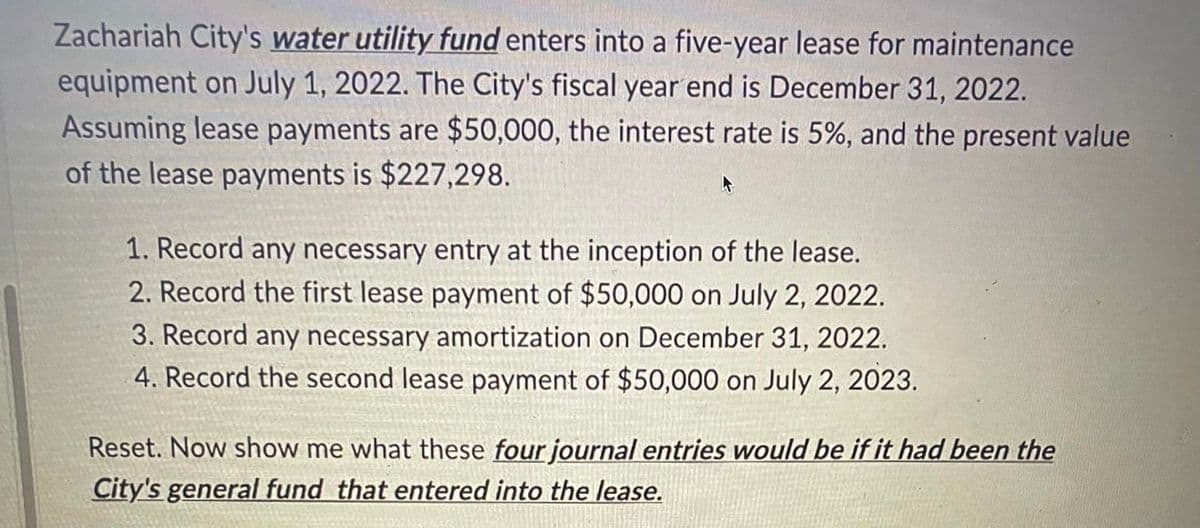

Zachariah City's water utility fund enters into a five-year lease for maintenance equipment on July 1, 2022. The City's fiscal year end is December 31, 2022. Assuming lease payments are $50,000, the interest rate is 5%, and the present value of the lease payments is $227,298. 1. Record any necessary entry at the inception of the lease. 2. Record the first lease payment of $50,000 on July 2, 2022. 3. Record any necessary amortization on December 31, 2022. 4. Record the second lease payment of $50,000 on July 2, 2023. Reset. Now show me what these four journal entries would be if it had been the City's general fund that entered into the lease.

Zachariah City's water utility fund enters into a five-year lease for maintenance equipment on July 1, 2022. The City's fiscal year end is December 31, 2022. Assuming lease payments are $50,000, the interest rate is 5%, and the present value of the lease payments is $227,298. 1. Record any necessary entry at the inception of the lease. 2. Record the first lease payment of $50,000 on July 2, 2022. 3. Record any necessary amortization on December 31, 2022. 4. Record the second lease payment of $50,000 on July 2, 2023. Reset. Now show me what these four journal entries would be if it had been the City's general fund that entered into the lease.

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter20: Accounting For Leases

Section: Chapter Questions

Problem 6E: Lessor Accounting Issues Ramsey Company leases heavy equipment to Terrell Inc. on March 1, 2019, on...

Related questions

Question

Transcribed Image Text:Zachariah City's water utility fund enters into a five-year lease for maintenance

equipment on July 1, 2022. The City's fiscal year end is December 31, 2022.

Assuming lease payments are $50,000, the interest rate is 5%, and the present value

of the lease payments is $227,298.

1. Record any necessary entry at the inception of the lease.

2. Record the first lease payment of $50,000 on July 2, 2022.

3. Record any necessary amortization on December 31, 2022.

4. Record the second lease payment of $50,000 on July 2, 2023.

Reset. Now show me what these four journal entries would be if it had been the

City's general fund that entered into the lease.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College