FICA Taxes Biweekly Taxable Wages Employee No. Employee Name OASDI HI 711 Castro, Manny Corrales, Pat Guitar, Joseph Moore, Connie Morrison, Harry Robertson, Catherine Swarez, Joseph $1,000.00 968.00 512 1,004.00 1,046.40 1,200.00 1,044.80 1,122.00 Totals 624 325 422 210 111 Employer's OASDI Total Taxable Wages Employer's OASDI Tax Employer's HI Tax Total Taxable Wages Employer's HI Tax

FICA Taxes Biweekly Taxable Wages Employee No. Employee Name OASDI HI 711 Castro, Manny Corrales, Pat Guitar, Joseph Moore, Connie Morrison, Harry Robertson, Catherine Swarez, Joseph $1,000.00 968.00 512 1,004.00 1,046.40 1,200.00 1,044.80 1,122.00 Totals 624 325 422 210 111 Employer's OASDI Total Taxable Wages Employer's OASDI Tax Employer's HI Tax Total Taxable Wages Employer's HI Tax

Chapter18: Accounting Periods And Methods

Section: Chapter Questions

Problem 9DQ: LO.2 Osprey Corporation, an accrual basis taxpayer, had taxable income for 2019 and paid 40,000 on...

Related questions

Question

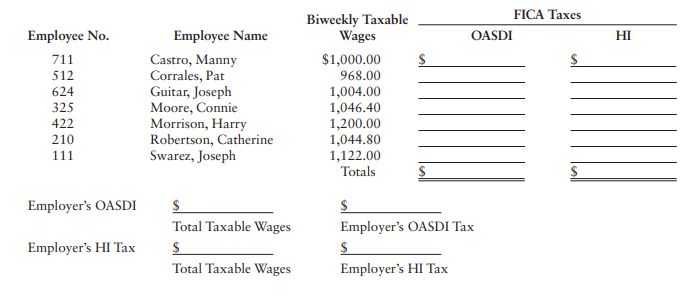

The biweekly taxable wages for the employees of Rite-Shop follow. Compute the FICA taxes for each employee and the employer’s FICA taxes.

Transcribed Image Text:FICA Taxes

Biweekly Taxable

Wages

Employee No.

Employee Name

OASDI

HI

711

Castro, Manny

Corrales, Pat

Guitar, Joseph

Moore, Connie

Morrison, Harry

Robertson, Catherine

Swarez, Joseph

$1,000.00

968.00

512

1,004.00

1,046.40

1,200.00

1,044.80

1,122.00

Totals

624

325

422

210

111

Employer's OASDI

Total Taxable Wages

Employer's OASDI Tax

Employer's HI Tax

Total Taxable Wages

Employer's HI Tax

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning