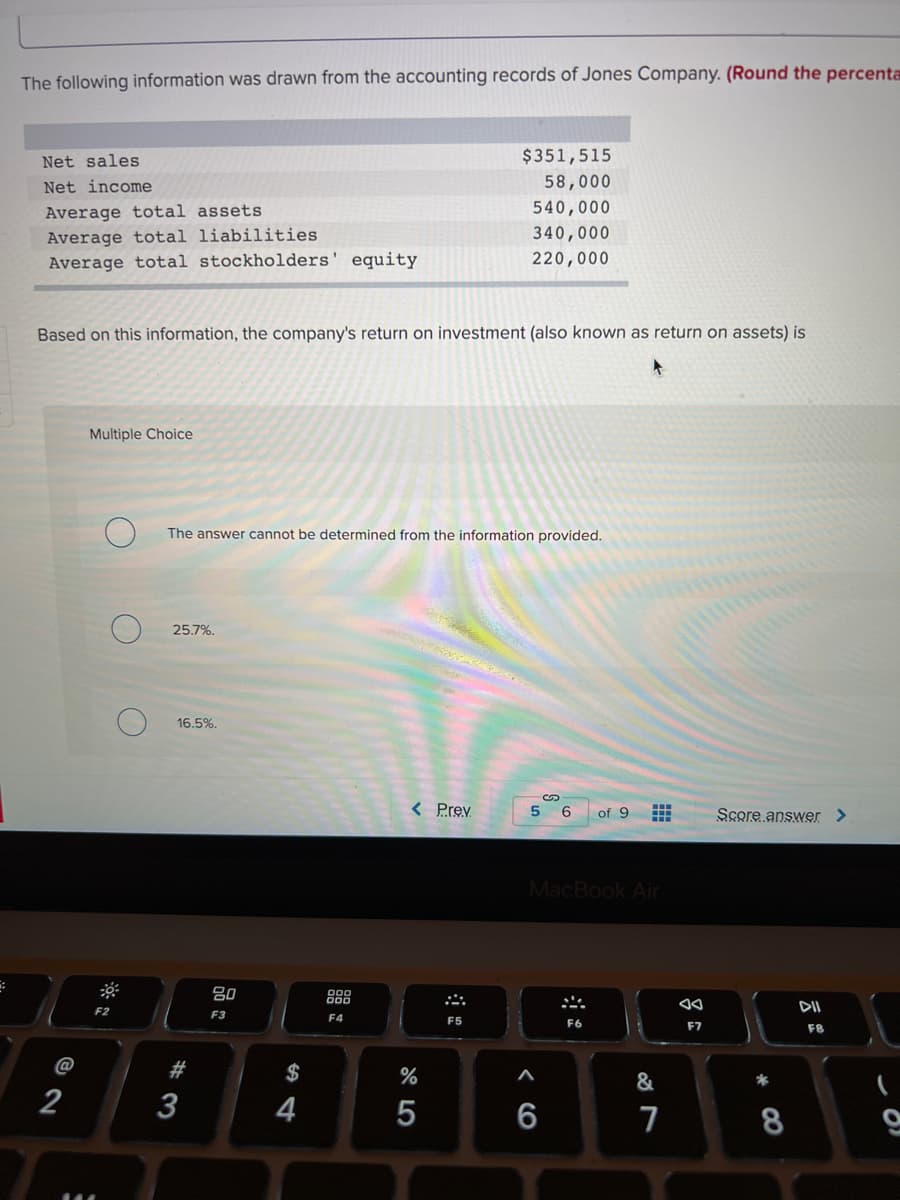

The following information was drawn from the accounting records of Jones Company. (Round the percenta Net sales $351,515 Net income 58,000 Average total assets Average total liabilities Average total stockholders' equity 540,000 340,000 220,000 Based on this information, the company's return on investment (also known as return on assets) is

The following information was drawn from the accounting records of Jones Company. (Round the percenta Net sales $351,515 Net income 58,000 Average total assets Average total liabilities Average total stockholders' equity 540,000 340,000 220,000 Based on this information, the company's return on investment (also known as return on assets) is

Managerial Accounting: The Cornerstone of Business Decision-Making

7th Edition

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Chapter15: Financial Statement Analysis

Section: Chapter Questions

Problem 58P: The following information has been gathered for Malette Manufacturing: Assume that the firm has no...

Related questions

Question

100%

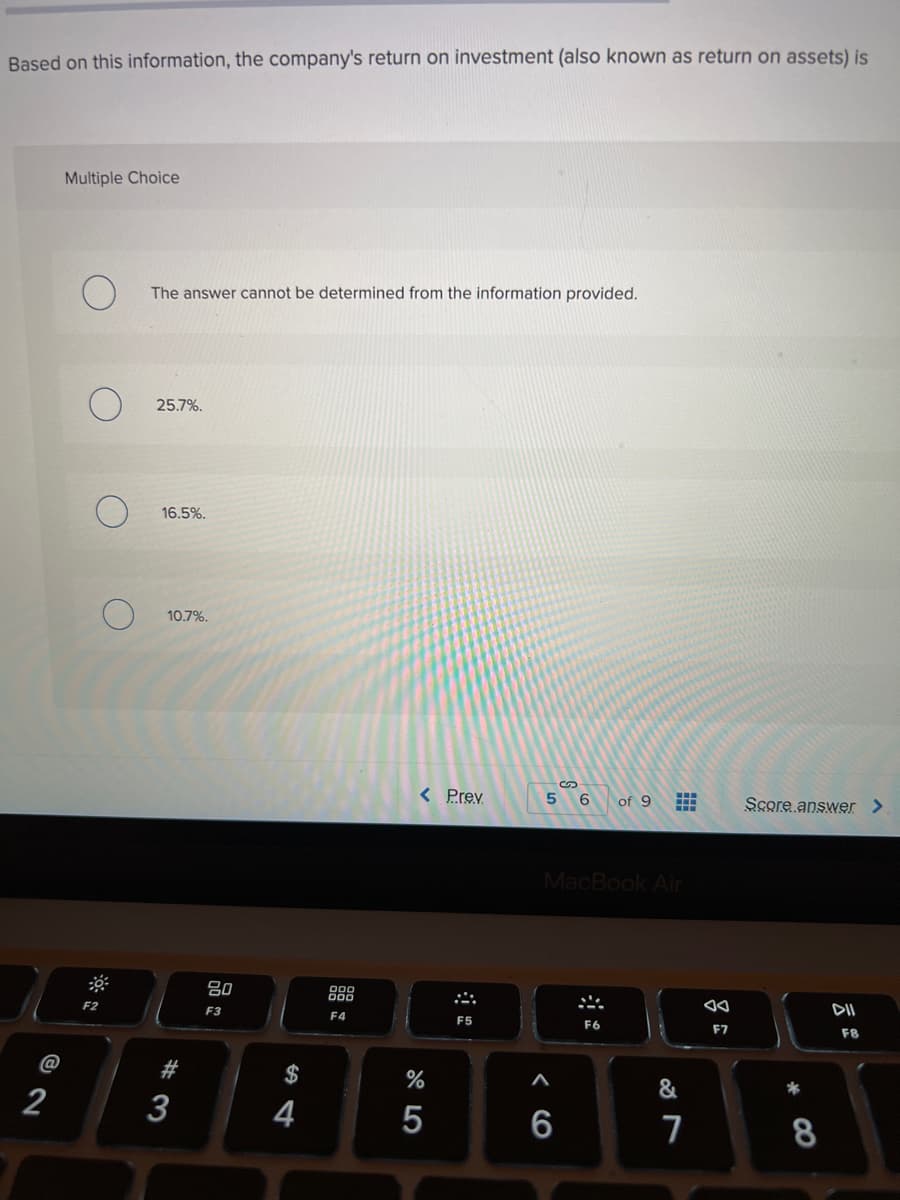

Transcribed Image Text:Based on this information, the company's return on investment (also known as return on assets) is

Multiple Choice

The answer cannot be determined from the information provided.

25.7%.

16.5%.

10.7%.

%24

< Prev

6

of 9

Score answer >

MacBook Air

吕0

888

F2

F3

DII

F4

F5

F7

F8

@

$

&

2

4

6

7

8

# 3

Transcribed Image Text:The following information was drawn from the accounting records of Jones Company. (Round the percenta

Net sales

$351,515

Net income

58,000

Average total assets

540,000

Average total liabilities

340,000

Average total stockholders' equity

220,000

Based on this information, the company's return on investment (also known as return on assets) is

Multiple Choice

The answer cannot be determined from the information provided.

25.7%.

16.5%.

< Prev

5

Score answer >

of 9

MacBook Air

80

888

DII

F2

F3

F4

F5

F7

F8

@

#

$

%

&

2

3

4

5

6

7

* CO

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

College Accounting, Chapters 1-27 (New in Account…

Accounting

ISBN:

9781305666160

Author:

James A. Heintz, Robert W. Parry

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning