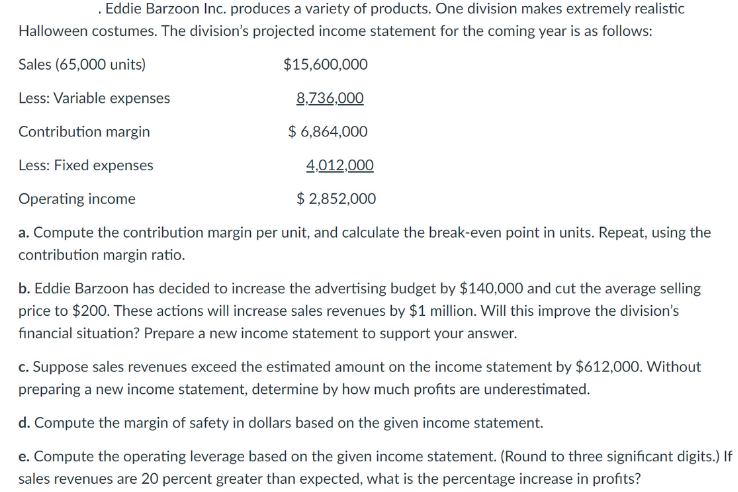

. Eddie Barzoon Inc. produces a variety of products. One division makes extremely realistic Halloween costumes. The division's projected income statement for the coming year is as follows: Sales (65,000 units) $15,600,000 Less: Variable expenses 8.736,000 Contribution margin $ 6,864,000 Less: Fixed expenses 4.012,000 Operating income $ 2,852,000 a. Compute the contribution margin per unit, and calculate the break-even point in units. Repeat, using the contribution margin ratio. b. Eddie Barzoon has decided to increase the advertising budget by $140,000 and cut the average selling price to $200. These actions will increase sales revenues by $1 million. Will this improve the division's financial situation? Prepare a new income statement to support your answer. c. Suppose sales revenues exceed the estimated amount on the income statement by $612,000. Without preparing a new income statement, determine by how much profits are underestimated. d. Compute the margin of safety in dollars based on the given income statement. e. Compute the operating leverage based on the given income statement. (Round to three significant digits.) If sales revenues are 20 percent greater than expected, what is the percentage increase in profits?

. Eddie Barzoon Inc. produces a variety of products. One division makes extremely realistic Halloween costumes. The division's projected income statement for the coming year is as follows: Sales (65,000 units) $15,600,000 Less: Variable expenses 8.736,000 Contribution margin $ 6,864,000 Less: Fixed expenses 4.012,000 Operating income $ 2,852,000 a. Compute the contribution margin per unit, and calculate the break-even point in units. Repeat, using the contribution margin ratio. b. Eddie Barzoon has decided to increase the advertising budget by $140,000 and cut the average selling price to $200. These actions will increase sales revenues by $1 million. Will this improve the division's financial situation? Prepare a new income statement to support your answer. c. Suppose sales revenues exceed the estimated amount on the income statement by $612,000. Without preparing a new income statement, determine by how much profits are underestimated. d. Compute the margin of safety in dollars based on the given income statement. e. Compute the operating leverage based on the given income statement. (Round to three significant digits.) If sales revenues are 20 percent greater than expected, what is the percentage increase in profits?

Cornerstones of Cost Management (Cornerstones Series)

4th Edition

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Don R. Hansen, Maryanne M. Mowen

Chapter16: Cost-volume-profit Analysis

Section: Chapter Questions

Problem 37P: Katayama Company produces a variety of products. One division makes neoprene wetsuits. The divisions...

Related questions

Question

Transcribed Image Text:. Eddie Barzoon Inc. produces a variety of products. One division makes extremely realistic

Halloween costumes. The division's projected income statement for the coming year is as follows:

Sales (65,000 units)

$15,600,000

Less: Variable expenses

8.736,000

Contribution margin

$ 6,864,000

Less: Fixed expenses

4.012,000

Operating income

$ 2,852,000

a. Compute the contribution margin per unit, and calculate the break-even point in units. Repeat, using the

contribution margin ratio.

b. Eddie Barzoon has decided to increase the advertising budget by $140,000 and cut the average selling

price to $200. These actions will increase sales revenues by $1 million. Will this improve the division's

financial situation? Prepare a new income statement to support your answer.

c. Suppose sales revenues exceed the estimated amount on the income statement by $612,000. Without

preparing a new income statement, determine by how much profits are underestimated.

d. Compute the margin of safety in dollars based on the given income statement.

e. Compute the operating leverage based on the given income statement. (Round to three significant digits.) If

sales revenues are 20 percent greater than expected, what is the percentage increase in profits?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning