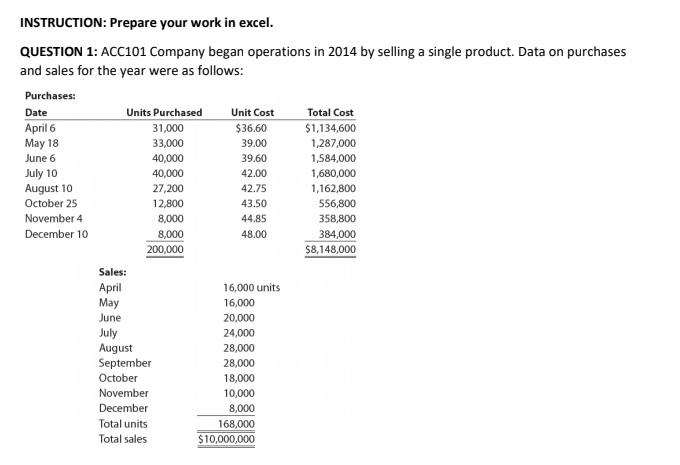

On January 4, 2015, the president of the company, Connie Kilmer, asked for your advice on costing the 32,000-unit physical inventory that was taken on December 31, 2014. Moreover, since the firm plans to expand its product line, she asked for your advice on the use of a perpetual inventory system in the future. 1. Determine the cost of December 31, 2014, inventory under the periodic system, using the (a) first-in, first-out method, (b) last-in, first-out method, and (c) weighted average cost method. 2. Determine the gross profit for the year under each of the three methods in (1). 3. a. Explain varying viewpoints why each of the three inventory costing methods may best reflect the results of operations for 2014. b. Which of the three inventory costing methods may best reflect the replacement cost of the inventory on the balance sheet as of December 31, 2014? c. Which inventory costing method would you choose to use for income tax purposes? Why?

On January 4, 2015, the president of the company, Connie Kilmer, asked for your advice on costing the

32,000-unit physical inventory that was taken on December 31, 2014.

Moreover, since the firm plans to expand its product line, she asked for your advice on the use of a perpetual inventory system in the future.

1. Determine the cost of December 31, 2014, inventory under the periodic system, using the (a) first-in, first-out method, (b) last-in, first-out method, and (c) weighted average cost method.

2. Determine the gross profit for the year under each of the three methods in (1).

3. a. Explain varying viewpoints why each of the three inventory costing methods may best reflect the results of operations for 2014.

b. Which of the three inventory costing methods may best reflect the replacement cost of the inventory on the balance sheet as of December 31, 2014?

c. Which inventory costing method would you choose to use for income tax purposes? Why?

Trending now

This is a popular solution!

Step by step

Solved in 5 steps with 5 images