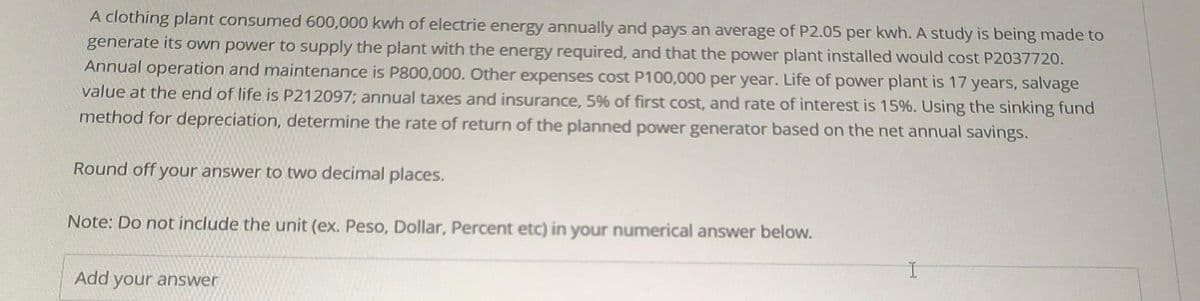

A clothing plant consumed 600,000 kwh of electrie energy annually and pays an average of P2.05 per kwh. A study is being made to generate its own power to supply the plant with the energy required, and that the power plant installed would cost P2037720. Annual operation and maintenance is P800,000. Other expenses cost P100,000 per year. Life of power plant is 17 years, salvage value at the end of life is P212097; annual taxes and insurance, 5% of first cost, and rate of interest is 15%. Using the sinking fund method for depreciation, determine the rate of return of the planned power generator based on the net annual savings. Round off your answer to two decimal places. Note: Do not include the unit (ex. Peso, Dollar, Percent etc) in your numerical answer below. Add your answer

A clothing plant consumed 600,000 kwh of electrie energy annually and pays an average of P2.05 per kwh. A study is being made to generate its own power to supply the plant with the energy required, and that the power plant installed would cost P2037720. Annual operation and maintenance is P800,000. Other expenses cost P100,000 per year. Life of power plant is 17 years, salvage value at the end of life is P212097; annual taxes and insurance, 5% of first cost, and rate of interest is 15%. Using the sinking fund method for depreciation, determine the rate of return of the planned power generator based on the net annual savings. Round off your answer to two decimal places. Note: Do not include the unit (ex. Peso, Dollar, Percent etc) in your numerical answer below. Add your answer

Chapter10: Capital Budgeting: Decision Criteria And Real Option

Section10.A: Mutually Exclusive Investments Having Unequal Lives

Problem 2P

Related questions

Question

Read the question carefully and give me right solution according to the question.

Transcribed Image Text:A clothing plant consumed 600,000 kwh of electrie energy annually and pays an average of P2.05 per kwh. A study is being made to

generate its own power to supply the plant with the energy required, and that the power plant installed would cost P2037720.

Annual operation and maintenance is P800,000. Other expenses cost P100,000 per year. Life of power plant is 17 years, salvage

value at the end of life is P212097; annual taxes and insurance, 5% of first cost, and rate of interest is 15%. Using the sinking fund

method for depreciation, determine the rate of return of the planned power generator based on the net annual savings.

Round off your answer to two decimal places.

Note: Do not include the unit (ex. Peso, Dollar, Percent etc) in your numerical answer below.

I

Add your answer

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College