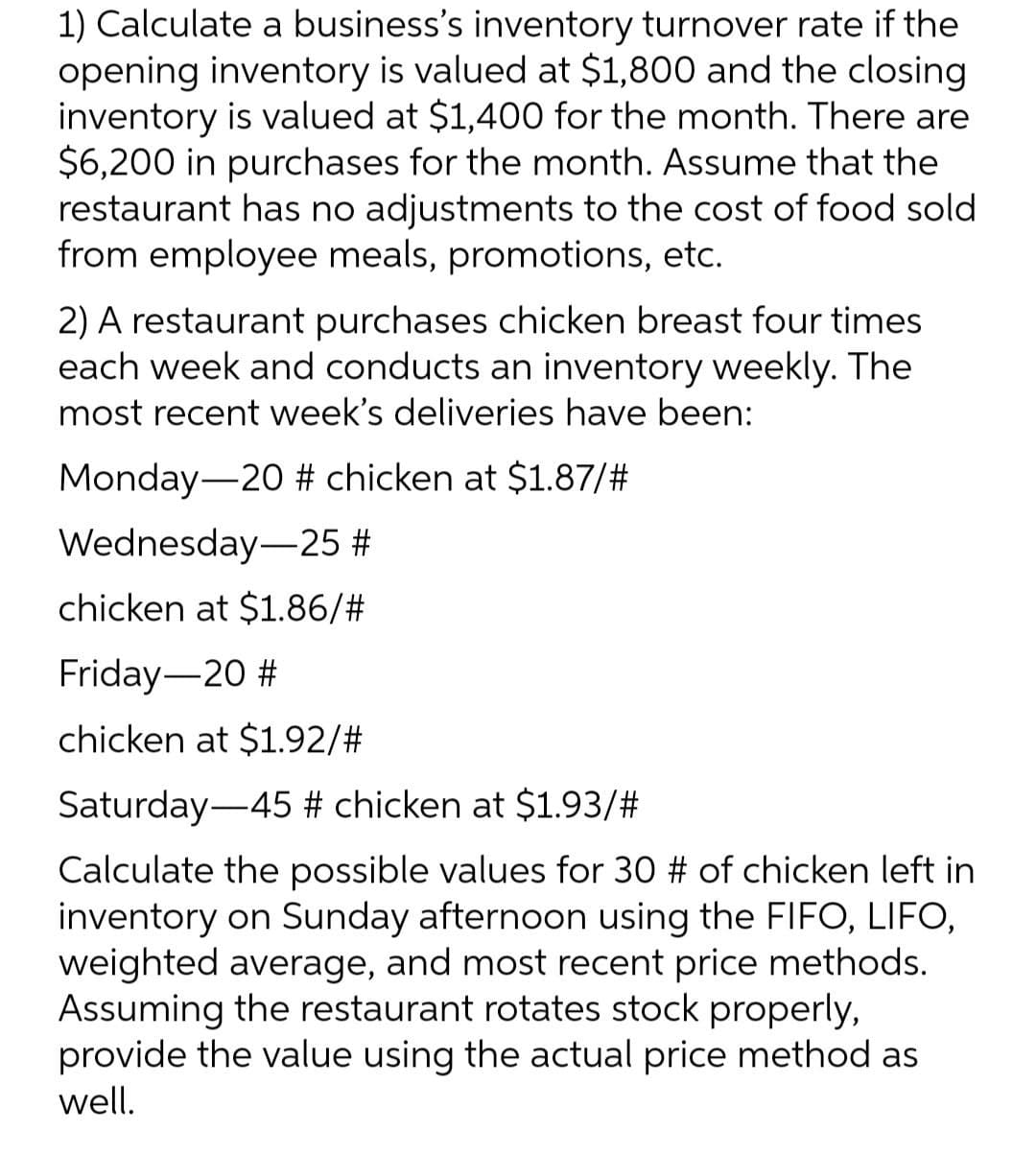

1) Calculate a business's inventory turnover rate if the opening inventory is valued at $1,800 and the closing inventory is valued at $1,400 for the month. There are $6,200 in purchases for the month. Assume that the restaurant has no adjustments to the cost of food sold from employee meals, promotions, etc.

1) Calculate a business's inventory turnover rate if the opening inventory is valued at $1,800 and the closing inventory is valued at $1,400 for the month. There are $6,200 in purchases for the month. Assume that the restaurant has no adjustments to the cost of food sold from employee meals, promotions, etc.

Chapter18: Accounting Periods And Methods

Section: Chapter Questions

Problem 26DQ

Related questions

Question

solve within 30 mins.

Transcribed Image Text:1) Calculate a business's inventory turnover rate if the

opening inventory is valued at $1,800 and the closing

inventory is valued at $1,400 for the month. There are

$6,200 in purchases for the month. Assume that the

restaurant has no adjustments to the cost of food sold

from employee meals, promotions, etc.

2) A restaurant purchases chicken breast four times

each week and conducts an inventory weekly. The

most recent week's deliveries have been:

Monday-20 # chicken at $1.87/#

Wednesday

25 #

chicken at $1.86/#

Friday-20 #

chicken at $1.92/#

Saturday 45 # chicken at $1.93/#

Calculate the possible values for 30 # of chicken left in

inventory on Sunday afternoon using the FIFO, LIFO,

weighted average, and most recent price methods.

Assuming the restaurant rotates stock properly,

provide the value using the actual price method as

well.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning