Zabberer Corporation bonds pay a coupon rate of interest of 12 percent annually and have a maturity value of $1,000. The bonds are scheduled to mature at the end of 14 years. The company has the option to call the bonds in 9 years at a premium of 9 percent above the maturity value. You believe the company will exercise its option to call the bonds at that time. If you require a pretax return of 11 percent on bonds of this risk, how much would you pay for one of these bonds today? Use Table II and Table IV to answer the question. Round your answer to the nearest dollar. $

Zabberer Corporation bonds pay a coupon rate of interest of 12 percent annually and have a maturity value of $1,000. The bonds are scheduled to mature at the end of 14 years. The company has the option to call the bonds in 9 years at a premium of 9 percent above the maturity value. You believe the company will exercise its option to call the bonds at that time. If you require a pretax return of 11 percent on bonds of this risk, how much would you pay for one of these bonds today? Use Table II and Table IV to answer the question. Round your answer to the nearest dollar. $

Chapter7: Payroll

Section: Chapter Questions

Problem 1.13C

Related questions

Question

Zabberer Corporation bonds pay a coupon rate of interest of 12 percent annually and have a maturity value of $1,000. The bonds are scheduled to mature at the end of 14 years. The company has the option to call the bonds in 9 years at a premium of 9 percent above the maturity value. You believe the company will exercise its option to call the bonds at that time.

If you require a pretax return of 11 percent on bonds of this risk, how much would you pay for one of these bonds today? Use Table II and Table IV to answer the question. Round your answer to the nearest dollar.

$

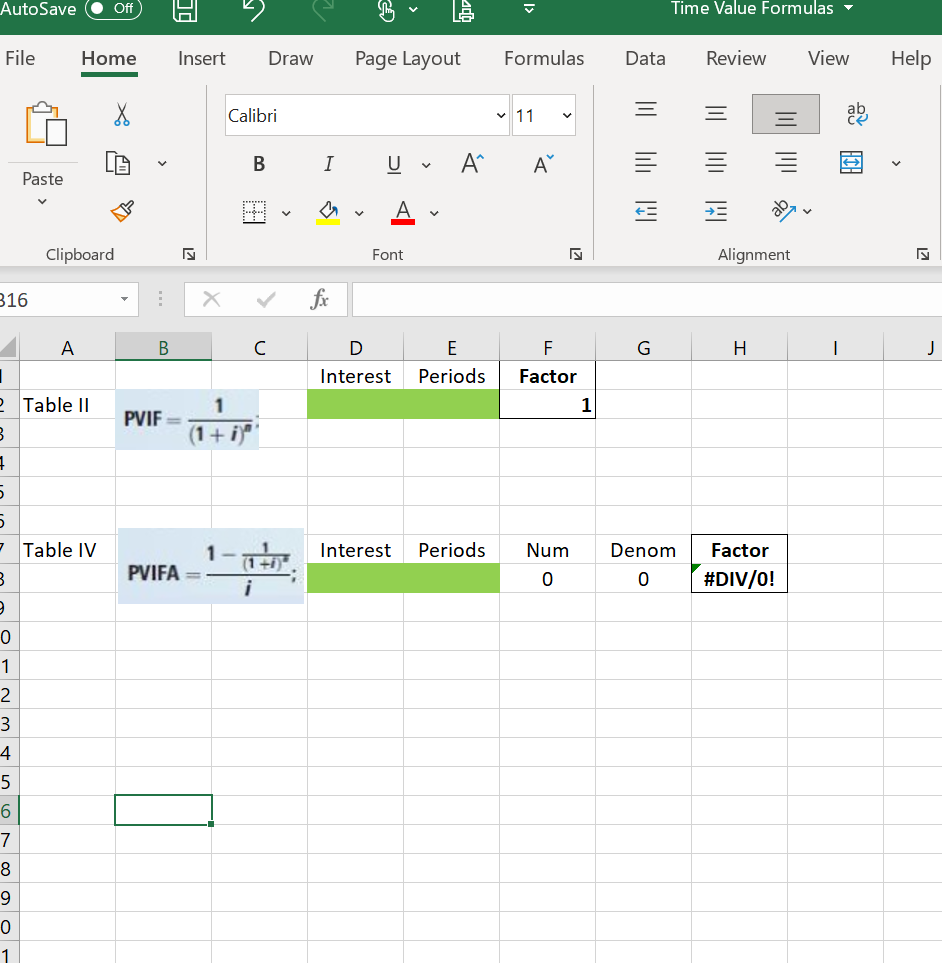

Transcribed Image Text:AutoSave

Off

Time Value Formulas -

File

Home

Insert

Draw

Page Layout

Formulas

Data

Review

View

Help

Calibri

v 11

В

U v

A°

A

Paste

Clipboard

Font

Alignment

B16

A

В

C

E

F

G

J

Interest

Periods

Factor

2 Table II

1

PVIF =

1

(1+ i)"

- Table IV

Interest

Periods

Num

Denom

Factor

(1+i

PVIFA

#DIV/O!

i

1

3

4

5

7

8

9.

1

I>

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you