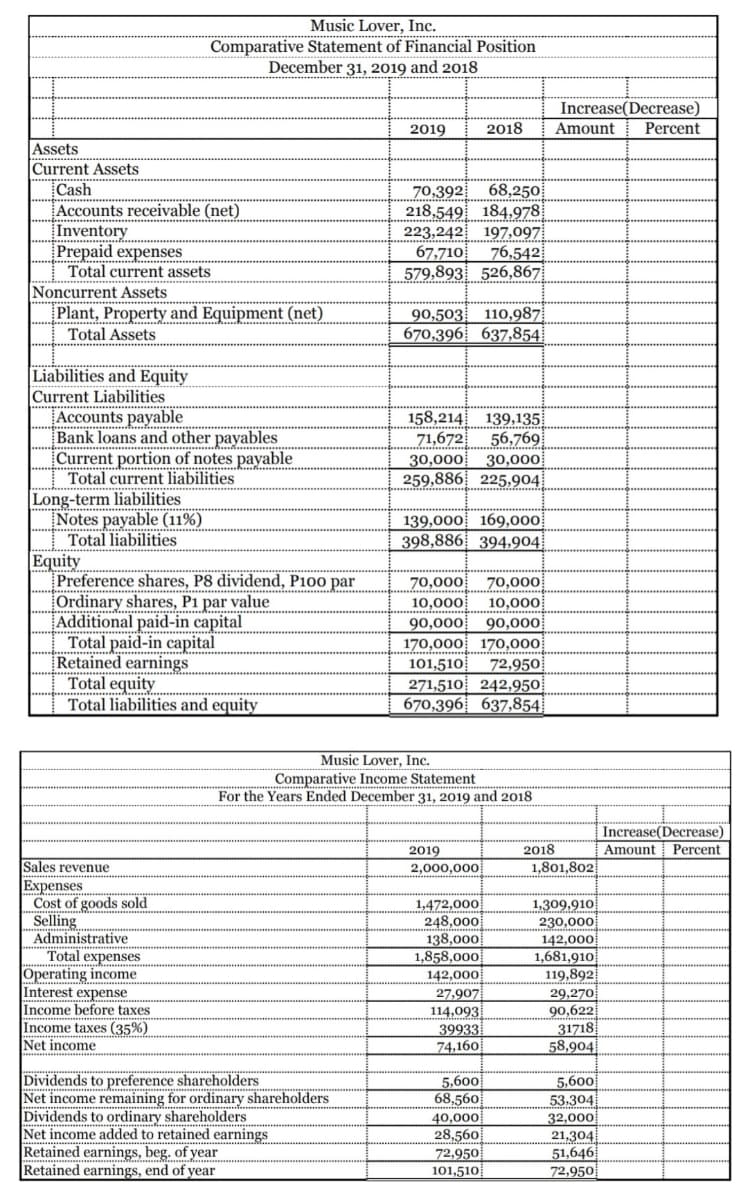

Requirements: a. Prepare horizontal analysis based on the above statements presented (for percent: round of your answers to 2 decimal places) Music Lover, Inc.xlsx b. Evaluate the company's financial position and results of operation using the comparative statement analysis i. Short-term solvency analysis ii. Long-term financial position analysis iii. Operating efficiency and profitability analysis

Requirements: a. Prepare horizontal analysis based on the above statements presented (for percent: round of your answers to 2 decimal places) Music Lover, Inc.xlsx b. Evaluate the company's financial position and results of operation using the comparative statement analysis i. Short-term solvency analysis ii. Long-term financial position analysis iii. Operating efficiency and profitability analysis

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter12: Fainancial Statement Analysis

Section: Chapter Questions

Problem 98.3C

Related questions

Question

Requirements:

a. Prepare horizontal analysis based on the above statements presented (for percent: round of your answers to 2 decimal places) Music Lover, Inc.xlsx

b. Evaluate the company's financial position and results of operation using the comparative statement analysis

i. Short-term solvency analysis

ii. Long-term financial position analysis iii. Operating efficiency and profitability analysis

Transcribed Image Text:Music Lover, Inc.

Comparative Statement of Financial Position

December 31, 2019 and 2018

Increase(Decrease)

Percent

2019

2018

Amount

Assets

Current Assets

Cash

Accounts receivable (net)

Inventory

Prepaid expenses

Total current assets

68,250

70,392

218,549 184,978

223,242 197,097

67,710

76,542

579,893 526,867

Noncurrent Assets

Plant, Property and Equipment (net)

Total Assets

90,503

110,987

670,396 637,854

Liabilities and Equity

|Current Liabilities

Accounts payable

Bank loans and other payables

Current portion of notes payable

Total current liabilities

158,214

139,135

71,672

56,769

30,000

30,000

259,886 225,904

Long-term liabilities

Notes payable (11%)

Total liabilities

Equity

Preference shares, P8 dividend, Pi00 par

Ordinary shares, P1 par value

Additional paid-in capital

Total paid-in capital

Retained earnings

Total equity

139,000 169,000

398,886 394,904

70,000

70,000

10,000

10,000

90,000

90,000

170,000 170,000

101,510

72,950

271,510 242,950

670,396 637,854

Total liabilities and equity

Music Lover, Inc.

Comparative Income Statement

For the Years Ended December 31, 2019 and 2018

Increase(Decrease)

Amount

Percent

2019

2018

Sales revenue

2,000,000

1,801,802

Expenses

Cost of goods sold

Selling

Administrative

Total expenses

Operating income

Interest expense

Income before taxes

Income taxes (35%)

Net income

1,472,000

248,000

138,000

1,858,000

142,000

1,309,910

230,000

142,000

1,681,910

119,892

29,270

90,622

31718

58,904

27,907

114,093

39933

74,160

Dividends to preference shareholders

Net income remaining for ordinary shareholders

Dividends to ordinary shareholders

Net income added to retained earnings

Retained earnings, beg. of year

Retained earnings, end of year

5,600

68,560

5,600

53,304

32,000

40,000

28,560

72,950

101,510

21,304

51,646

72,950

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps with 5 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning