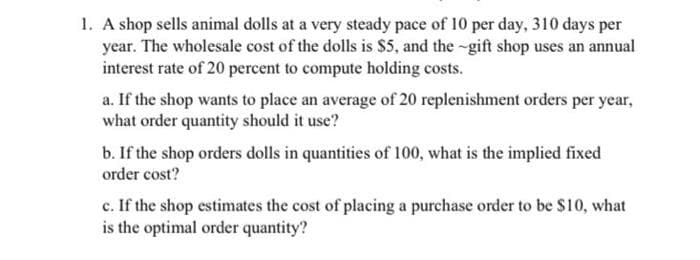

1. A shop sells animal dolls at a very steady pace of 10 per day, 310 days per year. The wholesale cost of the dolls is $5, and the -gift shop uses an annual interest rate of 20 percent to compute holding costs. a. If the shop wants to place an average of 20 replenishment orders per year, what order quantity should it use? b. If the shop orders dolls in quantities of 100, what is the implied fixed order cost? c. If the shop estimates the cost of placing a purchase order to be $10, what is the optimal order quantity?

1. A shop sells animal dolls at a very steady pace of 10 per day, 310 days per year. The wholesale cost of the dolls is $5, and the -gift shop uses an annual interest rate of 20 percent to compute holding costs. a. If the shop wants to place an average of 20 replenishment orders per year, what order quantity should it use? b. If the shop orders dolls in quantities of 100, what is the implied fixed order cost? c. If the shop estimates the cost of placing a purchase order to be $10, what is the optimal order quantity?

Managerial Economics: Applications, Strategies and Tactics (MindTap Course List)

14th Edition

ISBN:9781305506381

Author:James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Publisher:James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Chapter13: best-practice Tactics: Game Theory

Section: Chapter Questions

Problem 14E

Related questions

Question

I want handwritten only once again handwritten otherwise skip

Transcribed Image Text:1. A shop sells animal dolls at a very steady pace of 10 per day, 310 days per

year. The wholesale cost of the dolls is S5, and the -gift shop uses an annual

interest rate of 20 percent to compute holding costs.

a. If the shop wants to place an average of 20 replenishment orders per year,

what order quantity should it use?

b. If the shop orders dolls in quantities of 100, what is the implied fixed

order cost?

c. If the shop estimates the cost of placing a purchase order to be S10, what

is the optimal order quantity?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Economics: Applications, Strategies an…

Economics

ISBN:

9781305506381

Author:

James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Publisher:

Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:

9781337106665

Author:

Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:

Cengage Learning

Managerial Economics: Applications, Strategies an…

Economics

ISBN:

9781305506381

Author:

James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Publisher:

Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:

9781337106665

Author:

Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:

Cengage Learning