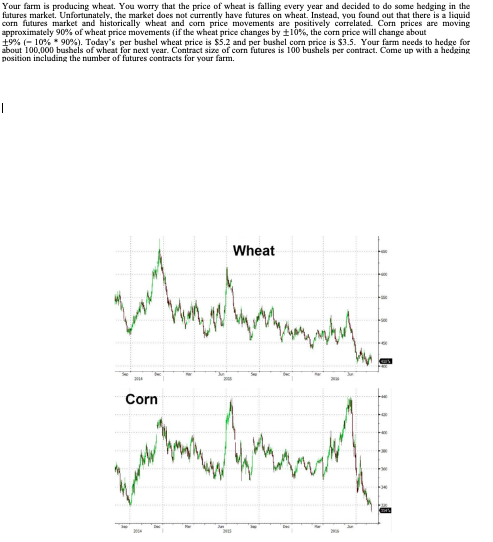

Your farm is producing wheat. You worry that the price of wheat is falling every year and decided to do some hedging in the futures market. Unfortunately, the market does not currently have futures on wheat. Instead, you found out that there is a liquid corn futures market and historically wheat and corn price movements are positively correlated. Corn prices are moving approximately 90% of wheat price movements (if the wheat price changes by t10%, the corn price will change about +9% (- 10% * 90%), Todays per bushel wheat price is $5.2 and per bushel com price is $3.5. Your farm needs to hedge for about 100,000 bushels of wheat for next year. Contract size of corn futures is 100 bushels per contract. Come up with a hedging position including the number of futures contracts for your farm. Wheat Corn

Your farm is producing wheat. You worry that the price of wheat is falling every year and decided to do some hedging in the futures market. Unfortunately, the market does not currently have futures on wheat. Instead, you found out that there is a liquid corn futures market and historically wheat and corn price movements are positively correlated. Corn prices are moving approximately 90% of wheat price movements (if the wheat price changes by ±10%, the corn price will change about ±9% (= 10% * 90%). Today’s per bushel wheat price is $5.2 and per bushel corn price is $3.5. Your farm needs to hedge for about 100,000 bushels of wheat for next year. Contract size of corn futures is 100 bushels per contract. Come up with a hedging position including the number of futures contracts for your farm.

Step by step

Solved in 3 steps with 2 images