ntries into T accounts and Trial Balance Ken Jones, an architect, organized Jones Architects on April 1, 20Y2. During the month, Jones Architects completed the following transactions: Transferred cash from a personal bank account to an account to be used for the business in exchange for Common Stock, $42,200. Purchased used automobile for $27,000, paying $6,300 cash and giving a note payable for the remainder. Paid April rent for office and workroom, $4,200. Paid cash for supplies, $2,030. Purchased office and computer equipment on account, $8,400. Paid cash for annual insurance policies on automobile and equipment, $2,800. Received cash from a client for plans delivered, $10,600. Paid cash to creditors on account, $2,450. Paid cash for miscellaneous expenses, $375. Received invoice for blueprint service, due in May, $1,400. Recorded fees earned on plans delivered, payment to be received in May, $7,300. Paid salary of assistant, $2,200. Paid cash for miscellaneous expenses, $1,140. Paid installment due on note payable, $340. Paid gas, oil, and repairs on automobile for April, $550. Required: 1. Record the above transactions (in chronological order) directly in the following T accounts, without journalizing: Cash, Accounts Receivable, Supplies, Prepaid Insurance, Automobiles, Equipment, Notes Payable, Accounts Payable, Common Stock, Professional Fees, Rent Expense, Salary Expense, Blueprint Expense, Automobile Expense, Miscellaneous Expense. To the left of each amount entered in the accounts, select the appropriate letter to identify the transaction. 2. Determine account balances of the T accounts. Accounts containing a single entry only (such as Prepaid Insurance) do not need a balance.

Entries into T accounts and

Ken Jones, an architect, organized Jones Architects on April 1, 20Y2. During the month, Jones Architects completed the following transactions:

- Transferred cash from a personal bank account to an account to be used for the business in exchange for Common Stock, $42,200.

- Purchased used automobile for $27,000, paying $6,300 cash and giving a note payable for the remainder.

- Paid April rent for office and workroom, $4,200.

- Paid cash for supplies, $2,030.

- Purchased office and computer equipment on account, $8,400.

- Paid cash for annual insurance policies on automobile and equipment, $2,800.

- Received cash from a client for plans delivered, $10,600.

- Paid cash to creditors on account, $2,450.

- Paid cash for miscellaneous expenses, $375.

- Received invoice for blueprint service, due in May, $1,400.

- Recorded fees earned on plans delivered, payment to be received in May, $7,300.

- Paid salary of assistant, $2,200.

- Paid cash for miscellaneous expenses, $1,140.

- Paid installment due on note payable, $340.

- Paid gas, oil, and repairs on automobile for April, $550.

Required:

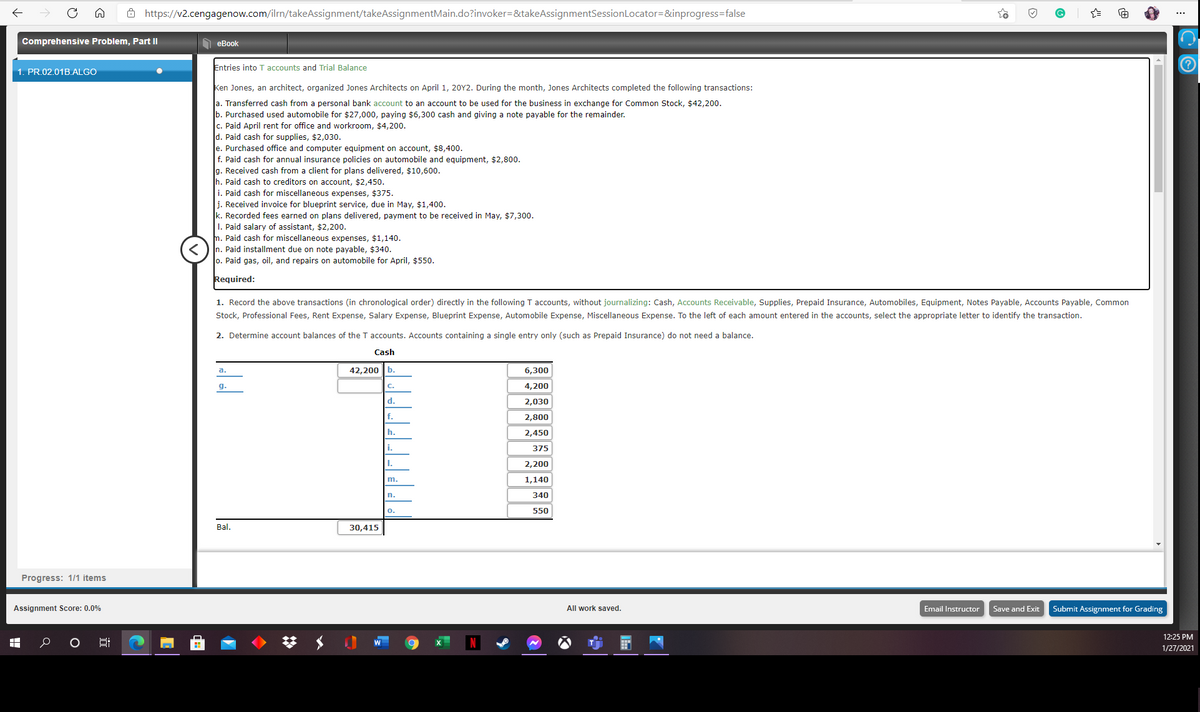

1. Record the above transactions (in chronological order) directly in the following T accounts, without journalizing: Cash, Accounts Receivable, Supplies, Prepaid Insurance, Automobiles, Equipment, Notes Payable, Accounts Payable, Common Stock, Professional Fees, Rent Expense, Salary Expense, Blueprint Expense, Automobile Expense, Miscellaneous Expense. To the left of each amount entered in the accounts, select the appropriate letter to identify the transaction.

2. Determine account balances of the T accounts. Accounts containing a single entry only (such as Prepaid Insurance) do not need a balance.

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 5 images