Cash $ 19,000 Accounts Receivable, Net 82,000 Merchandise Inventory 183,000 Total Assets 638,000 Accounts Payable 102,000 Accrued Liabilities 35,000 Short-term Notes Payable Long-term Liabilities 50,000 221,000 Net Income 69,000 Common Shares Outstanding 50,000 shares Current Ratio Debt Ratio Earnings per Share

Cash $ 19,000 Accounts Receivable, Net 82,000 Merchandise Inventory 183,000 Total Assets 638,000 Accounts Payable 102,000 Accrued Liabilities 35,000 Short-term Notes Payable Long-term Liabilities 50,000 221,000 Net Income 69,000 Common Shares Outstanding 50,000 shares Current Ratio Debt Ratio Earnings per Share

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter12: Fainancial Statement Analysis

Section: Chapter Questions

Problem 18MCQ

Related questions

Question

Determining the effects of business transactions on selected ratios

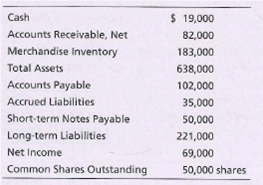

Financial statement data of Modern Traveler’s Magazine include the following items:

Requirements

- Compute Modern Traveler’s

current ratio , debt ratio, and earnings per share. Round all ratios to two decimal places, and use the following format for your answer: - Compute the three ratios after evaluating the effect of each transaction that follows. Consider each transaction separately.

a. Purchased merchandise inventory of $42,000 on account.

b. Borrowed $121,000 on a long-term note payable.

c. Issued 5,000 shares of common stock, receiving cash of $103,000.

d. Received cash on account, $5,000.

Transcribed Image Text:Cash

$ 19,000

Accounts Receivable, Net

82,000

Merchandise Inventory

183,000

Total Assets

638,000

Accounts Payable

102,000

Accrued Liabilities

35,000

Short-term Notes Payable

Long-term Liabilities

50,000

221,000

Net Income

69,000

Common Shares Outstanding

50,000 shares

Transcribed Image Text:Current Ratio

Debt Ratio

Earnings per Share

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps with 5 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning