What is the correct net income under the accrual basis of accoun

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter4: The Balance Sheet And The Statement Of Shareholders' Equity

Section: Chapter Questions

Problem 5C: It is February 16, 2020, and you are auditing Davenport Corporation's financial statements for 2019...

Related questions

Question

What is the correct net income under the accrual basis of accounting?

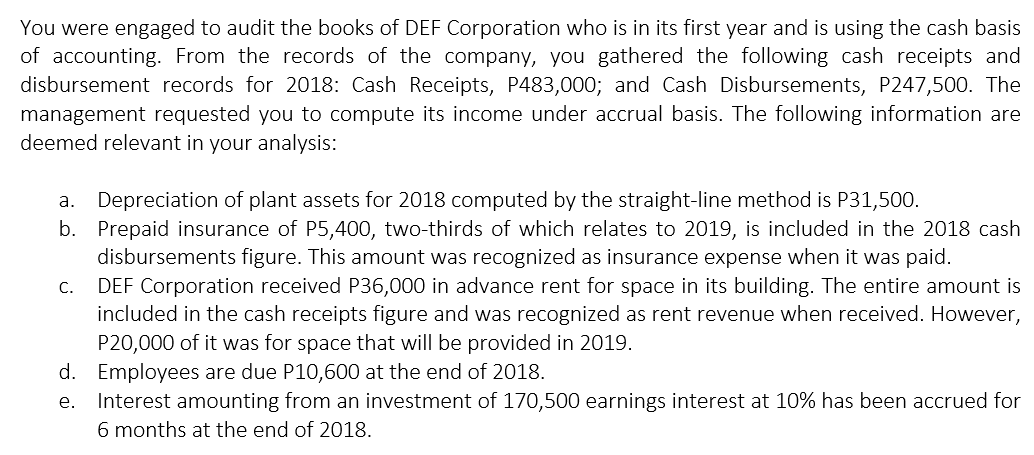

Transcribed Image Text:You were engaged to audit the books of DEF Corporation who is in its first year and is using the cash basis

of accounting. From the records of the company, you gathered the following cash receipts and

disbursement records for 2018: Cash Receipts, P483,000; and Cash Disbursements, P247,500. The

management requested you to compute its income under accrual basis. The following information are

deemed relevant in your analysis:

Depreciation of plant assets for 2018 computed by the straight-line method is P31,500.

b. Prepaid insurance of P5,400, two-thirds of which relates to 2019, is included in the 2018 cash

disbursements figure. This amount was recognized as insurance expense when it was paid.

DEF Corporation received P36,000 in advance rent for space in its building. The entire amount is

included in the cash receipts figure and was recognized as rent revenue when received. However,

P20,000 of it was for space that will be provided in 2019.

d. Employees are due P10,600 at the end of 2018.

Interest amounting from an investment of 170,500 earnings interest at 10% has been accrued for

a.

С.

е.

6 months at the end of 2018.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning