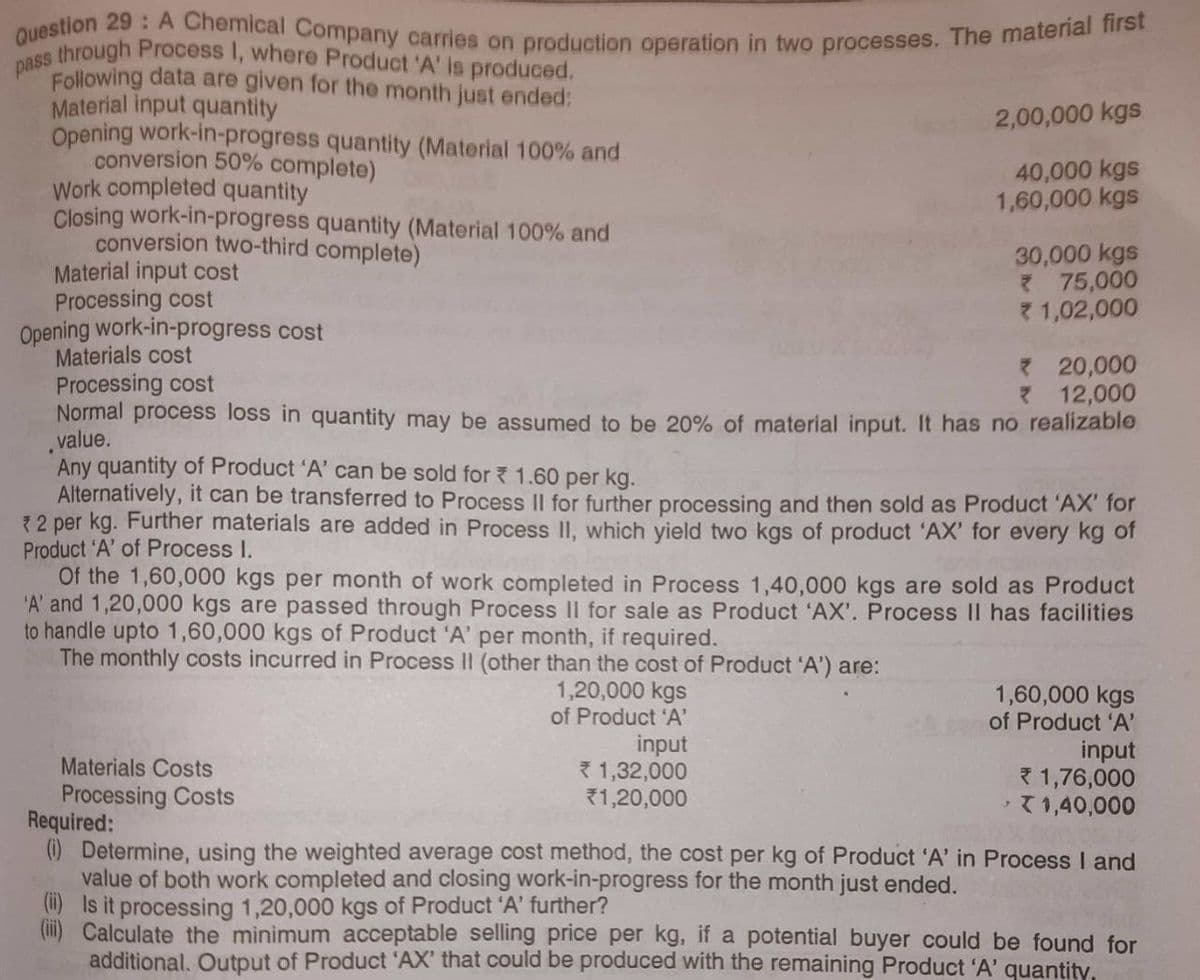

pass through Process I, where Product 'A' is produced. Question 29: A Chemical Company carries on production operation in two processes. The material first Following data are given for the month just ended: Material input quantity Opening work-in-progress quantity (Material 100% and conversion 50% complete) Work completed quantity Closing work-in-progress quantity (Material 100% and conversion two-third complete) Material input cost Processing cost Opening work-in-progress cost Materials cost 2,00,000 kgs 40,000 kgs 1,60,000 kgs 30,000 kgs * 75,000 1,02,000 Processing cost Normal process loss in quantity may be assumed to be 20% of material input. It has no realizable value. Materials Costs Processing Costs * 20,000 * 12,000 Any quantity of Product 'A' can be sold for 1.60 per kg. Alternatively, it can be transferred to Process II for further processing and then sold as Product 'AX' for * 2 per kg. Further materials are added in Process II, which yield two kgs of product 'AX' for every kg of Product 'A' of Process I. 1,20,000 kgs of Product 'A' input 1,32,000 *1,20,000 Of the 1,60,000 kgs per month of work completed in Process 1,40,000 kgs are sold as Product 'A' and 1,20,000 kgs are passed through Process II for sale as Product 'AX'. Process II has facilities to handle upto 1,60,000 kgs of Product 'A' per month, if required. The monthly costs incurred in Process II (other than the cost of Product 'A') are: 1,60,000 kgs of Product 'A' input *1,76,000 X 1,40,000 Required: (i) Determine, using the weighted average cost method, the cost per kg of Product 'A' in Process I and value of both work completed and closing work-in-progress for the month just ended. (ii) Is it processing 1,20,000 kgs of Product 'A' further? (ii) Calculate the minimum acceptable selling price per kg, if a potential buyer could be found for additional. Output of Product 'AX' that could be produced with the remaining Product 'A' quantity.

pass through Process I, where Product 'A' is produced. Question 29: A Chemical Company carries on production operation in two processes. The material first Following data are given for the month just ended: Material input quantity Opening work-in-progress quantity (Material 100% and conversion 50% complete) Work completed quantity Closing work-in-progress quantity (Material 100% and conversion two-third complete) Material input cost Processing cost Opening work-in-progress cost Materials cost 2,00,000 kgs 40,000 kgs 1,60,000 kgs 30,000 kgs * 75,000 1,02,000 Processing cost Normal process loss in quantity may be assumed to be 20% of material input. It has no realizable value. Materials Costs Processing Costs * 20,000 * 12,000 Any quantity of Product 'A' can be sold for 1.60 per kg. Alternatively, it can be transferred to Process II for further processing and then sold as Product 'AX' for * 2 per kg. Further materials are added in Process II, which yield two kgs of product 'AX' for every kg of Product 'A' of Process I. 1,20,000 kgs of Product 'A' input 1,32,000 *1,20,000 Of the 1,60,000 kgs per month of work completed in Process 1,40,000 kgs are sold as Product 'A' and 1,20,000 kgs are passed through Process II for sale as Product 'AX'. Process II has facilities to handle upto 1,60,000 kgs of Product 'A' per month, if required. The monthly costs incurred in Process II (other than the cost of Product 'A') are: 1,60,000 kgs of Product 'A' input *1,76,000 X 1,40,000 Required: (i) Determine, using the weighted average cost method, the cost per kg of Product 'A' in Process I and value of both work completed and closing work-in-progress for the month just ended. (ii) Is it processing 1,20,000 kgs of Product 'A' further? (ii) Calculate the minimum acceptable selling price per kg, if a potential buyer could be found for additional. Output of Product 'AX' that could be produced with the remaining Product 'A' quantity.

Cornerstones of Cost Management (Cornerstones Series)

4th Edition

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Don R. Hansen, Maryanne M. Mowen

Chapter6: Process Costing

Section: Chapter Questions

Problem 20E: Holmes Products, Inc., produces plastic cases used for video cameras. The product passes through...

Related questions

Question

100%

Transcribed Image Text:pass through Process I, where Product 'A' is produced,

Question 29: A Chemical Company carries on production operation in two processes. The material first

Following data are given for the month just ended:

Material input quantity

Opening work-in-progress quantity (Material 100% and

conversion 50% complete)

Work completed quantity

Closing work-in-progress quantity (Material 100% and

conversion two-third complete)

Material input cost

2,00,000 kgs

40,000 kgs

1,60,000 kgs

Processing cost

Opening work-in-progress cost

Materials cost

Processing cost

Normal process loss in quantity may be assumed to be 20% of material input. It has no realizable

value.

30,000 kgs

* 75,000

1,02,000

Materials Costs

Processing Costs

Any quantity of Product 'A' can be sold for 1.60 per kg.

Alternatively, it can be transferred to Process II for further processing and then sold as Product 'AX' for

* 2 per kg. Further materials are added in Process II, which yield two kgs of product 'AX' for every kg of

Product 'A' of Process I.

1,20,000 kgs

of Product 'A'

input

*1,32,000

*1,20,000

* 20,000

* 12,000

Of the 1,60,000 kgs per month of work completed in Process 1,40,000 kgs are sold as Product

'A' and 1,20,000 kgs are passed through Process II for sale as Product 'AX'. Process II has facilities

to handle upto 1,60,000 kgs of Product 'A' per month, if required.

The monthly costs incurred in Process II (other than the cost of Product 'A') are:

1,60,000 kgs

of Product 'A'

input

1,76,000

X 1,40,000

Required:

(i) Determine, using the weighted average cost method, the cost per kg of Product 'A' in Process I and

value of both work completed and closing work-in-progress for the month just ended.

(i) Is it processing 1,20,000 kgs of Product 'A' further?

Calculate the minimum acceptable selling price per kg, if a potential buyer could be found for

additional. Output of Product 'AX' that could be produced with the remaining Product 'A' quantity,

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 2 images

Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning