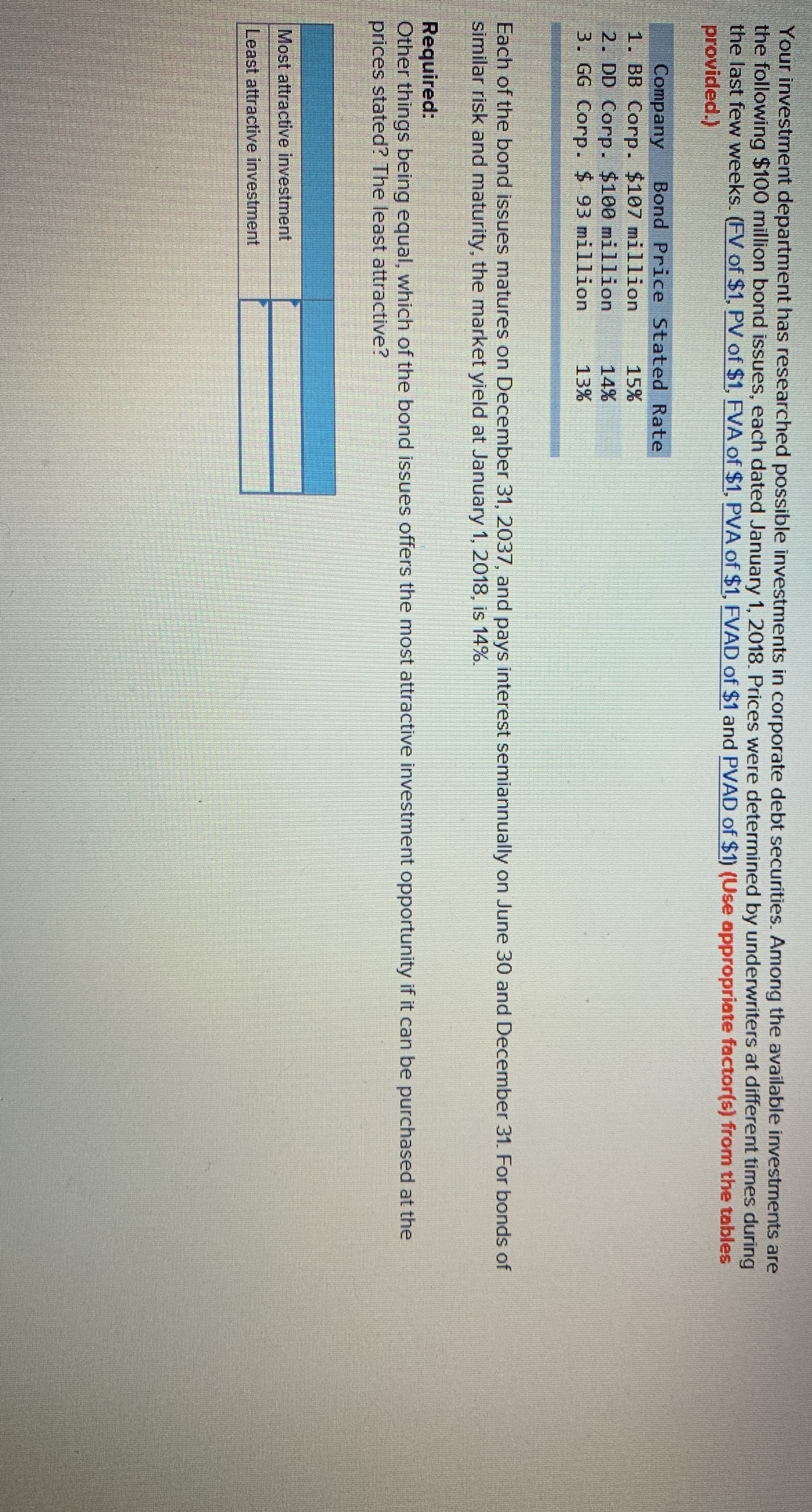

Your investment department has researched possible investments in corporate debt securities. Among the available investments are the following $100 the last few weeks. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from the tables provided.) million bond issues, each dated January 1, 2018. Prices were determined by underwriters at different times during Company Bond Price Stated Rate 1-BB Corp. $107 million 15% 2.DD Corp. $100 million 14% 3. GG Corp. $ 93 million 13% Each of the bond issues matures on December 31, 2037, and pays interest semiannually on June 30 and December 31. For bonds of similar risk and maturity, the market yield at January 1, 2018, is 14%. Required: Other things being equal, which of the bond issues offers the most attractive investment opportunity if it can be purchased at the prices stated? The least attractive? Most attractive investment Least attractive investment

Your investment department has researched possible investments in corporate debt securities. Among the available investments are the following $100 the last few weeks. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from the tables provided.) million bond issues, each dated January 1, 2018. Prices were determined by underwriters at different times during Company Bond Price Stated Rate 1-BB Corp. $107 million 15% 2.DD Corp. $100 million 14% 3. GG Corp. $ 93 million 13% Each of the bond issues matures on December 31, 2037, and pays interest semiannually on June 30 and December 31. For bonds of similar risk and maturity, the market yield at January 1, 2018, is 14%. Required: Other things being equal, which of the bond issues offers the most attractive investment opportunity if it can be purchased at the prices stated? The least attractive? Most attractive investment Least attractive investment

Financial Accounting

14th Edition

ISBN:9781305088436

Author:Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:Carl Warren, Jim Reeve, Jonathan Duchac

Chapter15: Investments And Fair Value Accounting

Section: Chapter Questions

Problem 4E

Related questions

Question

Transcribed Image Text:Your investment department has researched possible investments in corporate debt securities. Among the available investments are

the following $100

the last few weeks. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from the tables

provided.)

million bond issues, each dated January 1, 2018. Prices were determined by underwriters at different times during

Company Bond Price Stated Rate

1-BB Corp. $107 million 15%

2.DD Corp. $100 million 14%

3. GG Corp. $ 93 million 13%

Each of the bond issues matures on December 31, 2037, and pays interest semiannually on June 30 and December 31. For bonds of

similar risk and maturity, the market yield at January 1, 2018, is 14%.

Required:

Other things being equal, which of the bond issues offers the most attractive investment opportunity if it can be purchased at the

prices stated? The least attractive?

Most attractive investment

Least attractive investment

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps with 3 images

Recommended textbooks for you

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College