Your answer Determine the audited balance of Net income under the accrual basis:

Chapter9: Accounting For Receivables

Section: Chapter Questions

Problem 11EB: Outpost Designs uses the balance sheet aging method to account for uncollectible debt on...

Related questions

Question

Determine the audited balance of Net Income under the accrual basis

Transcribed Image Text:Your answer

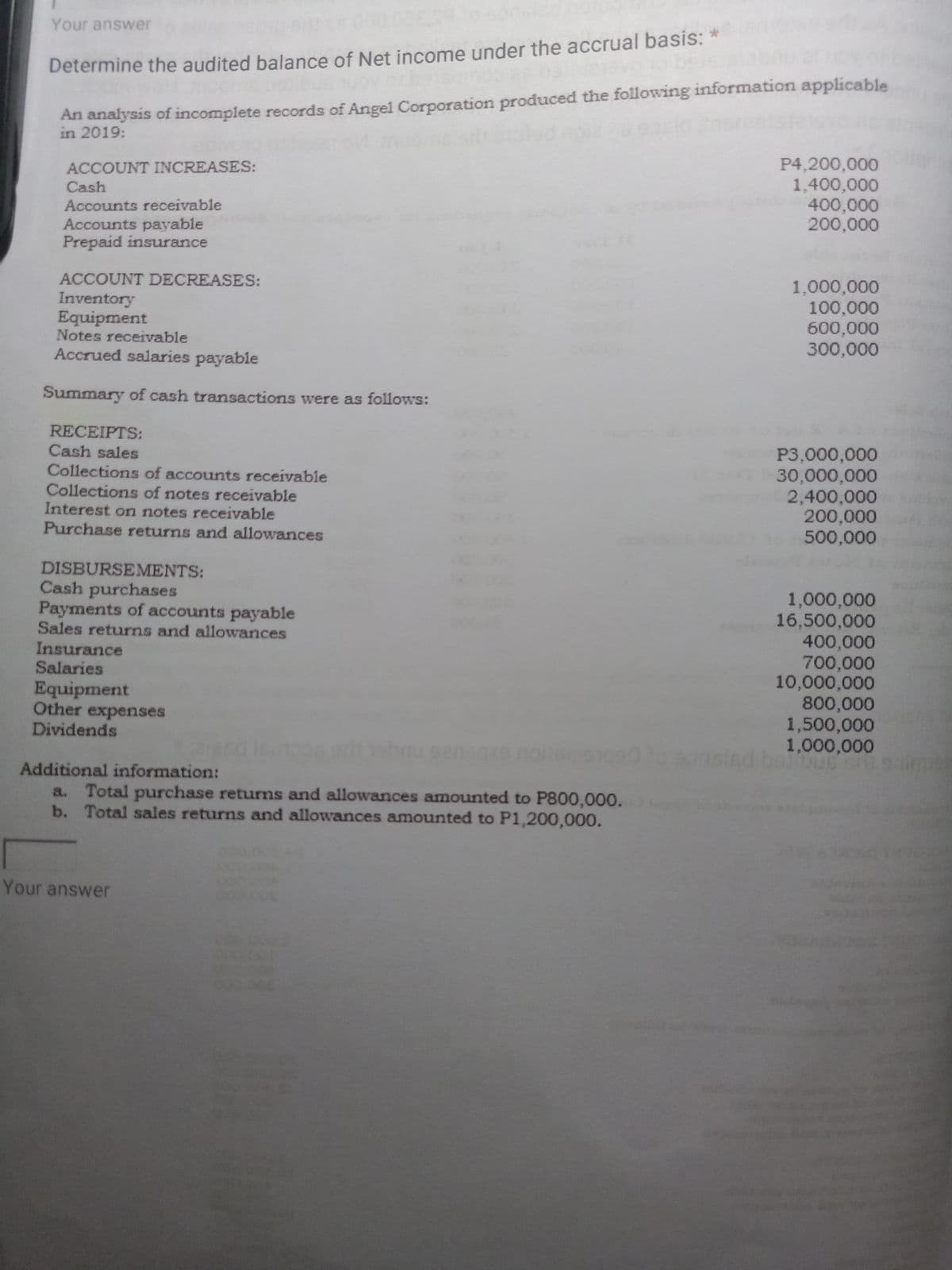

Determine the audited balance of Net income under the accrual basis:

An analysis of incomplete records of Angel Corporation produced the following information applicable

in 2019:

P4,200,000

1,400,000

400,000

200,000

ACCOUNT INCREASES:

Cash

Accounts receivable

Accounts payable

Prepaid insurance

ACCOUNT DECREASES:

Inventory

Equipment

Notes receivable

Accrued salaries payable

1,000,000

100,000

600,000

300,000

Summary of cash transactions were as follows:

RECEIPTS:

Cash sales

Collections of accounts receivable

Collections of notes receivable

Interest on notes receivable

Purchase returns and allowances

P3,000,000

30,000,000

2,400,000

200,000

500,000

DISBURSEMENTS:

Cash purchases

Payments of accounts payable

Sales returns and allowances

1,000,000

16,500,000

400,000

700,000

10,000,000

800,000

1,500,000

1,000,000

Insurance

Salaries

Equipment

Other expenses

Dividends

Additional information:

a. Total purchase returns and allowances amounted to P800,000.

b. Total sales returns and allowances amounted to P1,200,000.

Your answer

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Auditing: A Risk Based-Approach (MindTap Course L…

Accounting

ISBN:

9781337619455

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

Cengage Learning