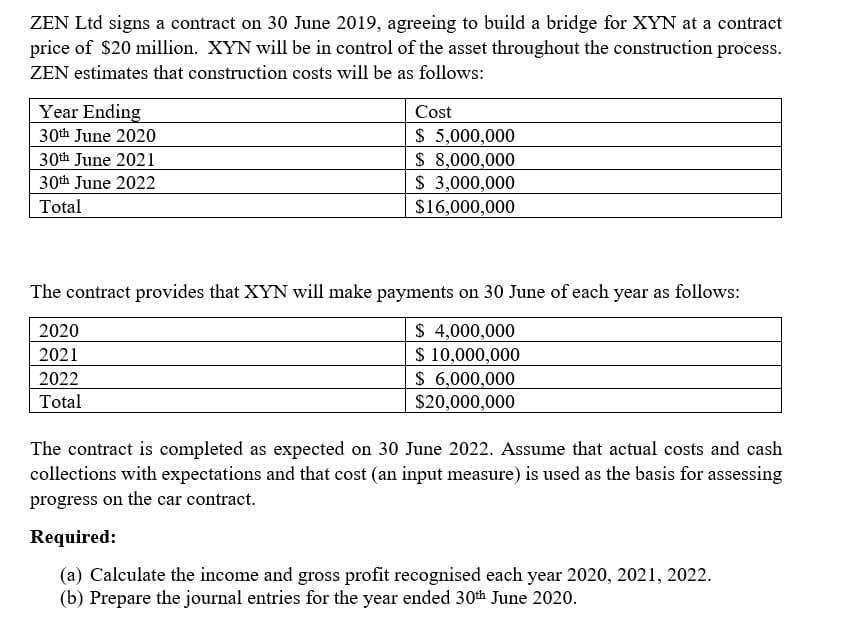

ZEN Ltd signs a contract on 30 June 2019, agreeing to build a bridge for XYN at a contract price of $20 million. XYN will be in control of the asset throughout the construction process. ZEN estimates that construction costs will be as follows: Year Ending 30th June 2020 30th June 2021 Cost $ 5,000,000 $ 8,000,000 $ 3,000,000 $16,000,000 30th June 2022 Total The contract provides that XYN will make payments on 30 June of each year as follows: $ 4,000,000 S 10,000,000 $ 6,000,000 $20,000,000 2020 2021 2022 Total The contract is completed as expected on 30 June 2022. Assume that actual costs and cash collections with expectations and that cost (an input measure) is used as the basis for assessing progress on the car contract. Required: (a) Calculate the income and gross profit recognised each year 2020, 2021, 2022. (b) Prepare the journal entries for the year ended 30th June 2020.

ZEN Ltd signs a contract on 30 June 2019, agreeing to build a bridge for XYN at a contract price of $20 million. XYN will be in control of the asset throughout the construction process. ZEN estimates that construction costs will be as follows: Year Ending 30th June 2020 30th June 2021 Cost $ 5,000,000 $ 8,000,000 $ 3,000,000 $16,000,000 30th June 2022 Total The contract provides that XYN will make payments on 30 June of each year as follows: $ 4,000,000 S 10,000,000 $ 6,000,000 $20,000,000 2020 2021 2022 Total The contract is completed as expected on 30 June 2022. Assume that actual costs and cash collections with expectations and that cost (an input measure) is used as the basis for assessing progress on the car contract. Required: (a) Calculate the income and gross profit recognised each year 2020, 2021, 2022. (b) Prepare the journal entries for the year ended 30th June 2020.

Chapter3: Income Sources

Section: Chapter Questions

Problem 88P

Related questions

Question

Transcribed Image Text:ZEN Ltd signs a contract on 30 June 2019, agreeing to build a bridge for XYN at a contract

price of $20 million. XYN will be in control of the asset throughout the construction process.

ZEN estimates that construction costs will be as follows:

Year Ending

30th June 2020

Cost

$ 5,000,000

$ 8,000,000

$ 3,000,000

$16,000,000

30th June 2021

30th June 2022

Total

The contract provides that XYN will make payments on 30 June of each year as follows:

$ 4,000,000

$ 10,000,000

$ 6,000,000

$20,000,000

2020

2021

2022

Total

The contract is completed as expected on 30 June 2022. Assume that actual costs and cash

collections with expectations and that cost (an input measure) is used as the basis for assessing

progress on the car contract.

Required:

(a) Calculate the income and gross profit recognised each year 2020, 2021, 2022.

(b) Prepare the journal entries for the year ended 30th June 2020.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT