Zeus Investments Inc. is a regional freight company that began operations on January 1, 20Y8. The following transactions relate to trading securities acquired by Zeus Inc., which has a fiscal year ending on December 31: 20Y8 Feb. 14. Purchased 3,400 shares of Apollo Inc. common stock at $44 per share plus a brokerage commission of $680. Apollo Inc. has 180,280 shares of common stock outstanding. Apr. 1. Purchased securities of Ares Inc. as a trading investment for $29,120. June 1. Sold 800 shares of Apollo Inc. for $45 per share less a $100 brokerage commission. June 27. Received an annual dividend of $0.14 per share on 2,600 shares of Apollo Inc. stock. Oct. 15. Sold the remaining shares of Apollo Inc. for $43 per share less a $28 brokerage commission. Dec. 31. The trading securities of Ares Inc. have a fair value on December 31 of $33,120. 20Y9 Mar. 14. Purchased securities of Athena Inc. as a trading investment for $76,725. July 30. Sold securities of Athena Inc. that cost $15,345 for $13,410. Dec. 31. The fair values of the Ares Inc. and Athena Inc. securities are as follows: Issuing Company Cost Fair Value Ares Inc. $29,120 $30,400 Athena Inc. 114,920 124,800

Zeus Investments Inc. is a regional freight company that began operations on January 1, 20Y8. The following transactions relate to trading securities acquired by Zeus Inc., which has a fiscal year ending on December 31: 20Y8 Feb. 14. Purchased 3,400 shares of Apollo Inc. common stock at $44 per share plus a brokerage commission of $680. Apollo Inc. has 180,280 shares of common stock outstanding. Apr. 1. Purchased securities of Ares Inc. as a trading investment for $29,120. June 1. Sold 800 shares of Apollo Inc. for $45 per share less a $100 brokerage commission. June 27. Received an annual dividend of $0.14 per share on 2,600 shares of Apollo Inc. stock. Oct. 15. Sold the remaining shares of Apollo Inc. for $43 per share less a $28 brokerage commission. Dec. 31. The trading securities of Ares Inc. have a fair value on December 31 of $33,120. 20Y9 Mar. 14. Purchased securities of Athena Inc. as a trading investment for $76,725. July 30. Sold securities of Athena Inc. that cost $15,345 for $13,410. Dec. 31. The fair values of the Ares Inc. and Athena Inc. securities are as follows: Issuing Company Cost Fair Value Ares Inc. $29,120 $30,400 Athena Inc. 114,920 124,800

College Accounting, Chapters 1-27

23rd Edition

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:HEINTZ, James A.

Chapter16: Accounting For Accounts Receivable

Section: Chapter Questions

Problem 8SPB: UNCOLLECTIBLE ACCOUNTSALLOWANCE METHOD Lewis Warehouse used the allowance method to record the...

Related questions

Question

Zeus Investments Inc. is a regional freight company that began operations on January 1, 20Y8. The following transactions relate to trading securities acquired by Zeus Inc., which has a fiscal year ending on December 31:

| 20Y8 | ||

| Feb. | 14. | Purchased 3,400 shares of Apollo Inc. common stock at $44 per share plus a brokerage commission of $680. Apollo Inc. has 180,280 shares of common stock outstanding. |

| Apr. | 1. | Purchased securities of Ares Inc. as a trading investment for $29,120. |

| June | 1. | Sold 800 shares of Apollo Inc. for $45 per share less a $100 brokerage commission. |

| June | 27. | Received an annual dividend of $0.14 per share on 2,600 shares of Apollo Inc. stock. |

| Oct. | 15. | Sold the remaining shares of Apollo Inc. for $43 per share less a $28 brokerage commission. |

| Dec. | 31. | The trading securities of Ares Inc. have a fair value on December 31 of $33,120. |

| 20Y9 | ||

| Mar. | 14. | Purchased securities of Athena Inc. as a trading investment for $76,725. |

| July | 30. | Sold securities of Athena Inc. that cost $15,345 for $13,410. |

| Dec. | 31. | The fair values of the Ares Inc. and Athena Inc. securities are as follows: |

| Issuing Company | Cost | Fair Value |

| Ares Inc. | $29,120 | $30,400 |

| Athena Inc. | 114,920 | 124,800 |

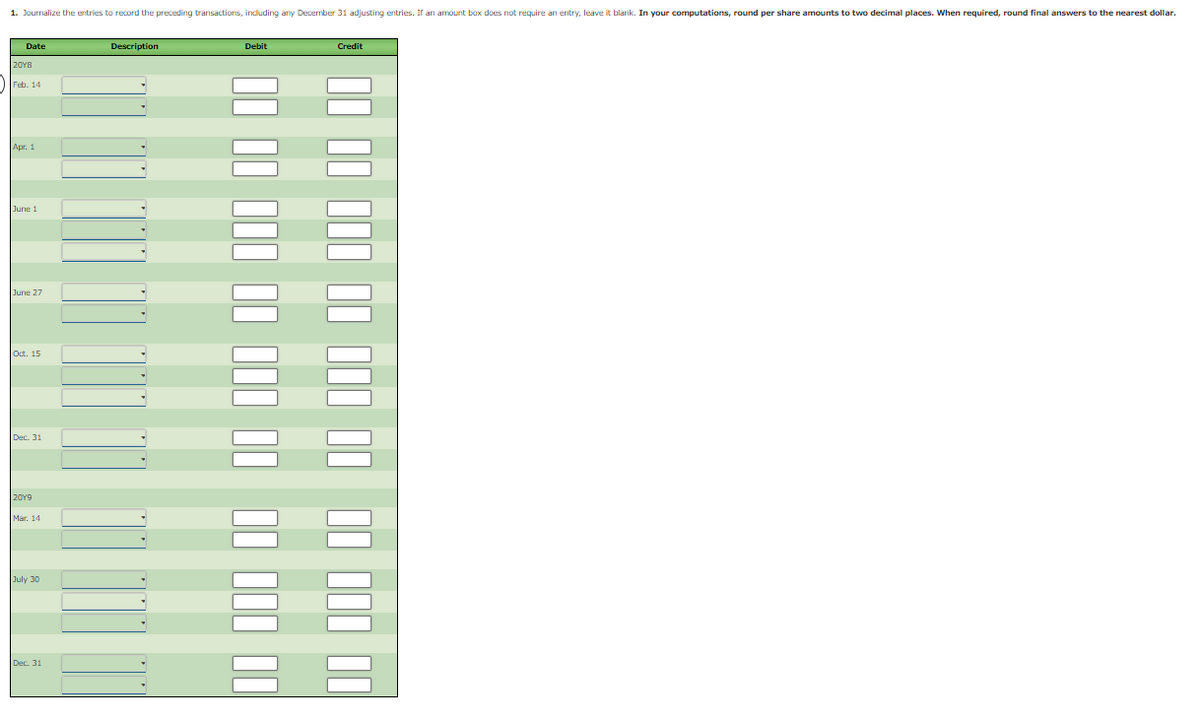

Transcribed Image Text:1. Journalize the entries to record the preceding transactions, indluding any December 31 adjusting entries. If an amount box does not require an entry, leave it blank. In your computations, round per share amounts to two decimal places. When required, round final answers to the nearest dollar.

Date

Description

Debit

Credit

20YB

Feb. 14

Apr. 1

June 1

June 27

Oct. 15

Dec. 31

|20Y9

Mar. 14

July 30

Dec. 31

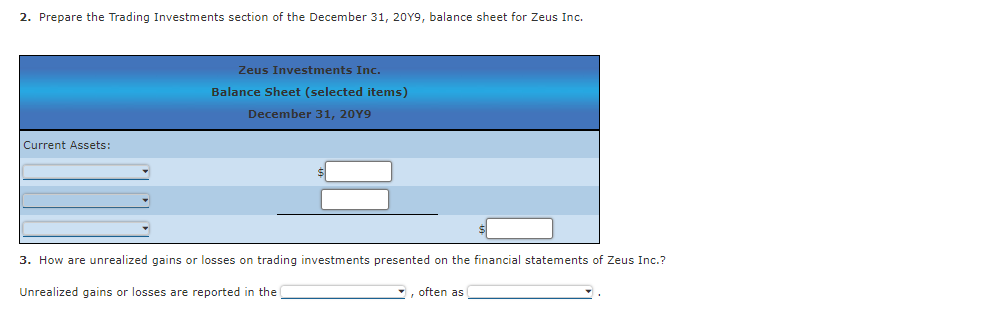

Transcribed Image Text:2. Prepare the Trading Investments section of the December 31, 20Y9, balance sheet for Zeus Inc.

Zeus Investments Inc.

Balance Sheet (selected items)

December 31, 20Y9

Current Assets:

3. How are unrealized gains or losses on trading investments presented on the financial statements of Zeus Inc.?

Unrealized gains or losses are reported in the

often as

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps

Recommended textbooks for you

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage