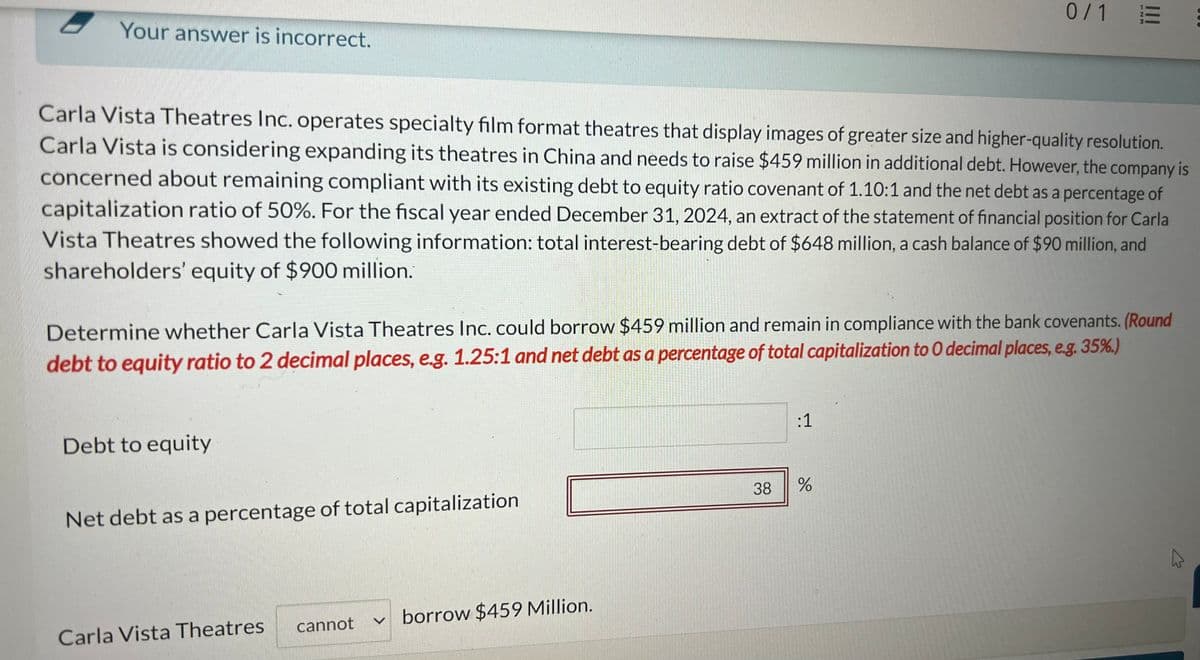

Your answer is incorrect. 0/1 E Carla Vista Theatres Inc. operates specialty film format theatres that display images of greater size and higher-quality resolution. Carla Vista is considering expanding its theatres in China and needs to raise $459 million in additional debt. However, the company is concerned about remaining compliant with its existing debt to equity ratio covenant of 1.10:1 and the net debt as a percentage of capitalization ratio of 50%. For the fiscal year ended December 31, 2024, an extract of the statement of financial position for Carla Vista Theatres showed the following information: total interest-bearing debt of $648 million, a cash balance of $90 million, and shareholders' equity of $900 million. Determine whether Carla Vista Theatres Inc. could borrow $459 million and remain in compliance with the bank covenants. (Round debt to equity ratio to 2 decimal places, e.g. 1.25:1 and net debt as a percentage of total capitalization to O decimal places, e.g. 35%.) Debt to equity Net debt as a percentage of total capitalization Carla Vista Theatres cannot borrow $459 Million. :1 38 % 1

Your answer is incorrect. 0/1 E Carla Vista Theatres Inc. operates specialty film format theatres that display images of greater size and higher-quality resolution. Carla Vista is considering expanding its theatres in China and needs to raise $459 million in additional debt. However, the company is concerned about remaining compliant with its existing debt to equity ratio covenant of 1.10:1 and the net debt as a percentage of capitalization ratio of 50%. For the fiscal year ended December 31, 2024, an extract of the statement of financial position for Carla Vista Theatres showed the following information: total interest-bearing debt of $648 million, a cash balance of $90 million, and shareholders' equity of $900 million. Determine whether Carla Vista Theatres Inc. could borrow $459 million and remain in compliance with the bank covenants. (Round debt to equity ratio to 2 decimal places, e.g. 1.25:1 and net debt as a percentage of total capitalization to O decimal places, e.g. 35%.) Debt to equity Net debt as a percentage of total capitalization Carla Vista Theatres cannot borrow $459 Million. :1 38 % 1

Financial Management: Theory & Practice

16th Edition

ISBN:9781337909730

Author:Brigham

Publisher:Brigham

Chapter21: Dynamic Capital Structures And Corporate Valuation

Section: Chapter Questions

Problem 3MC: David Lyons, CEO of Lyons Solar Technologies, is concerned about his firms level of debt financing....

Related questions

Question

Transcribed Image Text:Your answer is incorrect.

0/1 E

Carla Vista Theatres Inc. operates specialty film format theatres that display images of greater size and higher-quality resolution.

Carla Vista is considering expanding its theatres in China and needs to raise $459 million in additional debt. However, the company is

concerned about remaining compliant with its existing debt to equity ratio covenant of 1.10:1 and the net debt as a percentage of

capitalization ratio of 50%. For the fiscal year ended December 31, 2024, an extract of the statement of financial position for Carla

Vista Theatres showed the following information: total interest-bearing debt of $648 million, a cash balance of $90 million, and

shareholders' equity of $900 million.

Determine whether Carla Vista Theatres Inc. could borrow $459 million and remain in compliance with the bank covenants. (Round

debt to equity ratio to 2 decimal places, e.g. 1.25:1 and net debt as a percentage of total capitalization to O decimal places, e.g. 35%.)

Debt to equity

Net debt as a percentage of total capitalization

Carla Vista Theatres

cannot

borrow $459 Million.

:1

38

%

1

AI-Generated Solution

Unlock instant AI solutions

Tap the button

to generate a solution

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Auditing: A Risk Based-Approach (MindTap Course L…

Accounting

ISBN:

9781337619455

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Auditing: A Risk Based-Approach (MindTap Course L…

Accounting

ISBN:

9781337619455

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

Cengage Learning