Lakecraft Company Balance Sheet December 31, 2015 Assets Liabilities and Equity $ 60,000 $100,000 200,000 Current assets Current liabilities . . Equipment (net) Building (net) Stockholders' equity: Common stock ($5 par) . Retained earnings. 270,000 $100,000 410,000 510,000 Total assets.. $570,000 Total liabilities and equity $570,000

Lakecraft Company Balance Sheet December 31, 2015 Assets Liabilities and Equity $ 60,000 $100,000 200,000 Current assets Current liabilities . . Equipment (net) Building (net) Stockholders' equity: Common stock ($5 par) . Retained earnings. 270,000 $100,000 410,000 510,000 Total assets.. $570,000 Total liabilities and equity $570,000

Financial Accounting: The Impact on Decision Makers

10th Edition

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Gary A. Porter, Curtis L. Norton

Chapter13: Financial Statement Analysis

Section: Chapter Questions

Problem 13.1E

Related questions

Question

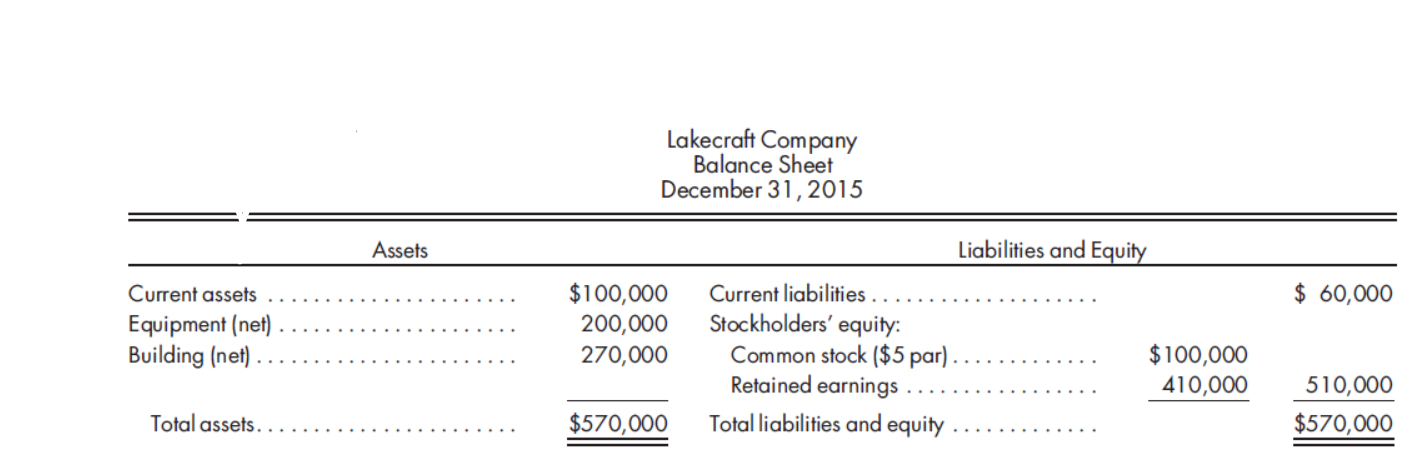

Lakecraft Company has the following balance sheet on December 31, 2015, when it is acquired for $950,000 in cash by Argo Corporation:

All assets have fair values equal to their book values. The combination is structured as a taxfree exchange. Lakecraft Company has a tax loss carryforward of $300,000, which it has not recorded. The balance of the $300,000 tax loss carryover is considered fully realizable. Argo is taxed at a rate of 30%.

Record the acquisition of Lakecraft Company by Argo Corporation.

Transcribed Image Text:Lakecraft Company

Balance Sheet

December 31, 2015

Assets

Liabilities and Equity

$ 60,000

$100,000

200,000

Current assets

Current liabilities . .

Equipment (net)

Building (net)

Stockholders' equity:

Common stock ($5 par) .

Retained earnings.

270,000

$100,000

410,000

510,000

Total assets..

$570,000

Total liabilities and equity

$570,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781285866307

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Fundamentals of Financial Management, Concise Edi…

Finance

ISBN:

9781305635937

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning