00 in cash and $4,000 in loans payable. A minimum cas th when the preliminary cash balance is below $12,000 and is paid at each month-end. If a preliminary cash bal Expenses are paid in the month incurred and include s O per month), and rent ($5,000 per month).

00 in cash and $4,000 in loans payable. A minimum cas th when the preliminary cash balance is below $12,000 and is paid at each month-end. If a preliminary cash bal Expenses are paid in the month incurred and include s O per month), and rent ($5,000 per month).

Managerial Accounting: The Cornerstone of Business Decision-Making

7th Edition

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Chapter9: Profit Planning And Flexible Budgets

Section: Chapter Questions

Problem 72P: Cash Budget The controller of Feinberg Company is gathering data to prepare the cash budget for...

Related questions

Concept explainers

Question

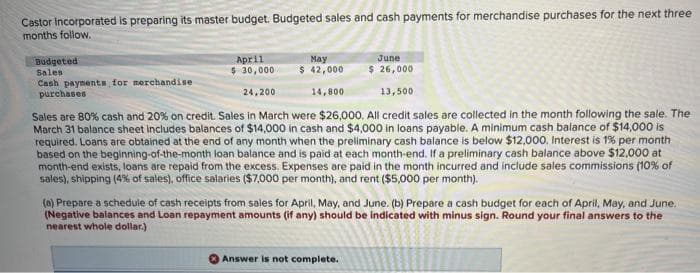

Transcribed Image Text:Castor Incorporated is preparing its master budget. Budgeted sales and cash payments for merchandise purchases for the next three

months follow.

April

$ 30,000

June

Budgeted

Sales

Cash payments for merchandise

purchases

May

$ 42,000

$ 26,000

24,200

14,800

13,500

Sales are 80% cash and 20% on credit. Sales in March were $26,000. All credit sales are collected in the month following the sale. The

March 31 balance sheet includes balances of $14,000 in cash and $4,000 in loans payable. A minimum cash balance of $14,000 is

required. Loans are obtained at the end of any month when the preliminary cash balance is below $12,000. Interest is 1% per month

based on the beginning-of-the-month loan balance and is paid at each month-end. If a preliminary cash balance above $12,000 at

month-end exists, loans are repaid from the excess. Expenses are paid in the month incurred and include sales commissions (10% of

sales), shipping (4% of sales), office salaries ($7,000 per month), and rent ($5,000 per month).

(a) Prepare a schedule of cash receipts from sales for April, May, and June. (b) Prepare a cash budget for each of April, May, and June.

(Negative balances and Loan repayment amounts (if any) should be indicated with minus sign. Round your final answers to the

nearest whole dollar.)

Answer is not complete.

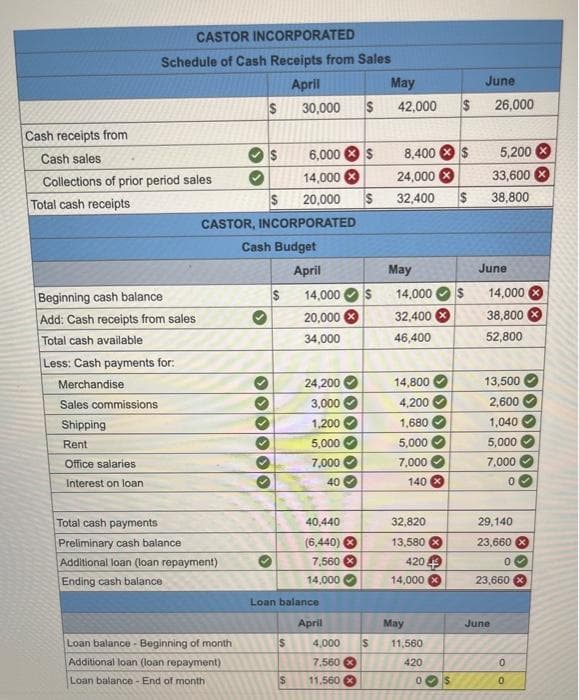

Transcribed Image Text:CASTOR INCORPORATED

Schedule of Cash Receipts from Sales

May

April

June

30,000

42,000

2$

26,000

Cash receipts from

8,400 8 s

24,000 8

6,000s

5,200 8

Cash sales

Collections of prior period sales

14,000

33,600

Total cash receipts

20,000

32,400

38,800

CASTOR, INCORPORATED

Cash Budget

April

May

June

Beginning cash balance

14,000

14,000

14,000 X

Add: Cash receipts from sales

20,000

32,400

38,800

Total cash available

34,000

46,400

52,800

Less: Cash payments for:

Merchandise

24,200

14,800

13,500

Sales commissions

3,000

4,200

2,600

Shipping

1,200

1,680

1,040

Rent

5,000 O

5,000 O

5,000

7,000 O

7,000

7,000

140

Office salaries

Interest on loan

40

Total cash payments

40,440

32,820

29,140

Preliminary cash balance

Additional loan (loan repayment)

13,580 8

420 9

(6,440) 8

23,660 X

7,560

Ending cash balance

14,000

14,000

23,660

Loan balance

April

May

June

Loan balance - Beginning of month

4,000

11,560

Additional loan (loan repayment)

7,560 3

420

Loan balance - End of month

11,560 8

%24

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning