UTA tax = $ employer in Durham, North Carolina, employs three individuals, whose taxable ea uring the current pay period, these employees earn $980, $1,600, and $1,150, re reshold is $26,000. UTA tax = $ UTA tax = $

UTA tax = $ employer in Durham, North Carolina, employs three individuals, whose taxable ea uring the current pay period, these employees earn $980, $1,600, and $1,150, re reshold is $26,000. UTA tax = $ UTA tax = $

Century 21 Accounting General Journal

11th Edition

ISBN:9781337680059

Author:Gilbertson

Publisher:Gilbertson

Chapter13: Accounting For Payroll And Payroll Taxes

Section13.3: Reporting Withholding And Payroll Taxes

Problem 1WT

Related questions

Question

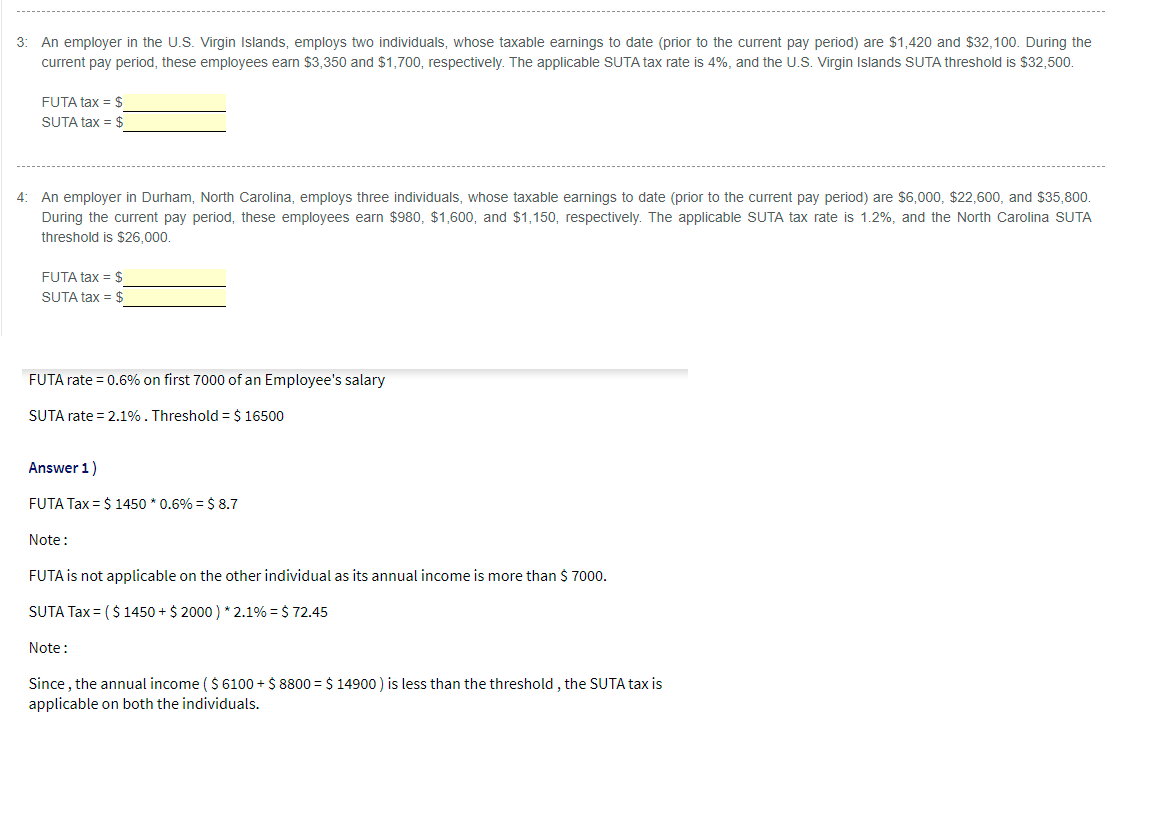

Transcribed Image Text:3: An employer in the U.S. Virgin Islands, employs two individuals, whose taxable earnings to date (prior to the current pay period) are $1,420 and $32,100. During the

current pay period, these employees earn $3,350 and $1,700, respectively. The applicable SUTA tax rate is 4%, and the U.S. Virgin Islands SUTA threshold is $32,500.

FUTA tax = $

SUTA tax = $

4: An employer in Durham, North Carolina, employs three individuals, whose taxable earnings to date (prior to the current pay period) are $6,000, $22,600, and $35,800.

During the current pay period, these employees earn $980, $1,600, and $1,150, respectively. The applicable SUTA tax rate is 1.2%, and the North Carolina SUTA

threshold is $26.000,

FUTA tax = $

SUTA tax = $

FUTA rate = 0.6% on first 7000 of an Employee's salary

SUTA rate = 2.1%. Threshold = $ 16500

Answer 1)

FUTA Tax = $ 1450 * 0.6% = $ 8.7

Note:

FUTA is not applicable on the other individual as its annual income is more than $ 7000.

SUTA Tax = ( $ 1450 + $ 2000 ) * 2.1% = $ 72.45

Note:

Since , the annual income ($ 6100 + $ 8800 = $ 14900 ) is less than the threshold , the SUTA tax is

applicable on both the individuals.

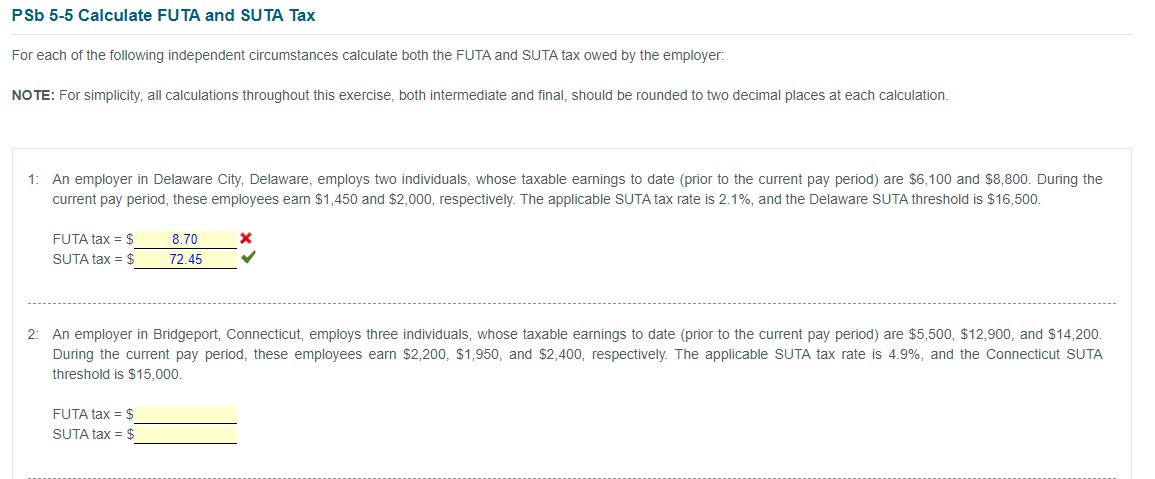

Transcribed Image Text:PSb 5-5 Calculate FUTA and SUTA Tax

For each of the following independent circumstances calculate both the FUTA and SUTA tax owed by the employer:

NOTE: For simplicity, all calculations throughout this exercise, both intermediate and final, should be rounded to two decimal places at each calculation.

1: An employer in Delaware City, Delaware, employs two individuals, whose taxable earnings to date (prior to the current pay period) are $6,100 and $8,800. During the

current pay period, these employees earn $1,450 and $2,000, respectively. The applicable SUTA tax rate is 2.1%, and the Delaware SUTA threshold is $16,500.

FUTA tax = $

8.70

SUTA tax = $

72.45

2: An employer in Bridgeport, Connecticut, employs three individuals, whose taxable earnings to date (prior to the current pay period) are $5,500, $12,900, and $14,200.

During the current pay period, these employees earn $2,200, $1,950, and $2,400, respectively. The applicable SUTA tax rate is 4.9%, and the Connecticut SUTA

threshold is $15,000.

FUTA tax = $

SUTA tax = $

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Accounting (Text Only)

Accounting

ISBN:

9781285743615

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Accounting (Text Only)

Accounting

ISBN:

9781285743615

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT