zation schedule The data on a loan has been collected in the Microsoft Excel Online file below. Open the spreadsheet and perform the required analysis to answer the questions below. Open spreadsheet a. Complete an amortization schedule for a $42,000 loan to be repaid in equal installments at the end of each of the next three years. The interest rate is 9% compounded annually. Round all answers to the Ending Balance Year 1 $ 2 $ 3 $ Year 1: Year 2: Year Beginning Balance Activity % Interest % % $ % $ $ Payment % Principal % b. What percentage of the payment represents interest and what percentage represents principal for each of the three years? Round all answers to two decimal places. % % $ $ $ c. Why do these percentages change over time? Interest $ $ $ Repayment. of Principal $ $ $

zation schedule The data on a loan has been collected in the Microsoft Excel Online file below. Open the spreadsheet and perform the required analysis to answer the questions below. Open spreadsheet a. Complete an amortization schedule for a $42,000 loan to be repaid in equal installments at the end of each of the next three years. The interest rate is 9% compounded annually. Round all answers to the Ending Balance Year 1 $ 2 $ 3 $ Year 1: Year 2: Year Beginning Balance Activity % Interest % % $ % $ $ Payment % Principal % b. What percentage of the payment represents interest and what percentage represents principal for each of the three years? Round all answers to two decimal places. % % $ $ $ c. Why do these percentages change over time? Interest $ $ $ Repayment. of Principal $ $ $

Chapter19: Lease And Intermediate-term Financing

Section: Chapter Questions

Problem 20P

Related questions

Question

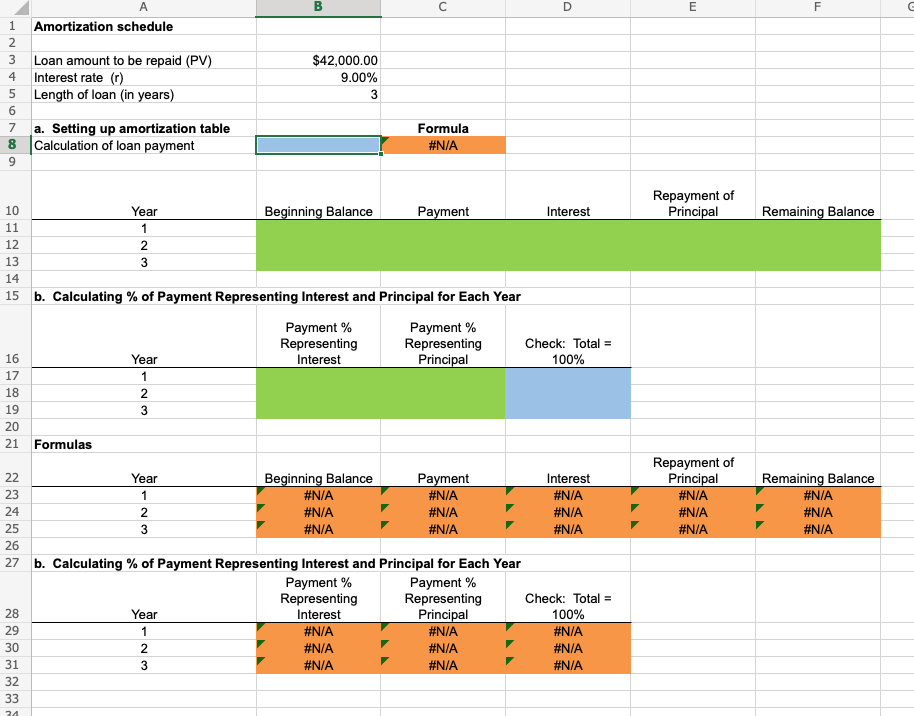

Transcribed Image Text:12345

3 Loan amount to be repaid (PV)

Interest rate (r)

Length of loan (in years)

6

789

10 112 13 14 15

16

17

18

19

20

21

22

23

24

25

A

Amortization schedule

28

29

30

31

32

33

24

a. Setting up amortization table

Calculation of loan payment

Year

1

2

3

Formulas

Year

1

2

3

Year

1

23

3

b. Calculating % of Payment Representing Interest and Principal for Each Year

Year

1

2

B

WN

$42,000.00

9.00%

3

3

Beginning Balance

Payment %

Representing

Interest

Beginning Balance

#N/A

#N/A

#N/A

с

26

27 b. Calculating % of Payment Representing Interest and Principal for Each Year

Formula

#N/A

Payment %

Representing

Interest

#N/A

#N/A

#N/A

Payment

Payment %

Representing

Principal

Payment

#N/A

#N/A

#N/A

Payment %

Representing

Principal

#N/A

#N/A

#N/A

D

Interest

Check: Total =

100%

Interest

#N/A

#N/A

#N/A

Check: Total =

100%

#N/A

#N/A

#N/A

E

Repayment of

Principal

Repayment of

Principal

#N/A

#N/A

#N/A

F

Remaining Balance

Remaining Balance

#N/A

#N/A

#N/A

G

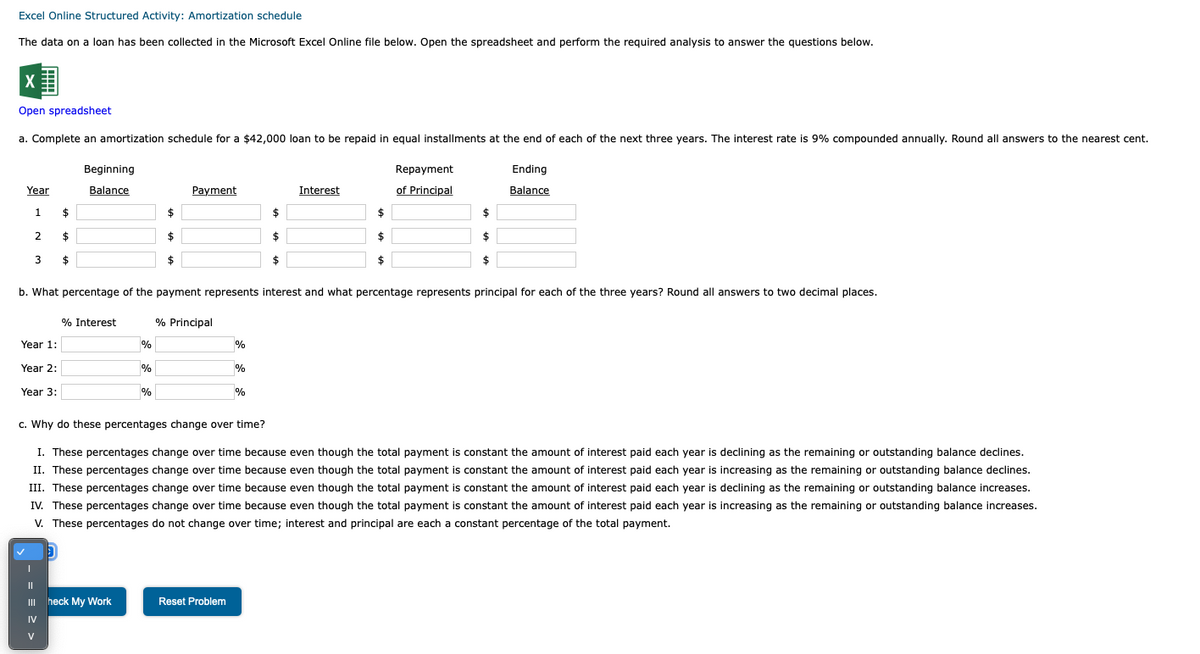

Transcribed Image Text:Excel Online Structured Activity: Amortization schedule

The data on a loan has been collected in the Microsoft Excel Online file below. Open the spreadsheet and perform the required analysis to answer the questions below.

X

Open spreadsheet

a. Complete an amortization schedule for a $42,000 loan to be repaid in equal installments at the end of each of the next three years. The interest rate is 9% compounded annually. Round all answers to the nearest cent.

Year

1

2

3

Year 1:

Year 2:

Year 3:

I

$

$

$

Beginning

Balance

|||

IV

V

% Interest

%

heck My Work

$

$

%

Payment

b. What percentage of the payment represents interest and what percentage represents principal for each of the three years? Round all answers to two decimal places.

% Principal

%

Reset Problem

%

$

$

$

%

Interest

$

$

$

Repayment

of Principal

$

c. Why do these percentages change over time?

I. These percentages change over time because even though the total payment is constant the amount of interest paid each year is declining as the remaining or outstanding balance declines.

II. These percentages change over time because even though the total payment is constant the amount of interest paid each year is increasing as the remaining or outstanding balance declines.

III. These percentages change over time because even though the total payment is constant the amount of interest paid each year is declining as the remaining or outstanding balance increases.

IV. These percentages change over time because even though the total payment is constant the amount of interest paid each year is increasing as the remaining or outstanding balance increases.

V. These percentages do not change over time; interest and principal are each a constant percentage of the total payment.

$

$

Ending

Balance

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 5 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning