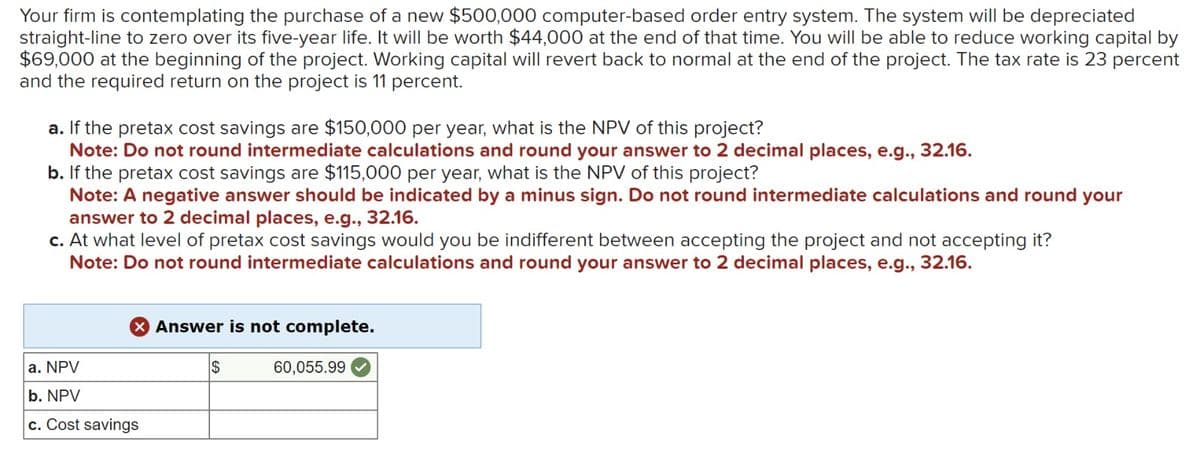

Your firm is contemplating the purchase of a new $500,000 computer-based order entry system. The system will be depreciated straight-line to zero over its five-year life. It will be worth $44,000 at the end of that time. You will be able to reduce working capital by $69,000 at the beginning of the project. Working capital will revert back to normal at the end of the project. The tax rate is 23 percent and the required return on the project is 11 percent. a. If the pretax cost savings are $150,000 per year, what is the NPV of this project? Note: Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16. b. If the pretax cost savings are $115,000 per year, what is the NPV of this project? Note: A negative answer should be indicated by a minus sign. Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16. c. At what level of pretax cost savings would you be indifferent between accepting the project and not accepting it? Note: Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16. a. NPV b. NPV c. Cost savings Answer is not complete. $ 60,055.99

Your firm is contemplating the purchase of a new $500,000 computer-based order entry system. The system will be depreciated straight-line to zero over its five-year life. It will be worth $44,000 at the end of that time. You will be able to reduce working capital by $69,000 at the beginning of the project. Working capital will revert back to normal at the end of the project. The tax rate is 23 percent and the required return on the project is 11 percent. a. If the pretax cost savings are $150,000 per year, what is the NPV of this project? Note: Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16. b. If the pretax cost savings are $115,000 per year, what is the NPV of this project? Note: A negative answer should be indicated by a minus sign. Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16. c. At what level of pretax cost savings would you be indifferent between accepting the project and not accepting it? Note: Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16. a. NPV b. NPV c. Cost savings Answer is not complete. $ 60,055.99

Cornerstones of Cost Management (Cornerstones Series)

4th Edition

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Don R. Hansen, Maryanne M. Mowen

Chapter19: Capital Investment

Section: Chapter Questions

Problem 15E: Gina Ripley, president of Dearing Company, is considering the purchase of a computer-aided...

Related questions

Question

Vijay

Transcribed Image Text:Your firm is contemplating the purchase of a new $500,000 computer-based order entry system. The system will be depreciated

straight-line to zero over its five-year life. It will be worth $44,000 at the end of that time. You will be able to reduce working capital by

$69,000 at the beginning of the project. Working capital will revert back to normal at the end of the project. The tax rate is 23 percent

and the required return on the project is 11 percent.

a. If the pretax cost savings are $150,000 per year, what is the NPV of this project?

Note: Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.

b. If the pretax cost savings are $115,000 per year, what is the NPV of this project?

Note: A negative answer should be indicated by a minus sign. Do not round intermediate calculations and round your

answer to 2 decimal places, e.g., 32.16.

c. At what level of pretax cost savings would you be indifferent between accepting the project and not accepting it?

Note: Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.

a. NPV

b. NPV

c. Cost savings

Answer is not complete.

$

60,055.99

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 1 images

Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning