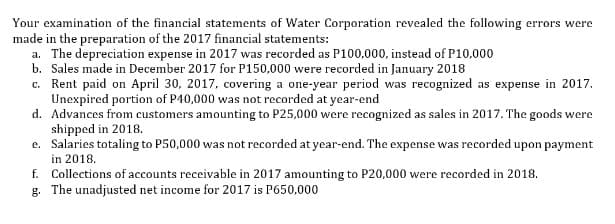

Your examination of the financial statements of Water Corporation revealed the following errors were made in the preparation of the 2017 financial statements: a. The depreciation expense in 2017 was recorded as P100,000, instead of P10,000 b. Sales made in December 2017 for P150,000 were recorded in January 2018 c. Rent paid on April 30, 2017, covering a one-year period was recognized as expense in 2017. Unexpired portion of P40,000 was not recorded at year-end d. Advances from customers amounting to P25,000 were recognized as sales in 2017. The goods were shipped in 2018. e. Salaries totaling to P50,000 was not recorded at year-end. The expense was recorded upon payment in 2018. f. Collections of accounts receivable in 2017 amounting to P20,000 were recorded in 2018. g. The unadjusted net income for 2017 is P650,000

Your examination of the financial statements of Water Corporation revealed the following errors were made in the preparation of the 2017 financial statements: a. The depreciation expense in 2017 was recorded as P100,000, instead of P10,000 b. Sales made in December 2017 for P150,000 were recorded in January 2018 c. Rent paid on April 30, 2017, covering a one-year period was recognized as expense in 2017. Unexpired portion of P40,000 was not recorded at year-end d. Advances from customers amounting to P25,000 were recognized as sales in 2017. The goods were shipped in 2018. e. Salaries totaling to P50,000 was not recorded at year-end. The expense was recorded upon payment in 2018. f. Collections of accounts receivable in 2017 amounting to P20,000 were recorded in 2018. g. The unadjusted net income for 2017 is P650,000

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter22: Accounting For Changes And Errors.

Section: Chapter Questions

Problem 11P: A review of Anderson Corporations books indicates that the errors and omissions pertaining to the...

Related questions

Question

1. What is the net effect of the errors in the working capital at the end of 2017?

2. What is the net effect of the errors in the working capital at the end of 2018?

Transcribed Image Text:Your examination of the financial statements of Water Corporation revealed the following errors were

made in the preparation of the 2017 financial statements:

a. The depreciation expense in 2017 was recorded as P100,000, instead of P10,000

b. Sales made in December 2017 for P150,000 were recorded in January 2018

c. Rent paid on April 30, 2017, covering a one-year period was recognized as expense in 2017.

Unexpired portion of P40,000 was not recorded at year-end

d. Advances from customers amounting to P25,000 were recognized as sales in 2017. The goods were

shipped in 2018.

e. Salaries totaling to P50,000 was not recorded at year-end. The expense was recorded upon payment

in 2018.

f. Collections of accounts receivable in 2017 amounting to P20,000 were recorded in 2018.

g. The unadjusted net income for 2017 is P650,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning