Your answer is partially correct. are the CFO of Sunland, Inc., a retailer of the exercise machine Slimbody6 and related accessories. Your firm ening up a new store in Los Angeles. The store will have a life of 20 years. It will generate annual sales of 5,900 the price of each machine is $2,500. The annual sales of accessories will be $600,000, and the operating expe re, including labor and rent, will amount to 50 percent of the revenues from the exercise machines. The initial re will equal $34,900,000 and will be fully depreciated on a straight-line basis over the 20-year life of the stor d to invest $2,500,000 in additional working capital immediately, and recover it at the end of the investment. ginal tax rate is 30 percent. The opportunity cost of opening up the store is 12.20 percent. What are the incre ws from this project at the beginning of the project as well as in years 1-19 and 2O? (Do not round intermedi nd NPV answer to 2 decimal places, e.g. 5,265.25 and all other answers to the nearest dollar, e.g. 5,2 remental cash flow at the beginning of the project $4 37400000 i remental cash flow in the years 1-19 24 5896000 remental cash flow in the year 20 8396000 V of the project 6343574.21 %24 %24 %24

Your answer is partially correct. are the CFO of Sunland, Inc., a retailer of the exercise machine Slimbody6 and related accessories. Your firm ening up a new store in Los Angeles. The store will have a life of 20 years. It will generate annual sales of 5,900 the price of each machine is $2,500. The annual sales of accessories will be $600,000, and the operating expe re, including labor and rent, will amount to 50 percent of the revenues from the exercise machines. The initial re will equal $34,900,000 and will be fully depreciated on a straight-line basis over the 20-year life of the stor d to invest $2,500,000 in additional working capital immediately, and recover it at the end of the investment. ginal tax rate is 30 percent. The opportunity cost of opening up the store is 12.20 percent. What are the incre ws from this project at the beginning of the project as well as in years 1-19 and 2O? (Do not round intermedi nd NPV answer to 2 decimal places, e.g. 5,265.25 and all other answers to the nearest dollar, e.g. 5,2 remental cash flow at the beginning of the project $4 37400000 i remental cash flow in the years 1-19 24 5896000 remental cash flow in the year 20 8396000 V of the project 6343574.21 %24 %24 %24

Chapter11: Cash Flow Estimation And Risk Analysis

Section: Chapter Questions

Problem 1dM

Related questions

Question

Transcribed Image Text:Current Attempt in Progress

Your answer is partially correct.

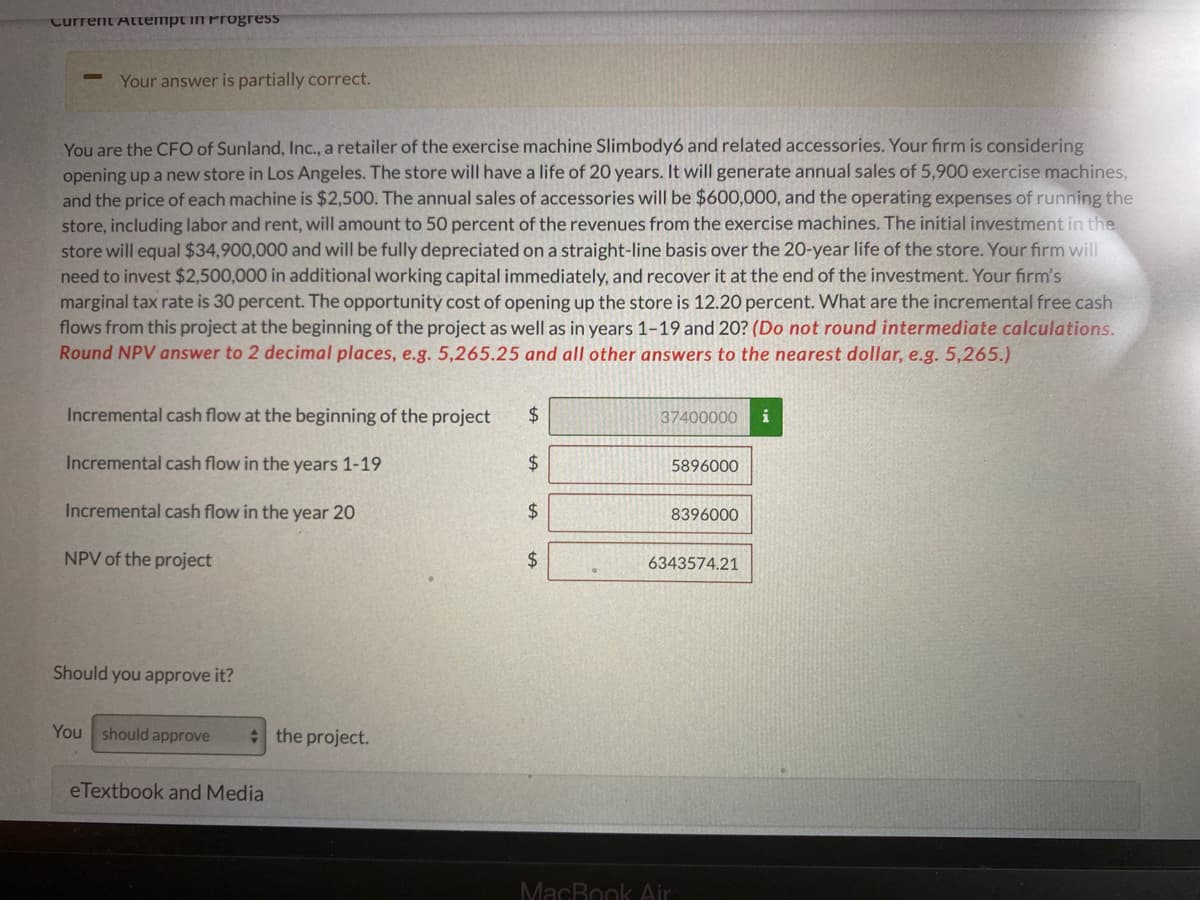

You are the CFO of Sunland, Inc., a retailer of the exercise machine Slimbody6 and related accessories. Your firm is considering

opening up a new store in Los Angeles. The store will have a life of 20 years. It will generate annual sales of 5,900 exercise machines,

and the price ofeach machine is $2,500. The annual sales of accessories will be $600,000, and the operating expenses of running the

store, including labor and rent, will amount to 50 percent of the revenues from the exercise machines. The initial investment in the

store will equal $34,900,000 and will be fully depreciated on a straight-line basis over the 20-year life of the store. Your firm will

need to invest $2,500,000 in additional working capital immediately, and recover it at the end of the investment. Your firm's

marginal tax rate is 30 percent. The opportunity cost of opening up the store is 12.20 percent. What are the incremental free cash

flows from this project at the beginning of the project as well as in years 1-19 and 20? (Do not round intermediate calculations.

Round NPV answer to 2 decimal places, e.g. 5,265.25 and all other answers to the nearest dollar, e.g. 5,265.)

Incremental cash flow at the beginning of the project

$4

37400000

i

Incremental cash flow in the years 1-19

24

5896000

Incremental cash flow in the year 20

$

8396000

NPV of the project

6343574.21

Should you approve it?

You should approve

the project.

eTextbook and Media

MacBook Air

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 6 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning