Your Task… Using your assigned financial statements calculate the required ratios below Indicate if the change from year to year is favorable or unfavorable. All values should be accurate to at least two decimal places. The expectation is to submit a professional report free of grammar and spelling errors and easy to read. Think of this as a menu you would be handing to a customer. All calculations are to be represented. Analysis of Profitability Gross Profit Ratio Operating Profit Ratio Net Profit Ratio Sales to Total Assets Ratio Return on Total Assets Return on Equity Earnings Per Share

Your Task… Using your assigned financial statements calculate the required ratios below Indicate if the change from year to year is favorable or unfavorable. All values should be accurate to at least two decimal places. The expectation is to submit a professional report free of grammar and spelling errors and easy to read. Think of this as a menu you would be handing to a customer. All calculations are to be represented. Analysis of Profitability Gross Profit Ratio Operating Profit Ratio Net Profit Ratio Sales to Total Assets Ratio Return on Total Assets Return on Equity Earnings Per Share

Fundamentals of Financial Management (MindTap Course List)

15th Edition

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Eugene F. Brigham, Joel F. Houston

Chapter4: Analysis Of Financial Statements

Section: Chapter Questions

Problem 24P: Income Statement for Year Ended December 31, 2018 (Millions of Dollars) Net sales 795.0 Cost of...

Related questions

Question

Your Task…

- Using your assigned financial statements calculate the required ratios below

- Indicate if the change from year to year is favorable or unfavorable.

- All values should be accurate to at least two decimal places.

- The expectation is to submit a professional report free of grammar and spelling errors and easy to read. Think of this as a menu you would be handing to a customer.

- All calculations are to be represented.

Analysis of Profitability

- Gross Profit Ratio

- Operating Profit Ratio

- Net Profit Ratio

- Sales to Total Assets Ratio

- Return on Total Assets

- Return on Equity

- Earnings Per Share

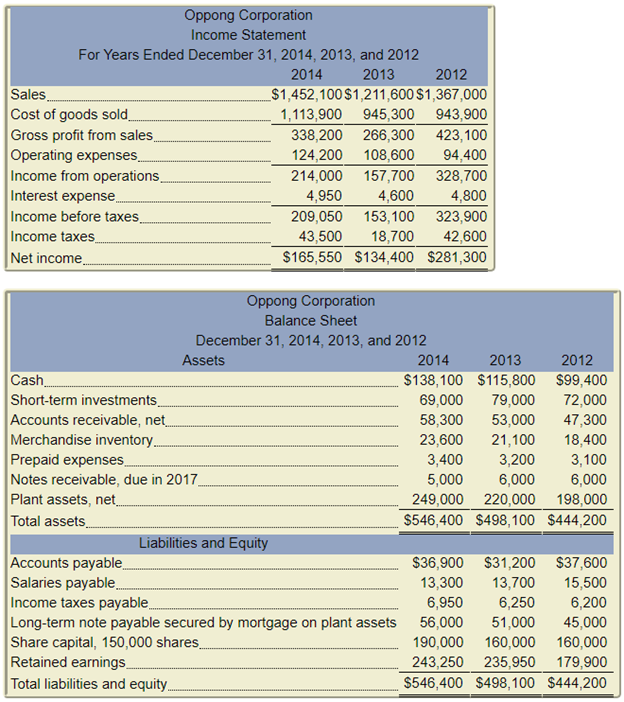

Transcribed Image Text:Oppong Corporation

Income Statement

For Years Ended December 31, 2014, 2013, and 2012

2013

2014

2012

Sales

Cost of goods sold

$1,452,100$1,211,600 $1,367,000

1,113,900 945,300

943,900

Gross profit from sales,

Operating expenses.

Income from operations,

Interest expense

Income before taxes.

338,200 266,300

423,100

94,400

328,700

124,200

108,600

214,000 157,700

4,950

4,600

4,800

209,050 153,100

18,700

323,900

Income taxes

43,500

42,600

Net income

$165,550 $134,400 $281,300

Oppong Corporation

Balance Sheet

December 31, 2014, 2013, and 2012

Assets

2014

2013

2012

Cash

Short-term investments_

Accounts receivable, net

Merchandise inventory

Prepaid expenses,

Notes receivable, due in 2017

Plant assets, net

Total assets

$138,100 $115,800 $99,400

79,000

69,000

58,300

72,000

47,300

53,000

23,600

21,100

18,400

3,200

6,000

3,100

6,000

3,400

5,000

249,000 220,000 198,000

$546,400 $498,100 $444,200

Liabilities and Equity

Accounts payable

Salaries payable.

Income taxes payable,

$36,900 $31,200 $37,600

13,700

13,300

15,500

6,950

6,250

6,200

45,000

Long-term note payable secured by mortgage on plant assets

51,000

56,000

190,000 160,000 160,000

Share capital, 150,000 shares.

Retained earnings

Total liabilities and equity.

243,250 235,950

$546,400 $498,100 $444,200

179,900

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781337395250

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781337395250

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781285866307

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning