000. Jingle Corp makes several payments to Reindeer Corp during 2018. Jingle Corp ced the construction of the building with debt. The total debt of Jingle Corp and the cash ents made by Jingle Corp for the building are below. Assume that all interest is paid in on December 31. Specific Construction Debt 8%, 2-year note to finance the construction of the building, dated $100,000 January 1, 2018, with interest payable annually on December 31. Other Debt 3.55%, 10-year note payable, dated December 31, 2015, with $50,000 interest payable annually on December 31. 5.55%, 20-year note payable, dated December 31, 2009, with $500,000 interest payable annually on December 31. Expenditures Amount Date March 1, 2018 June 1, 2018 September 1, 2018 December 31 2018. $123,000 $45,000 $20,000 $32.000

000. Jingle Corp makes several payments to Reindeer Corp during 2018. Jingle Corp ced the construction of the building with debt. The total debt of Jingle Corp and the cash ents made by Jingle Corp for the building are below. Assume that all interest is paid in on December 31. Specific Construction Debt 8%, 2-year note to finance the construction of the building, dated $100,000 January 1, 2018, with interest payable annually on December 31. Other Debt 3.55%, 10-year note payable, dated December 31, 2015, with $50,000 interest payable annually on December 31. 5.55%, 20-year note payable, dated December 31, 2009, with $500,000 interest payable annually on December 31. Expenditures Amount Date March 1, 2018 June 1, 2018 September 1, 2018 December 31 2018. $123,000 $45,000 $20,000 $32.000

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter10: Property, Plant And Equipment: Acquisition And Subsequent Investments

Section: Chapter Questions

Problem 9RE: Dexter Construction Corporation is building a student condominium complex; it started construction...

Related questions

Question

(a) What is the weighted average of accumulated expenditures?

(b) What is the avoidable interest for the building in 2018?

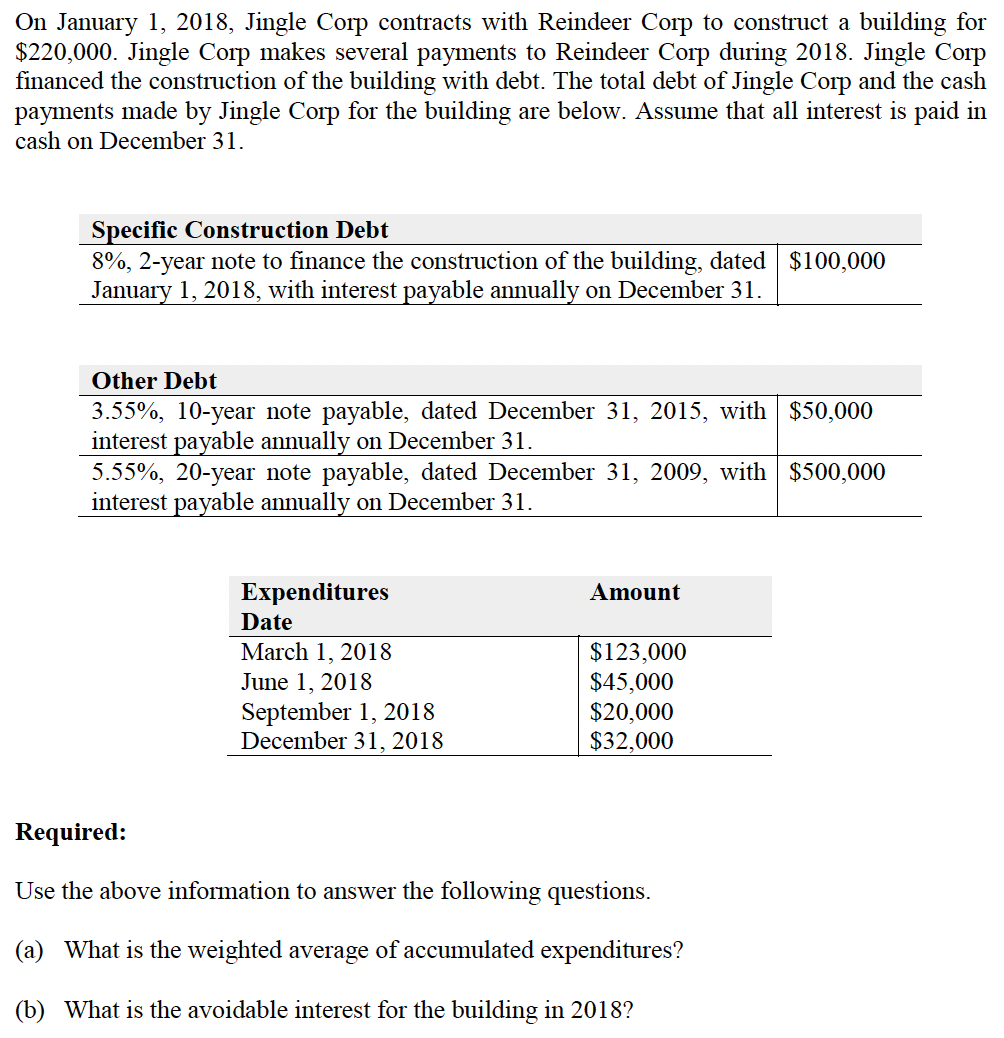

Transcribed Image Text:On January 1, 2018, Jingle Corp contracts with Reindeer Corp to construct a building for

$220,000. Jingle Corp makes several payments to Reindeer Corp during 2018. Jingle Corp

financed the construction of the building with debt. The total debt of Jingle Corp and the cash

payments made by Jingle Corp for the building are below. Assume that all interest is paid in

cash on December 31.

Specific Construction Debt

8%, 2-year note to finance the construction of the building, dated $100,000

January 1, 2018, with interest payable annually on December 31.

Other Debt

3.55%, 10-year note payable, dated December 31, 2015, with $50,000

interest payable annually on December 31.

5.55%, 20-year note payable, dated December 31, 2009, with $500,000

interest payable annually on December 31.

Expenditures

Amount

Date

March 1, 2018

June 1, 2018

September 1, 2018

December 31, 2018

$123,000

$45,000

$20,000

$32,000

Required:

Use the above information to answer the following questions.

(a) What is the weighted average of accumulated expenditures?

(b) What is the avoidable interest for the building in 2018?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College