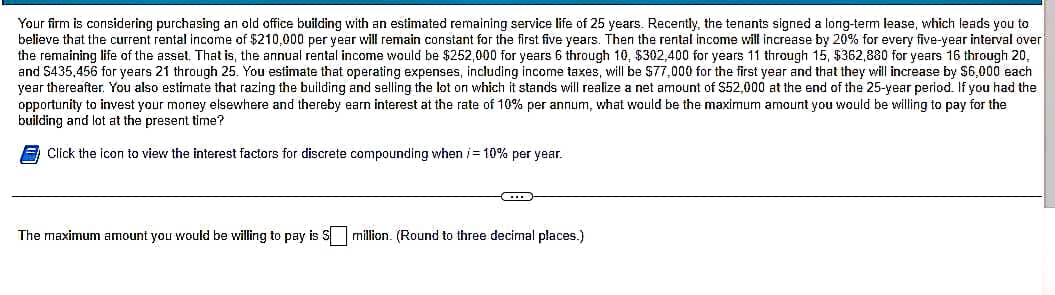

Your firm is considering purchasing an old office building with an estimated remaining service life of 25 years. Recently, the tenants signed a long-term lease, which leads you to believe that the current rental income of $210,000 per year will remain constant for the first five years. Then the rental income will increase by 20% for every five-year interval over the remaining life of the asset. That is, the annual rental income would be $252,000 for years 6 through 10, $302,400 for years 11 through 15, $362,880 for years 16 through 20, and $435,456 for years 21 through 25. You estimate that operating expenses, including income taxes, will be $77,000 for the first year and that they will increase by $6,000 each year thereafter. You also estimate that razing the building and selling the lot on which it stands will realize a net amount of $52,000 at the end of the 25-year period. If you had the opportunity to invest your money elsewhere and thereby earn interest at the rate of 10% per annum, what would be the maximum amount you would be willing to pay for the building and lot at the present time? Click the icon to view the interest factors for discrete compounding when /= 10% per year. The maximum amount you would be willing to pay is S million. (Round to three decimal places.)

Your firm is considering purchasing an old office building with an estimated remaining service life of 25 years. Recently, the tenants signed a long-term lease, which leads you to believe that the current rental income of $210,000 per year will remain constant for the first five years. Then the rental income will increase by 20% for every five-year interval over the remaining life of the asset. That is, the annual rental income would be $252,000 for years 6 through 10, $302,400 for years 11 through 15, $362,880 for years 16 through 20, and $435,456 for years 21 through 25. You estimate that operating expenses, including income taxes, will be $77,000 for the first year and that they will increase by $6,000 each year thereafter. You also estimate that razing the building and selling the lot on which it stands will realize a net amount of $52,000 at the end of the 25-year period. If you had the opportunity to invest your money elsewhere and thereby earn interest at the rate of 10% per annum, what would be the maximum amount you would be willing to pay for the building and lot at the present time? Click the icon to view the interest factors for discrete compounding when /= 10% per year. The maximum amount you would be willing to pay is S million. (Round to three decimal places.)

Chapter10: Capital Budgeting: Decision Criteria And Real Option

Section: Chapter Questions

Problem 19P

Related questions

Question

A10

Transcribed Image Text:Your firm is considering purchasing an old office building with an estimated remaining service life of 25 years. Recently, the tenants signed a long-term lease, which leads you to

believe that the current rental income of $210,000 per year will remain constant for the first five years. Then the rental income will increase by 20% for every five-year interval over

the remaining life of the asset. That is, the annual rental income would be $252,000 for years 6 through 10, $302,400 for years 11 through 15, $362,880 for years 16 through 20.

and $435,456 for years 21 through 25. You estimate that operating expenses, including income taxes, will be $77,000 for the first year and that they will increase by $6,000 each

year thereafter. You also estimate that razing the building and selling the lot on which it stands will realize a net amount of $52,000 at the end of the 25-year period. If you had the

opportunity to invest your money elsewhere and thereby earn interest at the rate of 10% per annum, what would be the maximum amount you would be willing to pay for the

building and lot at the present time?

Click the icon to view the interest factors for discrete compounding when /= 10% per year.

C

The maximum amount you would be willing to pay is S million. (Round to three decimal places.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning