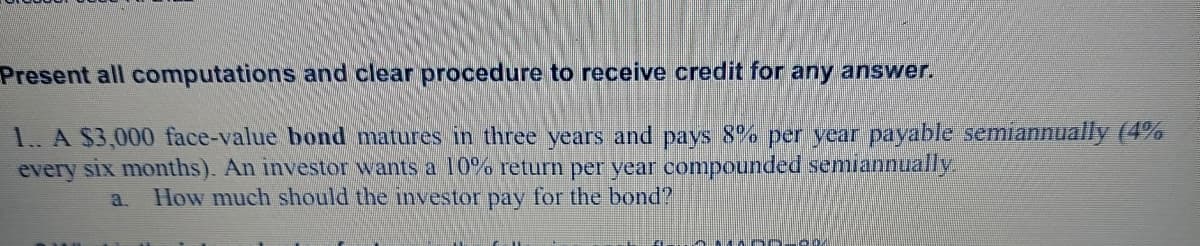

. A $3,000 face-value bond matures in three years and pays 8% per year payable semiannually (4% very six months). An investor wants a 10% return per year compounded semiannually. a. How much should the investor pay for the bond?

Q: QUESTION FOUR Which of the following is NOT a principle of Islamic banking? A ) Prohibit...

A: The answer is - (D) Credit risk transfer

Q: 9. The big Social Security indexing debate Social Security is a old-age insurance program. Most peop...

A: The CPI is the consumer price index. It measures the weighted average price of a basket of consumer ...

Q: The production and prices in a country in two subsequent years are described by the following table ...

A: The formula for real GDP : Real GDP = Price of goods in base year * Quantity of goods in current yea...

Q: If Php 10,000 is deposited each year for 9 years, how much annuity can a person get annually from th...

A: Cost of money is the amount of interest rate paid for borrowing funds.

Q: Why is the presentaion of corparate results increasingly accompanied by the presentation of a social...

A: As we know that production is needed for completion of our daily life demand or for money . But thes...

Q: Question 1 A firm has an opportunity to invest $100,000 in a project that will result revenue of $30...

A: Given: Investment=$100000 Revenue=$30000 Maintenance=$8000 Salvage value=$32000 Number of years=7 No...

Q: Consider the following cost function: C = 0.3q3 - 6q2 + 90q + 100. When output is 18 units, average ...

A: Here we calculate the average cost and marginal cost by using the given cost function and fill the b...

Q: 1. Use Exhibit 1. Which of the following statements is (are) correct? (x) Using the midpoint method,...

A: Income elasticity of demand measures the change in Qd(quantity demanded) of a product in corresponde...

Q: Assume that the two universities in USA (UA and UAA) are competing with one another to attract top s...

A: A payoff matrix represents the startegic decision of players which shows their payoff in the case of...

Q: The table below shows some data I got from FRED on the CPI and PCE deflator. The PCE deflator is a p...

A: Inflation rate is calculated as a percentage change in PCE deflator or CPI. CPI calculated the over...

Q: Using the information provided in the table below, answer the following questions. Country A Count...

A: A country has an absolute advantage in producing the good which it can produce more than the other c...

Q: 61. The average total cost pf producing 50 units is Rs.250 and total fixed cost is Rs.1000. What is ...

A: Given: The average total cost of producing 50 units is = Rs250 The total fixed cost is = Rs1,000 To ...

Q: Consider the demand function for processed pork in Canada, Q = 796.00 - 37p • 20p, + 3p. + 0.002Y Th...

A: Here we calculate the equilibrium price of pork and equilibrium quantity of pork , by using the give...

Q: 30 15 30 90 120 TOURISM (Millions of visitors) According to the adjustment of the previous graph, if...

A:

Q: On the graph, label your starting AD line as AD 2019. Draw a new AD line showing the change to AD d...

A:

Q: Troy Long wishes to deposit a single sum of money into a savings account so that five equal annual. ...

A: here we calculate the amount expect by Troy by calculating the present value so the calculation of t...

Q: economic factors thst affect healthy eating

A: Qd(quantity demanded) of a product depends on various factors such as P(own price), Y(income), Ps(pr...

Q: Hamelink identifies three economic sectors of global communication: the infrastructure (satellites, ...

A: Below are the three identified sectors: 1. Infrastructure 2. Services 3. Content

Q: On this least-cost abatement curve, how much (GECO2) could we abate if we spent €8.37 billion?

A: Since you have posted multiple questions, as per guidelines we can solve only 1st question.

Q: Consumer's surplus left with the consumer under price discrimination is

A: Consumer's surplus left with the consumer under which price discrimination

Q: Show that absolute PPP is satisfied when the domestic price of the consumption basket in foreign ...

A: ANSWER The outright computation is determined by separating the worth of a fair in one cash, by th...

Q: Below is a chart showing the Labor Force Participation rate for 15-64 year olds in the U.S. vs. Japa...

A: Real GDP is the product of base year price and current year output level during an year. It is the...

Q: Most U.S. states impose gasoline taxes as a way to collect revenue. Assume that there are no market ...

A: Note: “Since you have asked multiple questions, we will solve the first question for you. If you wan...

Q: 4 players (Alex, Boris, Cato, David) are on the reality show. The prize is 4 gold coins. Each coin c...

A: Given information 4 players Alex, Boris, Cate, David there are 4 coins to share among 4 players shar...

Q: Which of the following examples shows the most elastic demand?

A: Price elasticity of demand: Price elasticity of demand shows the effect on demand with the change in...

Q: Part (a) In Japan, from the 1990s to the late 2000s, the interest rates fell to very low levels. How...

A: Answer A) In Japan, the country's interest rate is fell very low from 1990 to the 2000s and failed t...

Q: what are two issues with the Law associated Dodd-Frank

A: Dodd-Frank Law: A summary of government guidelines, essentially influencing monetary organizations a...

Q: 4. Suppose co = 0 and c1 = 70, 000. Is insurance at coverage level z > 0 fair insurance? What covera...

A: 4. For any z>0, the cost of insurance is C(z)=70000z The expected value of payout is given by P(...

Q: nflow year 1 12000 nflow year 2 12000 nflow year 3 12000 nflow year 4 12000 And the required rate of...

A: The net present value or net present worth applies to a series of cash flows occurring at different ...

Q: Explain the three main types of unemployment and outline the policies that can be used to reduce eac...

A: Unemployment is a situation in which a person who is willing and able (capable) to work do not find ...

Q: . A consumer has ·100 hours of time to allocate to either labor or leisure ·A real wage w=50 ·Divid...

A: Hi! Thank you for the question as per the honour code, we’ll answer the first question since the exa...

Q: Situation : Compute the interest for an amount of P 400,000 for a period of 7 years. 9. If it was ma...

A: Interest is the amount paid in excess of the principal amount by the borrower to the lender. Interes...

Q: QUESTION 7 If foreign immigration (only) increases the number of workers in the US by 10%, GDP per w...

A: Given: Foreign Immigration increases the number of workers in US by 10%.

Q: conomist estima Cost function of a single-product firm C(Q) = 100 + 20Q + 15Q2 + 10Q³ Based on this ...

A: Variable costs are any expenses that change based on how much a company produces and sells. This mea...

Q: Is brain drain, good or bad thing? Expl

A: The human resource of a country plays a very important role in the economy. It is the human resource...

Q: Below are some employment data from the country Commagene. 2018 2019 2020 Number of Employed Number ...

A: Here we calculate the value of the followings terms by using the given information and using relevan...

Q: Assume that the labour demand equation for a fictional country is La= 90 - 2(w), where w is the wage...

A: Here we calculate the following terms by using the given information ,and fill the blanks so the cal...

Q: With which of the theories of wages, is the name of John Stuart Mill associated?

A: To find: With which of the theories of wages, is the name of John Stuart Mill associated?

Q: Compare the Marxist Theory and Psychology of Addiction with the Realistic Theory and psychology of A...

A: ▪︎Theory of Marxism.This was started by Karl Max. It is a socioeconomic, political, and economic the...

Q: ood X as an input into its manufacturing process. It buys 8000 units of good X 1000 units of good Y,...

A: *Answer:

Q: Which of the following is NOT the assumption of the Marginal Productivity Theory of Distribution?

A: To find: Which of the following is NOT the assumption of the Marginal Productivity Theory of Distri...

Q: Ecological fallacy occurs when a researcher interprets the results of group-level data to the indivi...

A: Ecological Fallacy : The Ecological fallacy can be defined as the failure in reasoning when the inte...

Q: One winter recently, the price of a cruise increased by 10 percent and the quantity demanded decreas...

A: Cross price elasticity of demand measures the responsiveness of quantity demanded of good 1 with res...

Q: 1. Comparison of two (2) administration in the Philippines in terms of poverty and unemployment ( yo...

A: The Philippines is a presidential republic with an equal distribution of authority across its three ...

Q: study finds that the noise from lawn mowers is harmful; hence, the government imposes a $25 tax on t...

A: Hi! Thank you for the question, As per the honor code, we are allowed to answer three sub-parts at a...

Q: ur answer, should the firm continue or stop the production? Justify. Output (Units) Total Revenue ...

A: Average cost is the total cost divided by quantity of output. e,g. If the total cost is 48$ for 8 it...

Q: 6. Discuss the following statement: "Real GDP has decreased for two quarters in a row; we definitive...

A: The gross domestic product of an economy is generally calculated by using the expenditure approach o...

Q: pls solve this ques within 10-15 minutes in clear handwriting I'll give you multiple upvotes.

A: The Intemporal budget constraint can be defined as a choice of consumption over time with given inco...

Q: QUESTION 10 If prices grow by 2.9% every year, over 9 years, what is the total inflation rate? Write...

A:

Q: QUESTION 8 Leisure, I Consider the picture above, in which the consumer chooses to dedicate all of t...

A: Here, the given graph shows the relationship between consumption and leisure choices of a consumer.

Step by step

Solved in 2 steps

- Suppose you purchased a corporate bond with a 10-year maturity, a $1,000 par value, a 9% coupon rate ($45 interest payment every six months), and semiannual interest payments. Five years after the bonds were purchased, the going rate of interest on new bonds fell to 6% (or 6% compounded semiannually). What is the current market value (P) of the bond (five years after the purchase)?(a) P = $890(b) p = $1,223(c) P = $1,090(d) p = $1,128Consider a bond with a face value of $2,136 that pays a coupon of $100 for 10 years. Suppose the bond is purchased at $400, and can be resold next year for $450. What is the rate of return of the bond? a. 1.125% b. 1.375% c. 25% d. 37.5%suppose that you invest $100 today in a risk-free investment and let the 4 percent annual intrest rate compound. Rounded to the full dollars, what will be the value of your investment 4 years from now?

- The sole proprietor of the FM2 Financial Services, Bondo, receives allaccounting profits earned by her firm and a K28,000-a-year salary she pays herself. Itis noteworthy that she also has a standing salary offer of K35,000 a year if she agreesto work for Bank of Zambia. If she had invested her capital outside her own company,she estimates that would have made a return of K22,000 a year. Further, informationhas reached you that last year, Bondo’s accounting profit was K50,000. Calculate hereconomic profit?A corporate bond returns 12 percent of its cost (in present value terms) in the first year, 11 percent in the second year, 10 percent in the third year, and the remainder in the fourth year. What is the bond's duration in years? Please show all the steps including the equation.Which of the following investment options willmaximize your future wealth at the end of 18 years?Assume any funds that remain invested will earn anominal rate of 12% compounded monthly.(a) Deposit $8,000 now.(b) Deposit $120 at the end of each month for thefirst 12 years.(c) Deposit $105 at the end of each month for 18years.(d) Deposit a lump sum in the amount of $35,000 atthe end of year 12.

- A Php 1,500-bond which will mature in 10 years and with a bond rate of 15% payable annually is to be redeemed at par at the end of this period. If it is sold now for Php 1,390, determine the yield at this price. (Answer is in percentage.) Use continuous computations, round off your final answers to two (2) decimal places.Suppose that you, on 1st of January 2023, enter a long position in a 10-year forward contract on a non-dividend-paying stock. The stock price is $50 and the risk-free rate of interest is 5% per annum with yearly compounding (as per 1st of January 2023). a) What are the forward price and the initial value of the forward contract? Five years later, 1st of January 2028, the price of the stock is $60 and the risk-free interest is still 5%. b) On 1st of January 2028, what are the forward price and the value of the forward contract that you entered into on 1st of January 2023? Explain. c) Suppose that you on 1st of January 2028 enter a short position in a forward contract on the same underlying stock and with expiration date in 5 years. What is the value of your total position? (I.e. what is the total value of the long position in the forward contract in a) and your short position). What is the payoff of your total position at maturity? d) On 1st of January 2028, what is the value…▼ Cash Flow Present Discounted Value Interest Rate is based on the notion that a dollar paid in the future is less valuable than a dollar paid today. Part 2 The present value of a loan in which $3000 is to be paid out a year from today with the interest rate equal to 3% is $enter your response here. (Round your response to the neareast two decimal place) Part 3 If a loan is paid after two years, and the amount $3000 is to be paid then with a corresponding 1% interest rate, the present value of the loan is $enter your response here. (Round your response to the neareast two decimal place)

- Your sister has been offered a 5-year bond with a P1,000 par value and a 7 percent coupon rate. This bond's interest is paid semi-annually. If your sister is to earn a nominal rate of return of 9 percent, compounded semi-annually, how much should she pay for the bond?You plan to open a retirement account. Your employer will match 50% of your deposits up to a limit on the match of $2,500 per year. You believe the fund will earn 12% over the next 30 years, and you will make 30 deposits of $5,000, plus 50% employer matching, totaling $7,500 per year. a. How much money will be in the account immediately after the last deposit? b. How much total money will you put into the fund?Susie Lee won a lottery. She will have a choice of receiving $25,000 at the end of each year for the next 30 years, or a lump sum today. If she can earn an annual return of 10 percent on any investment she makes, what is the least she should be willing to accept today as a lump-sum payment? (Round to the nearest hundred dollars.) Use the NPV as you have equal cash flows of $25,000 for the next 30 years.