Your friend in mechanical engineering has invented a money machine. The main drawback of the machine is that it is slow. It takes one year to manufacture $100. However, once built, the machine will last forever and will require no maintenance. The machine can be built immediately, but it will cost $1,000 to build. Your friend wants to know if he should invest the money to construct it. If the interest rate is 5.5% per year, what should your friend do? The NPV of the machine is $ (Round to the nearest dollar.) What should your friend do? (Select the best choice below.) O A. Accept the machine because the NPV is equal to or greater than $0. B. Accept the machine because the NPV is equal to or less than $0. C. Reject the machine because the NPV is equal to or greater than $0. D. Reject the machine because the NPV is less than $0.

Your friend in mechanical engineering has invented a money machine. The main drawback of the machine is that it is slow. It takes one year to manufacture $100. However, once built, the machine will last forever and will require no maintenance. The machine can be built immediately, but it will cost $1,000 to build. Your friend wants to know if he should invest the money to construct it. If the interest rate is 5.5% per year, what should your friend do? The NPV of the machine is $ (Round to the nearest dollar.) What should your friend do? (Select the best choice below.) O A. Accept the machine because the NPV is equal to or greater than $0. B. Accept the machine because the NPV is equal to or less than $0. C. Reject the machine because the NPV is equal to or greater than $0. D. Reject the machine because the NPV is less than $0.

Chapter10: Capital Budgeting: Decision Criteria And Real Option

Section: Chapter Questions

Problem 4P

Related questions

Question

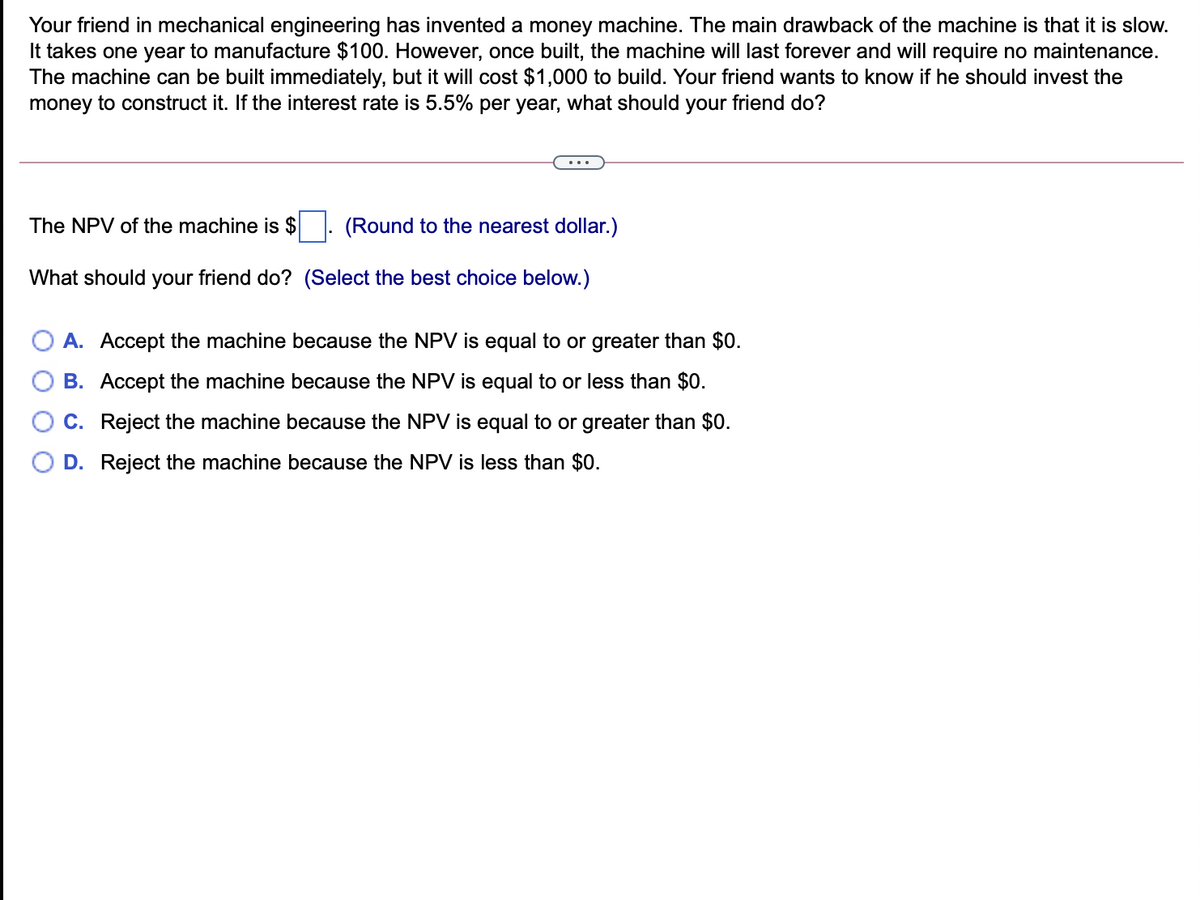

Transcribed Image Text:Your friend in mechanical engineering has invented a money machine. The main drawback of the machine is that it is slow.

It takes one year to manufacture $100. However, once built, the machine will last forever and will require no maintenance.

The machine can be built immediately, but it will cost $1,000 to build. Your friend wants to know if he should invest the

money to construct it. If the interest rate is 5.5% per year, what should your friend do?

The NPV of the machine is $

(Round to the nearest dollar.)

What should your friend do? (Select the best choice below.)

A. Accept the machine because the NPV is equal to or greater than $0.

B. Accept the machine because the NPV is equal to or less than $0.

C. Reject the machine because the NPV is equal to or greater than $0.

D. Reject the machine because the NPV is less than $0.

Expert Solution

Step 1

The Net Present Value (NPV) method is a Capital Budgeting technique used to decide whether to invest or reject a project.

It uses the concept of the time value of money.

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College