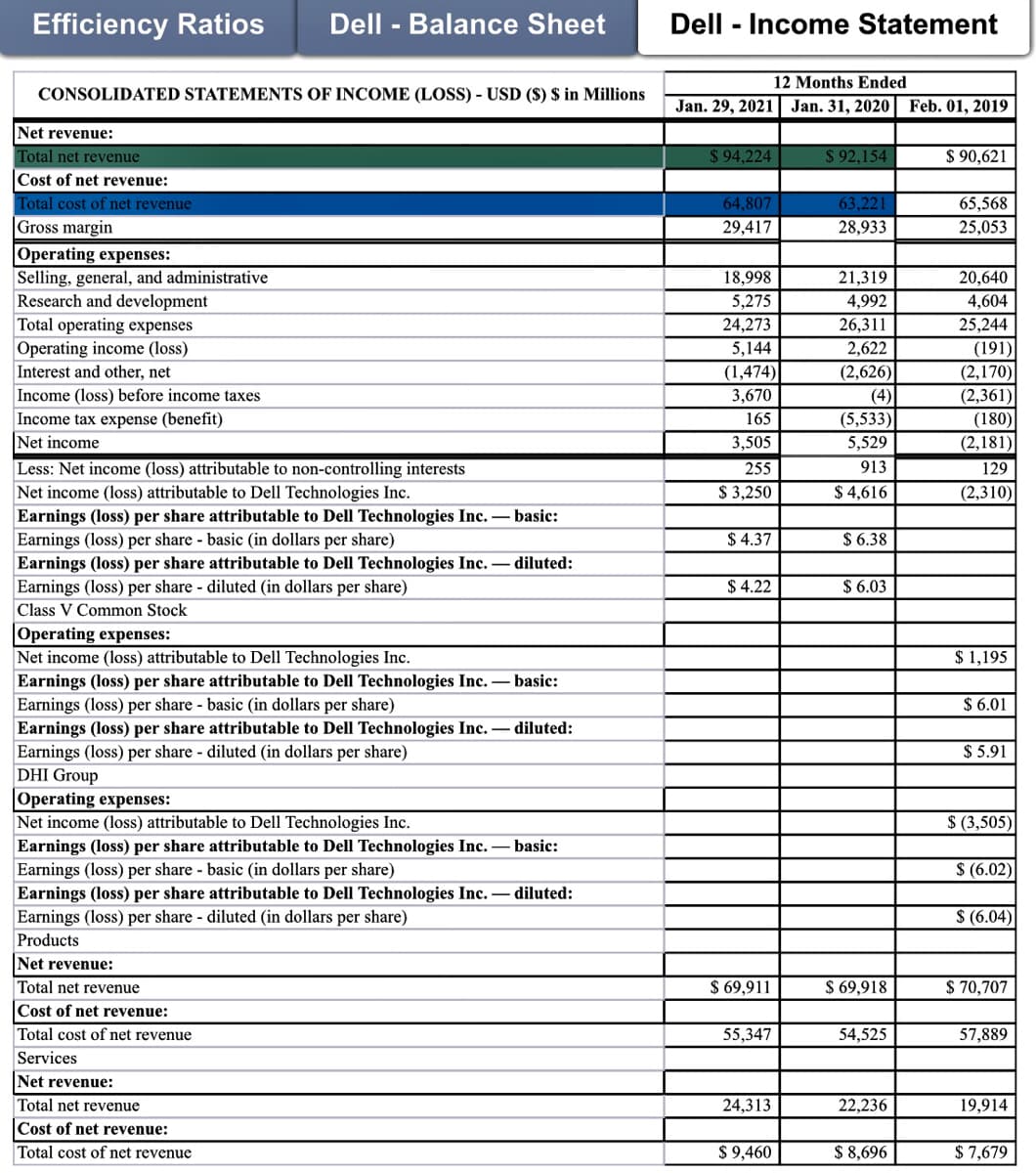

You will be working with the Income Statement and Balance Sheet of Dell Technologies, Inc.

Determine the cash conversion cycle for Dell technology for the years 2020-2021

Transcribed Image Text:Efficiency Ratios

Current assets:

Cash and cash equivalents

CONSOLIDATED STATEMENTS OF FINANCIAL POSITION - USD ($) $ in Millions Jan. 29, 2021 Jan. 31, 2020 Feb. 1, 2019

Accounts receivable, net of allowance of $104 and $94 (Note 20)

Short-term financing receivables, net of allowance of $228 and $109 (Note 4)

Inventories

Other current assets

Total current assets

Dell - Balance Sheet

Property, plant, and equipment, net

Long-term investments

Long-term financing receivables, net of allowance of $93 and $40 (Note 4)

Goodwill

Intangible assets, net

Other non-current assets

Total assets

Current liabilities:

Short-term debt

Accounts payable

Accrued and other

Short-term deferred revenue

Total current liabilities

Long-term debt

Long-term deferred revenue

Other non-current liabilities

Total liabilities

Commitments and contingencies (Note 10)

Redeemable shares (Note 17)

Stockholders' equity (deficit):

Common stock and capital in excess of $0.01 par value (Note 14)

Treasury stock at cost

Dell - Income Statement

Accumulated deficit

Accumulated other comprehensive loss

Total Dell Technologies Inc. stockholders' equity (deficit)

Non-controlling interests

Total stockholders' equity

Total liabilities, redeemable shares, and stockholders' equity

$ 14,201

12,788

5,155

3,402

8,021

43,567

6,431

1,624

5,339

40,829

14,429

11,196

123,415

6,362

21,696

9,549

16,525

54,132

41,622

14,276

5,360

115,390

472

16,849

(305)

(13,751)

(314)

2,479

5,074

7,553

$ 123,415

$ 9,302

12,484

4,895

3,281

6,906

36,868

6,055

864

4,848

41,691

18,107

10,428

118,861

7,737

20,065

9,773

14,881

52,456

44,319

12,919

5,383

115,077

629

16,091

(65)

(16,891)

(709)

(1,574)

4,729

3,155

$ 118,861

12,371

3,649

19,213

2021

2020

Average Average

12,636

3,342

12,428

3,465

20,881 19,639

Transcribed Image Text:Efficiency Ratios

CONSOLIDATED STATEMENTS OF INCOME (LOSS) - USD ($) $ in Millions

Net revenue:

Total net revenue

Cost of net revenue:

Total cost of net revenue

Gross margin

Operating expenses:

Selling, general, and administrative

Research and development

Total operating expenses

Operating income (loss)

Interest and other, net

Dell - Balance Sheet

Income (loss) before income taxes

Income tax expense (benefit)

Net income

Less: Net income (loss) attributable to non-controlling interests

Net income (loss) attributable to Dell Technologies Inc.

Earnings (loss) per share attributable to Dell Technologies Inc. - basic:

Earnings (loss) per share - basic (in dollars per share)

Earnings (loss) per share attributable to Dell Technologies Inc. - diluted:

Earnings (loss) per share - diluted (in dollars per share)

Class V Common Stock

Operating expenses:

Net income (loss) attributable to Dell Technologies Inc.

Earnings (loss) per share attributable to Dell Technologies Inc. - basic:

Earnings (loss) per share - basic (in dollars per share)

Earnings (loss) per share attributable to Dell Technologies Inc. - diluted:

Earnings (loss) per share - diluted (in dollars per share)

DHI Group

Operating expenses:

Net income (loss) attributable to Dell Technologies Inc.

Earnings (loss) per share attributable to Dell Technologies Inc. - basic:

Earnings (loss) per share - basic (in dollars per share)

Earnings (loss) per share attributable to Dell Technologies Inc. - diluted:

Earnings (loss) per share - diluted (in dollars per share)

Products

Net revenue:

Total net revenue

Cost of net revenue:

Total cost of net revenue

Services

Net revenue:

Total net revenue

Cost of net revenue:

Total cost of net revenue

Dell - Income Statement

12 Months Ended

Jan. 29, 2021 Jan. 31, 2020 Feb. 01, 2019

$94,224

64,807

29,417

18,998

5,275

24,273

5,144

(1,474)

3,670

165

3,505

255

$3,250

$4.37

$ 4.22

$ 69,911

55,347

24,313

$ 9,460

$ 92,154

63,221

28,933

21,319

4,992

26,311

2,622

(2,626)

(4)

(5,533)

5,529

913

$ 4,616

$6.38

$6.03

$ 69,918

54,525

22,236

$ 8,696

$ 90,621

65,568

25,053

20,640

4,604

25,244

(191)

(2,170)

(2,361)

(180)

(2,181)

129

(2,310)

$ 1,195

$6.01

$5.91

$ (3,505)

$ (6.02)

$ (6.04)

$ 70,707

57,889

19,914

$ 7,679

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage